Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

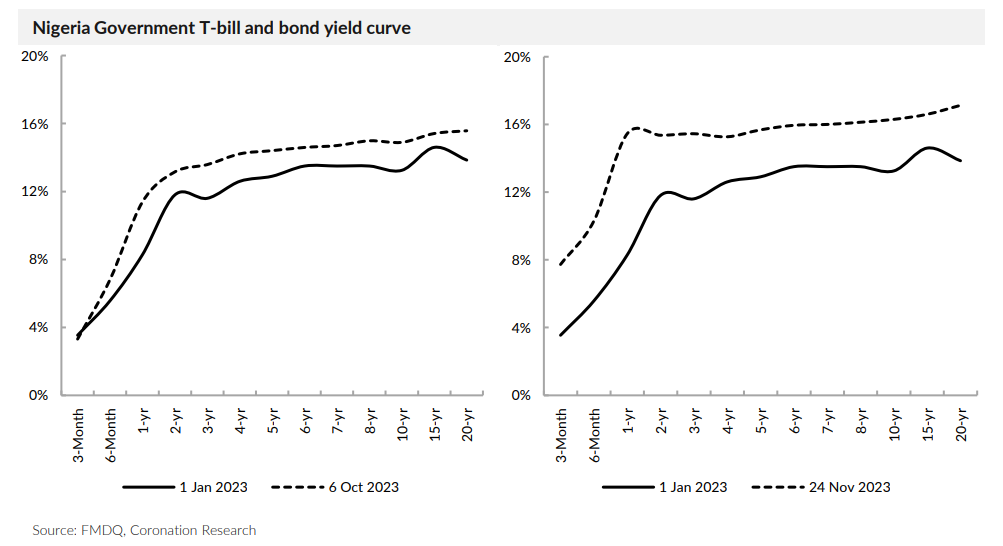

The Central Bank of Nigeria’s auction of Treasury bills last week confirmed that the direction of market interest rates is upward. Though rates are still well below the rate of inflation, they are much better than earlier in the year. The strange thing is that the CBN has made no pronouncement on the subject, even though rates are changing quickly.

The exchange rate in the Nigerian Autonomous Foreign Exchange Market (NAFEM) fell by 0.40% to close at ₦794.89/US$1 last week. Similarly, in the parallel market, the Naira fell by 1.73% to close at ₦1,155.00/US$1. Consequently, the gap between the NAFEM window and the parallel market settled at 45.30%. The reported gross foreign exchange (FX) reserves of the CBN fell by 0.30% to close at US$33.20bn.

The CBN Governor, in his keynote address at the CIBN annual bankers’ dinner last week, stated that the CBN is committed to ensuring that FX challenges be addressed with new market policies, while also ensuring that FX backlogs are cleared. We anticipate the CBN to persist in market intervention until achieving a degree of stabilisation.

Last week, at the primary market for Treasury Bills, the CBN rolled over bills worth ₦211.71bn (US$266.34m) across the 91-, 182-, and 364-day maturities. The offer was oversubscribed by ₦1,019.43bn with a bid to offer of 5.82x (versus 2.82x at the last auction). Total sales at the auction settled at ₦561.71bn (net issuance of ₦350.00bn, bid-to-cover of 2.19x). Stop rates for the 91-day and 182-day maturities rose by 100 basis points each to 8.00% and 12.00% respectively, while the stop rate for the 364-day maturity remained unchanged at 16.75%. We think that the oversubscription was due to

fund managers selling long-dated bonds in order to buy short-dated T-bills.

Activity in the secondary market for Treasury Bills reflected a bullish mood last week as average yields declined 225 basis points to 10.50% pa. Across the spectrum, average yields at the short-end declined by 134 basis points to 6.86%, the mid-end declined by 165 basis points to 9.11%, while the long-end fell by 232 basis points to settle at 12.93%.

Sell-offs on longer-dated FGN bonds drove yields up last week as investors sought to take advantage of increased yields on shorter-dated instruments. Average yields in the secondary market for FGN bonds rose 18 basis points to 15.91% pa. last week. At the mid and long ends of the yield curve, average yields rose by 55 and 15 basis points,

respectively, while buying interest, especially on the March 2024 (-193bps) bond drove the average yield at the short-end of the curve down by 25 basis points to 14.21%.

Last week, the price of Brent crude slipped, losing 0.04% to close at US$80.58/bbl. Year-to-date, the price of Brent crude is down by 6.20% and it has been trading at an average of US$82.61/bbl year-to-date which is 16.63% lower than the average of US$99.09/bbl in 2022.

Ahead of the OPEC+ summit scheduled for Thursday to decide on production cuts in 2024, oil prices saw a rise for the first time in more than a month on Friday despite the liberation of some captives in Gaza which appeared to reduce the risk associated with the war between Israel and Hamas. We maintain our view that, this year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

In case you missed it: African Eurobond Contagion?

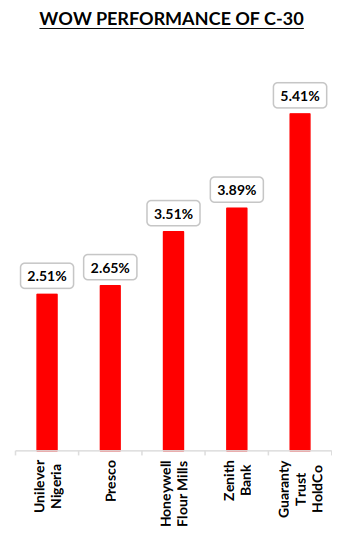

The NGX All-Share Index closed positive as it gained 0.17% to settle at 71,230.48 points. Consequently, the year-to-date return rose to 38.98%. Gains in Guaranty Trust Holding Company (+5.41%), Zenith Bank (+3.89%) and Honeywell Flour Mills (+3.51%) drove the market, offsetting losses in Stanbic IBTC (-7.08%), International Breweries (-5.56%), and

Nigerian Breweries (-5.00%). Across the sub-indices the NGX Insurance index (+4.07%) topped the list of gainers, followed by NGX Banking (+1.94%), NGX 30 (+0.11%) and NGX Industrial Goods (+0.04%) indices. The NGX Oil and Gas (+0.00%) index closed flat, while the NGX Consumer Goods (-0.53%) and NGX Pension (-0.38%) indices closed negative.

Actions speak louder than words. We heard no official announcement that market interest rates would rise, but market interest rates, notably Nigerian Treasury Bill (T-bill) rates, are rising decisively. No official person – to our knowledge – has made a speech on the need for higher market interest rates, but rates are going up anyway.

We first saw this happening in the open market operations (OMO) of the CBN in October. OMO bill auctions are a way of managing liquidity in the financial system and they influence T-bill rates.

As we argued in Nigeria Weekly Update, On our way to better savings? November 6, 2023, the rise in OMO rates would likely lead to a rise in T-bill rates. This prediction worked out (see chart, above) but our other prediction, namely that the meeting of the Monetary Policy Council (MPC) in November 21 would provide us with guidance on interest rates, was not as good.

Last week, the MPC did not convene, mirroring its absence in September, with its most recent meeting back in July (meetings are scheduled every two months). One likely explanation is that the CBN is much more concerned with managing the backlog of demand for foreign exchange than with official rate-setting (see Nigeria Weekly Update, A US$ boost for Nigerian markets? 30 Oct 2023). And it is just possible, we believe, that the monetary authorities currently prefer not to pronounce on interest rates, given the sensitivity (felt by borrowers, above all) of market interest rates going up: better to act than to speak.

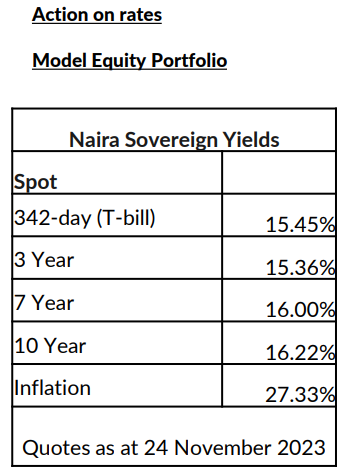

Savers are the big beneficiaries here. T-bill and FGN bond investors have dealt with miserable rates for most of 2023 (as, indeed, they have done since November 2019) with interest rates nowhere near the rate of inflation. For much of this year T-bills have carried single-digit yields, though there were some relatively good times in March, July and August. Now it seems like the coordination of OMO and T-bill auctions effectively produces 1-year T-bill yields at auction in the region of 20.00% per annum. This is still well short of inflation at 27.33% pa, but much better than rates seen earlier this year.

What makes us think that these rates will stick? Our first argument is that the raising of OMO rates and the allocations by the CBN at recent T-bill auctions, as well as the allocations by the Debt Management Office (DMO) at recent FGN bond auctions, appear coordinated. This looks like policy in action. Second, in late October, CBN Governor Dr Yemi Cardoso stated (in a rare public speech) that the CBN would be seen to be taking price stability very seriously. We think this is what he means.

Could rates go higher still? It is not always necessary to take market interest rates above the rate of inflation in order to tame inflation. So, it is possible that the CBN will let market rates settle where they are now and observe their effect, combined with the de-bottlenecking of the foreign exchange market, on inflation, and adjust accordingly. Whether market interest rates have reached a plateau, or whether more rises are on the way, we believe these rates are far better than what has gone before and well worth holding in the short term.

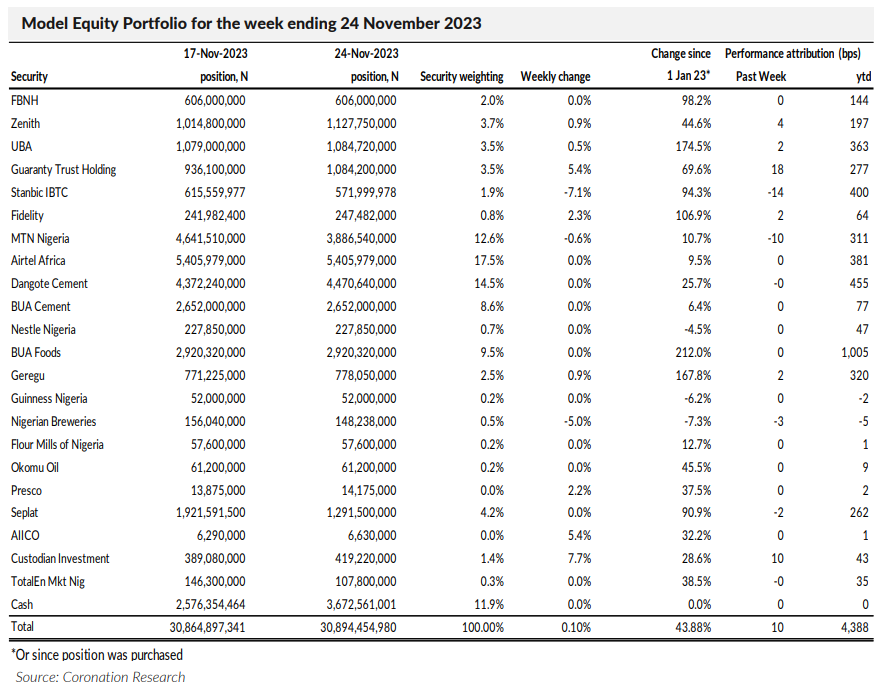

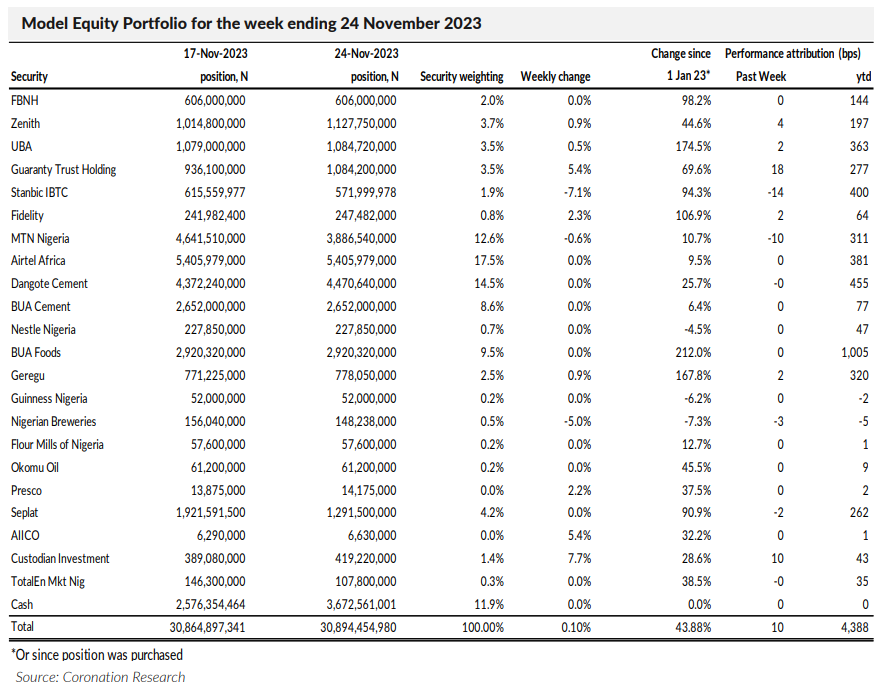

Last week, the Model Equity Portfolio rose by 0.10% compared with a rise in the NGX All-Share Index of 0.17%,

underperforming it by 7bps. Year-to-date it has risen by 43.88% compared with a rise of 38.98% in the NGX All-Share

Index, outperforming it by 490bps.

The source of our underperformance last week was our selection of bank stocks which rose by 0.60% while the NGX Banking Index rose by 1.94%. We cannot feel too sore about this since our selection of banks stocks has outperformed several times over the past few weeks. The overall performance of the Model Equity Portfolio would have been worse had it not been for our notional position in Custodian Investment which delivered a useful 10bps last week.

Last week, and as we forewarned last Monday, we made a small notional sale in MTN Nigeria in order to bring it down to a neutral weight, and we made small notional adjustments in the principal stocks by index weight to bring our positions in line with their individual index weights. (Airtel Africa, Dangote Cement, MTN Nigeria, BUA Foods and BUA Cement together make up 62.59% of the NGX All-Share Index.)

Also, as advised last week, we made notional sales in Seplat Energy in order to bring this back down towards a neutral

position and continued to make notional sales in Total Energies in order to take profits. We will continue with these efforts this week. We plan no further changes this week.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.