Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

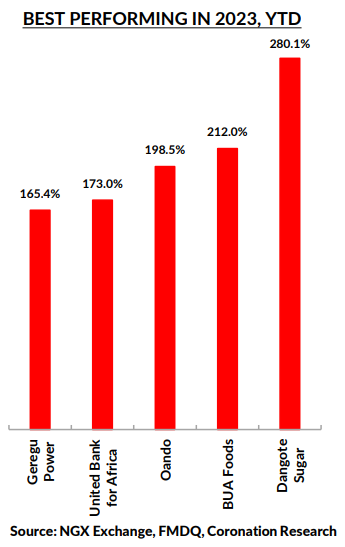

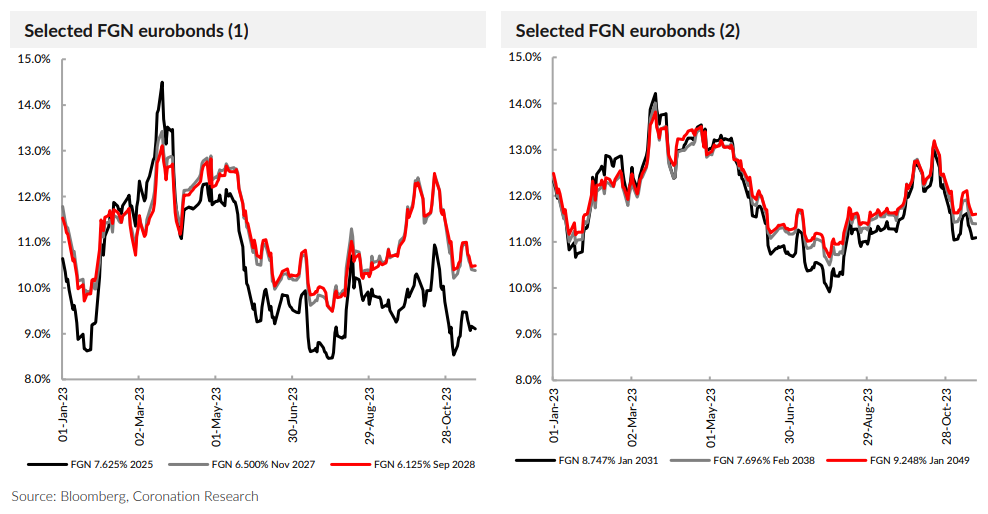

To read the news on African Eurobonds, one might think that there is some kind of continent-wide problem. Restructuring is ongoing in Ghana and recently adopted in Ethiopia and Zambia. Yet, Federal Government of Nigeria (FGN) Eurobond yields have actually been tightening recently. What are the lessons?

The exchange rate in the Nigerian Autonomous Foreign Exchange Market (NAFEM) fell by 1.47% to close at ₦791.75/US$1 last week. In the parallel (street) market, the Naira fell by 1.32% to close at ₦1,135.00/US$1. Consequently, the gap between the NAFEM window and the parallel market settled at 43.35%. The gross foreign exchange (FX)

reserves of the CBN fell by 0.20% to close at US$33.31bn.

Market liquidity remains tight in the FX markets. And as we mentioned last week, we expect the CBN to continue to intervene in the market until a degree of stabilization is reached.

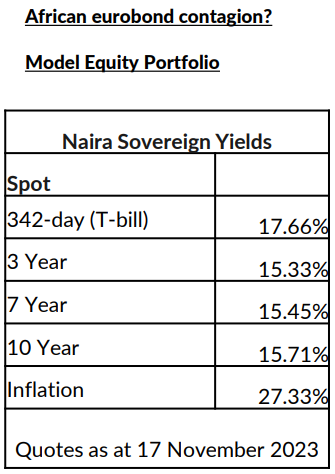

In the secondary market for Treasury Bills, bullish sentiments prevailed last week with average yields declining by 61 basis points to 12.75% pa. The average yield at the mid-end of the yield curve declined significantly by 181 basis points to 10.77%; while the short- and long-end of the curve declined by 10 and 45 basis points to settle at 8.20% and 15.25%, respectively.

Average yields in the secondary market for FGN bonds rose 6 basis points to 15.73% pa. due to selloffs taking place mainly along the mid- to long-end of the yield curve with average yields rising by 8 and 24 basis points to 15.55% and 16.86%, respectively. However, at the short end of the yield curve average yields fell by 22 basis points to settle at 14.47% driven by positive sentiments towards the March 2024 maturity.

The Debt Management Office (DMO) rolled out another bond auction last week with ₦360.0bn (US$454.7m) worth of bonds for sale across the Apr-29, Jun-22, Jun-38 and Jun-53 maturities.

The issue was oversubscribed by ₦85.3bn with a bid-to-offer of 1.24x (vs 1.06x at the previous auction). The total allotment settled at ₦434.50bn and despite increased demand at the auction, stop rates increased across all maturities.

The Apr-29 added 110 basis points to 16.00%, the Jun-33 rose 125 basis points to 17.00%, the Jun-38 rose 170 basis points to 17.50%, and the Jun-53 rose 140 basis points to 18.00%. We get a clear sense of an ongoing strategy to raise market interest rates on the part of the authorities.

For the fourth consecutive week, the price of Brent crude declined, losing 1.01% to close at US$80.61/bbl. Year-to-date, the price of Brent crude is down by 6.17%. And it has been trading at an average of US$82.63/bbl year-to-date which is 16.61% lower than the average of US$99.09/bbl in 2022. Friday actually saw a more than 4% increase in oil prices, rising from a four-month low reached the previous day. Support came from U.S. sanctions on certain Russian oil shippers as well as profits taken by investors with short positions. We maintain our view that, for most of the year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

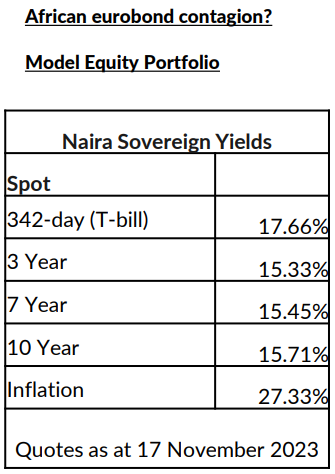

The NGX All-Share Index closed positive as it gained 0.36% to settle at 71,112.99 points. Consequently, the year-to-date return rose to 38.75%. Gains in Oando (+21.88%), Seplat Energy (+6.06%) and Nigerian Breweries (+5.26%) drove the market, offsetting losses in Fidelity Bank (-3.83%), BUA Cement (-2.80%), and Sterling Bank (-2.74%). Across the sub-indices the NGX Oil/Gas (+2.61%) topped the list of gainers, followed by NGX Insurance (+0.91%), NGX Pension (+0.91%), NGX30 (+0.25%) and NGX Consumer Goods (+0.24%) indices, while the NGX Insurance index (-1.18%) and NGX Banking index (-0.04%) closed negative.

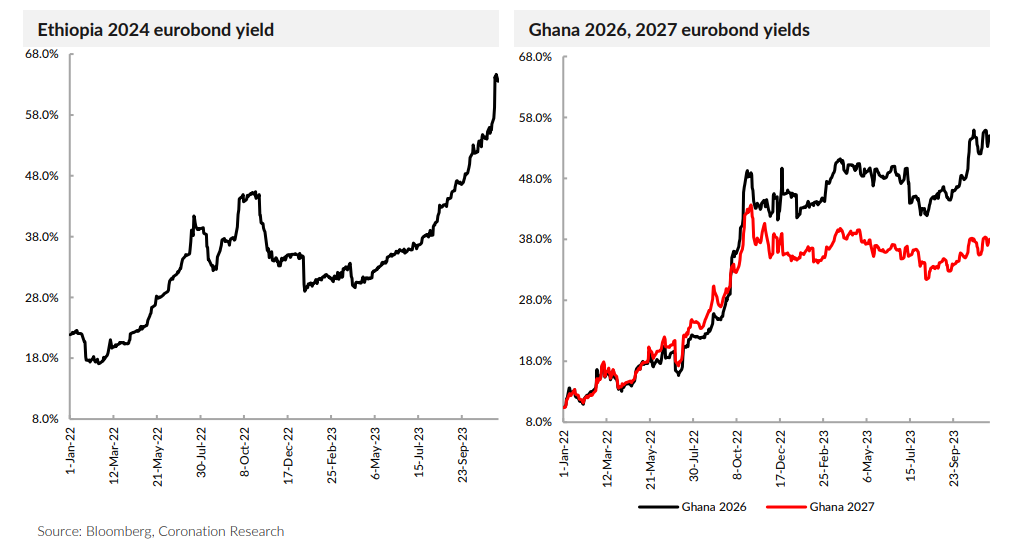

Holders of Sub-Saharan Africa Eurobonds have had a difficult time of late. Just over a year ago, Ghanaian Eurobonds reached extraordinary yields as the country went into a restructuring program with the International Monetary Fund (IMF). Lately, it has been the turn of Ethiopian Eurobonds to hit the storm, with the yield of its 2024 US dollar-denominated bond hitting 63.5%. What are the implications for Federal Government of Nigeria (FGN) Eurobonds?

To begin with, Ethiopia, Ghana and Nigeria are very different issuers. Ethiopia is a rarity in the market and has one Eurobond outstanding, issued in 2014 with a 10-year tenor. Ghana is a familiar name in the Eurobond market with over a dozen issues outstanding.

Read also: Navigating the interest rate landscape in Nigeria: A crucial insight

A few years ago, investors perceived Ghana as a smarter issuer than Nigeria. There are distinct seasons for issuing Eurobonds and timing is everything. In early 2020, Ghana issued three Eurobonds, raising a total of US$3.0bn, just before the Covid-19 pandemic sent a wrecking ball through global markets. Meanwhile Nigeria’s legislature was still approving its Eurobond issue. And by the time the issuing authority received the rubber stamp the party was over. International investors wanted safety above yield, and it was too late for Nigeria to issue.

In 2021, and once global markets had recovered, Ghana again issued Eurobonds, raising more than it had the previous year. Nigeria, comparatively late, raised a total of US$5.25bn in late 2021 and early 2022.

Then, as we know, Ghana’s public finances ran into trouble, precipitating the intervention of the IMF later in the year, and a restructuring of the government’s debt both in domestic Cedi and in US dollars. The lesson for Eurobond investors is that, when it comes to macroeconomic management, things can go badly wrong in just a couple of years.

Investors in Nigerian sovereign Eurobonds can count themselves lucky. The country is not overburdened with Eurobond issues, with an outstanding total of US$15.0bn that looks small in relation to its US dollar GDP (a metric Eurobond investors reference). Although recently announced plans are to securitise future US dollar cash flows owing to the Nigerian government (money that would otherwise be available to service Eurobonds, among other US dollar debts) in order to support foreign exchange reserves, the Eurobond market does appear worried; Nigerian yields have tightened recently.

As for Ethiopia, it announced recently a restructuring of foreign debt, including its single Eurobond mentioned above. The yield on this US$1.0bn deal reached 63.5% recently. And, further afield, Zambian debt is also being restructured at this time.

The lesson is that, when it comes to Sub-Saharan sovereign Eurobonds, the market judges them on a country-by-country basis And, the more a sovereign issuer attempts to address its macroeconomic woes (see Coronation Research, Investment Opportunities from Fuel Subsidy Removal, 9 June) the better the market responds. Risks remain, as always, but we believe that Nigerian sovereign Eurobonds continue to represent good value.

Last week, the Model Equity Portfolio rose by 0.71% compared with a rise in the NGX All-Share Index of 0.37%,

outperforming it by 34bps. Year-to-date it has risen by 43.75% compared with a rise of 38.75% in the NGX All-Share

Index, outperforming it by 500bps.

Last week, our double overweight in Seplat Energy delivered 36bps (a neutral position would have delivered 18bps); our selection of bank stocks (within an overall neutral position in the sector) delivered 21bps (while the banking sub-index fell by 0.04%); and our small overweight position in MTN Nigeria delivered 35bps (a neutral position would have delivered 29bps). These were the main sources of our outperformance.

This week, we will begin to return our notional overweight position in MTN Nigeria to a neutral position. We will begin to take profits on our notional overweight in Seplat Energy. We will continue to re-balance the notional holdings in the

major stocks by index weight towards neutral positions. We plan no further changes this week.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.