Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Last week, it was announced that Nigeria will soon receive an inflow of some US$10.0bn to support the Naira in the foreign exchange markets. How would such an inflow affect Nigeria’s Eurobond, T-bill, FGN bond and equity markets? We believe that Nigeria’s US dollar and Naira-denominated markets are largely decoupled at the moment, and we also question whether such an inflow is good for Eurobonds.

Last week, the exchange rate at the Nigerian Autonomous Foreign Exchange Market (NAFEM) gained 2.32% to close at ₦789.94/US$1. Conversely, at the parallel (street) market, the Naira fell by 4.88% to close at ₦1,230.00/US$1. Consequently, the gap between the NAFEM window and the parallel market widened further to 51.71%. The

gross foreign exchange (FX) reserves of the Central Bank of Nigeria (CBN) rose by 0.23% to US$33.33bn.

Late in the week, the government announced an expected inflow of US$10.0 billion, confirming the statement earlier made by the Minister of Finance about an expected inflow.

The inflow may consist of a US$3.0 billion loan from the African Export-Import Bank (Afreximbank) secured by NNPC Limited; and a US$7.0 billion proposed securitisation of dividends from Nigeria Liquified Natural Gas (NLNG).

The market responded to the news positively as the Naira in both the NAFEM and parallel markets gained 5.7% and 5.4% on Friday bringing the exchange rates down from a week high of ₦837.49/US$1 and ₦1,300.00/US$1 on Thursday.

We expect that the inflow has the potential to ease the FX liquidity crunch in the short term, while other reforms to address long-term FX challenges are put in place.

At the primary market auction for Treasury Bills which was held midweek, the CBN offered bills worth ₦108.13bn (US$136.88m) across the 91-day, 184-day, and 364-day maturities.

Total subscription at the auction was ₦638.13bn, 98.7% higher than the previous auction. System liquidity which stood at ₦232.09bn as of 23rd October and FAAC disbursements were the major drivers of the high demand seen at the auction.

Total allotment settled at ₦370.34bn implying a bid-to-cover ratio of 1.72x, with a net issuance of ₦262.21bn. Despite high demand at the auction, stop rates across the trio of maturities rose to 5.99% (+233 bps), 9.00% (+389 bps), and 13.00% (+375 bps), respectively.

Activity in the secondary market for Treasury Bills was bearish last week as average yield rose by 23bps to 7.15% pa. The yield on the short-end (+82bps to 4.16%), mid-end (+87bps to 5.91%) and long end (+10ps to 9.02%) of the curve all rose.

The secondary market for FGN bonds also witnessed bearish moods as the average benchmark yield for bonds rose by 43bps to close at 14.88%. The yields on the 3-year (+38bps to 13.38%), 7-year (+27bps to 15.21%) and 10-year (+39bps to 15.39%) bonds expanded.

While we await the CBN’s interest rate policy direction for the rest of the year to be enunciated, the allocation by the CBN at the above-mentioned T-bill auction suggests a hawkish attitude to rate-setting for now and possible upward pressure on rates.

Last week, the price of Brent crude lost 3.21% to settle at US$89.20/bbl. Year-to-date, the price of Brent crude is down by 3.21% and it has been trading at an average of US$82.59/bbl year-to-date which is 16.66% lower than the average of US$99.09/bbl in 2022.

Even though events in the Middle East have not yet directly impacted the availability of oil, many are concerned that major oil producer and Hamas supporter Iran and other countries may disrupt exports from the region. We maintain our view that, for most of the year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

ICYMI: Pension funds embrace equities investment opportunities

Last week, the NGX All-Share Index gained 0.33% to settle at 67,136.58 points. Its year-to-date return rose to 31.00%. Geregu Nigeria (+20.63%), Unilever Nigeria (+5.51%) and Seplat Energy (+3.70%) closed positive while International Breweries (-8.70%), Nigerian Breweries (-5.13%), and Stanbic IBTC (-2.59%) closed negative.

Performances across the NGX sub-indices were mostly negative as the NGX Insurance (-1.12%) topped the list of

losers, followed by NGX Pension (-0.18%), NGX Industrial Goods (-0.15%) and NGX Consumer Goods (-0.04%) indices while the NGX Oil and Gas (+2.07%), NGX Banking (+1.04%) and NGX-30 (+0.33%) index closed in the green.

Last week, it was reported that the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, had announced an expected inflow of US$10.0bn to Nigeria in a matter of weeks.

A news story later in the week reported that a loan of some US$7.0bn was being prepared for Nigeria LNG Limited (a state-owned liquefied natural gas producer), likewise a US$3.0bn loan for the Nigerian National Petroleum Corporation (NNPC Limited, which is also state-owned)

What is the likely impact on Nigerian markets? The Eurobond market reacted positively last week, with spreads on Federal Government of Nigeria (FGN) US dollar Eurobonds tightening. Currency markets responded marginally, with mild appreciation of the Naira in both the official NAFEM market and the parallel market. By contrast, Naira-denominated markets, namely the T-bill, FGN bond and the equity markets, appear to have been unaffected.

Indeed, there are no straightforward implications for Naira-denominated government debt markets from the – reportedly imminent – arrival of US$10.0bn at the Central Bank of Nigeria (CBN), in our view. This may seem strange. Surely a strengthening of the nation’s finance implies a reduction in government borrowing in its own currency. The problem is that the market understands the US dollar inflows to be earmarked for settling outstanding US dollar obligations and for settling US dollars with a long queue of businesses (such as foreign-owned airlines, shipping companies and investors) that want to repatriate funds.

We also put a question mark over the reaction of the FGN Eurobond market. After all, the price of a Eurobond is the

value of the future discounted US dollar cash flows that will service it. What benefit is there if a large part of those future cash flows turns up in one go? Does it change anything, other than adding the lenders of those dollars to the nation’s obligations? Surely not. The Eurobond market’s reaction was deeply illogical, we believe. Fortunately, we think that, regardless of last week’s announcements, FGN Eurobonds represent good value, so there is no need to change our view.

The most important market is, of course, the foreign exchange market. Here it is noticeable that the parallel market did not appreciate very much after the announcement (which was at the Nigeria Economic Summit a week ago). The key question, and one that is very difficult to answer, is whether the arrival of a large sum of US dollars – and we cannot be sure exactly how much it will be – will satisfy all the various US dollar obligations and backlog in US dollar demand. If it does, then we could see a spectacular appreciation in the parallel rate. Watch this space.

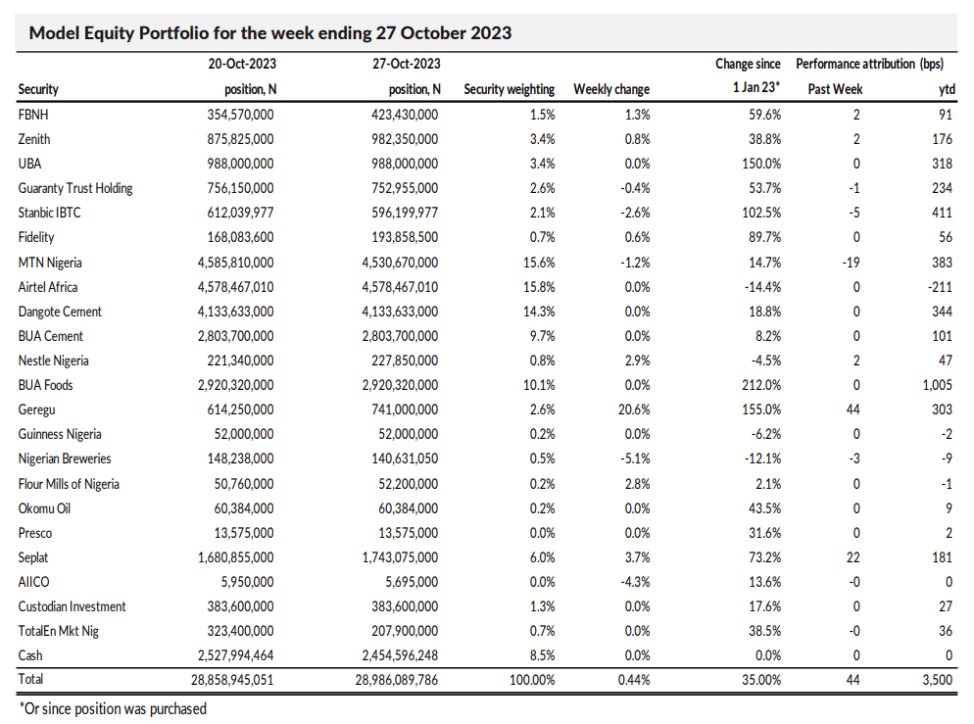

Last week, the Model Equity Portfolio rose by 0.44% compared with a rise in the NGX All-Share Index of 0.33%,

outperforming it by 11bps. Year-to-date it has risen by 35.00% compared with a rise of 30.99% in the NGX All-Share

Index, outperforming it by 401bps.

Last week, and in contrast with the previous two weeks’ trading, the market saw positioning for upcoming nine-month (9M) and third quarter (Q3) results in the shares of several companies representing a large percentage of the index weight. Trading was also brisk in the bank sector which gained 1.0% over the week.

Our outperformance last week was due to our double overweight in Seplat Energy (we announced our intention to make Seplat Energy a double overweight a month ago) which earned us 22bps from a 3.7% rise in the stock. A neutral position would have earned up 11bps. Our two-percentage-point overweight in MTN Nigeria did not cost us much in the face of a 1.2% decline in the stock last week. Its nine-month results, announced this morning, were weak, with downward pressure on operating margins in the third quarter as well as a loss on a foreign currency loan booked in the third quarter. On balance, MTN Nigeria’s underlying business looks good, so long as management can tackle costs (as the company said it would during today’s conference call), and we will retain our small overweight position in it for now.

Last week, and as earlier advised, we began to re-balance out notional positions in bank stocks to better reflect their near-neutral weights relative to each other, while also reverting from a small underweight position to a neutral position in them. Also, as early advised, we made notional sales in TotalEnergies in order to take notional profits from this position. We intend to continue building up the Model Equity Portfolio’s aggregate position in banks to a neutral position this week and to continue with notional sales of TotalEntergies. We plan no other changes this week.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. The information is believed to be accurate but not independently verified. The report is intended for the use of clients. It should not be considered as a solicitation to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.