Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

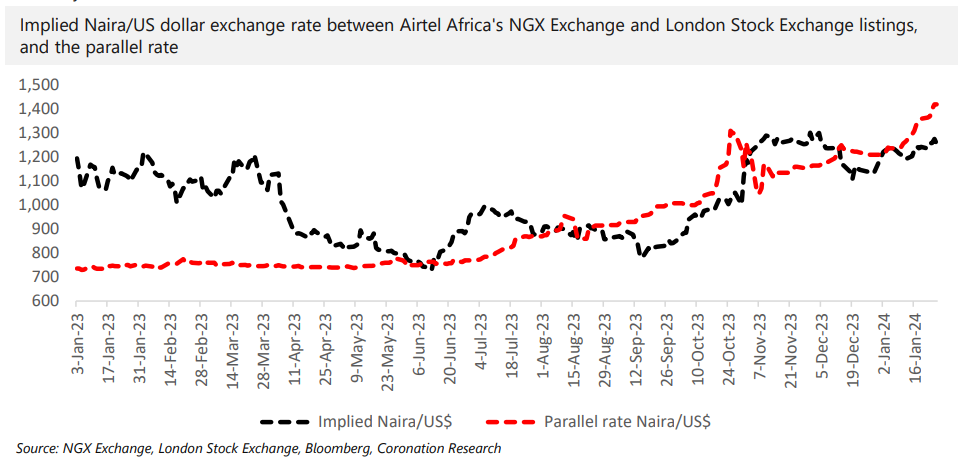

What is driving the price of Airtel Africa and what does this say about the parallel exchange rate? Aside from the company’s fundamental value, it is clear that the parallel exchange rate plays a key part in determining its price in Nigeria. Unfortunately, the reverse is not true: the price of Airtel Africa shares does not tell us where the exchange rate is heading.

The Naira exchange rate at the NAFEM window ended the week at ₦891.90/US$1 gaining 1.18%. Conversely, the parallel market rate continued to fall, losing 4.23% to close at ₦1,420.00/US$1. Accordingly, the gap between the official and street markets widened to 59.21% (50.70% the previous week). Last week, the Central Bank of Nigeria did not publish its gross external reserves.

During the week, the CBN rolled over Treasury bills worth ₦36.04bn (US$40.41m) across the 91-day, 182-day, and 364-day maturities. The bid-to-offer ratio increased to 30.14x (20.16x previous auction) as the subscription amount reached ₦1.09tn. Despite the demand level, stop rates increased across the trio of maturities to 5.10%, 7.15%, and 11.54%, respectively.

In the secondary markets, yields improved for both T-bills and FGN bonds last week. From the point of view of individual investors, it is clear to us that risk is back in fashion – even if briefly – and some players have left the T-bill market aside for the equity market which have delivered 36.95% year-to-date.

Average yields on Treasury bills closed 334 basis points higher at 6.73% pa. Across the yield spectrum, average yields on the long end added 667 basis points to 11.21%, the short end gained 2 basis points to 1.77%, while there was little to no activity at the belly of the curve with average yields unchanged at 2.74%.

Average yields on FGN bonds rose to 13.80% pa adding 24 basis points on the week. Average yields across the short, mid, and long end of the curve rose to 11.97%, 14.42%, and 15.26%, adding 10bps, 34bps, and 29bps, respectively.

Over the week, Brent crude price rose by 6.35%, the highest since 13 October 2023, to close at US$83.55/bbl. This brought the year-to-date change in price to an average of US$78.65/bbl which is 8.45% lower than the average of US$82.19/bbl in 2023.

The price increase was due to supply concerns as a result of the Middle East conflict. We expect that the average price this year will exceed the US$77.96/bbl assumption in Nigeria’s 2024 budget.

Last week, the local bourse continued its bullish run as the index increased by 8.32% to close at 102,401.88 points, bringing the year-to-date return to 36.95%. Gains in Tripple Gee and Company (+32.24%), Dangote Cement (+28.82%), and Sunu Assurances (+25.00%) outweighed losses in Veritas Kapital Assurance (-23.38%), Cadbury Nigeria (-20.86%) and Deap Capital Management and Trust (-19.19%).

The current enthusiasm for stocks is concentrated in a small number of the largest stocks by index weight, notably Dangote Cement, BUA Cement and BUA Foods, as well as Geregu. In addition, some small stocks are being marked up sharply. This has taken the traditional January rally to unprecedented levels, as we explained in last week’s Nigeria Weekly Update, but the rally at this stage is not as broadly-based as it was two weeks ago.

The NGX Industrial Goods index (+23.20%) led the gainers last week, followed by the NGX Oil and Gas index (+11.57%), the NGX 30 index (+8.42%), the NGX Consumer index (+5.29%), the NGX Consumer Goods index (+5.29%) and the NGX Pension index (+1.76%) while the NGX Insurance index (-4.10%) and NGX Banking index (-1.63%) closed negative.

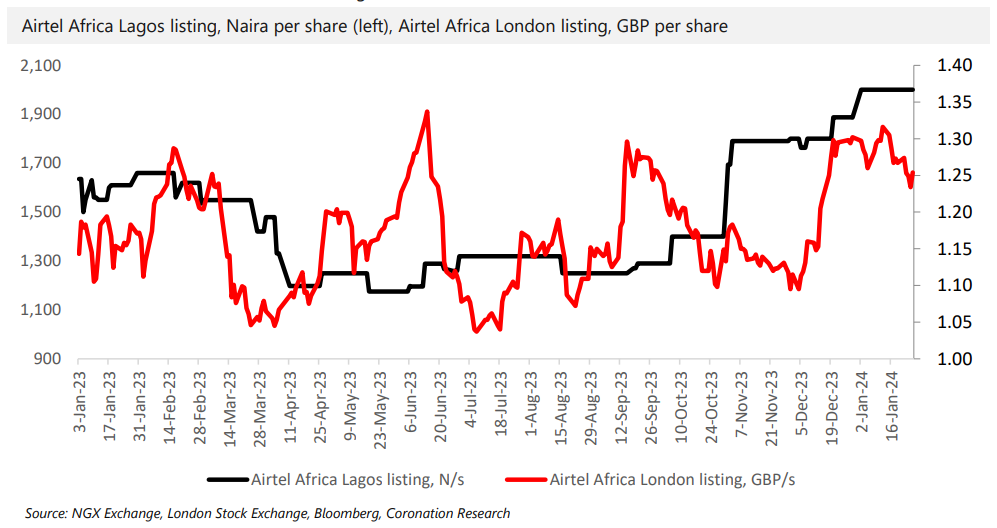

In the last three months of 2023, the NGX-Exchange listed shares of Airtel Africa rallied by 46.3% compared with a rally in the NGX All-Share Index of 12.6%. Those familiar with the dual listing of Airtel Africa shares in Lagos and in London spotted a likely cause. The Naira had weakened by 16.7% against the US dollar in the parallel market, and it was getting close to year-end.

Buying Airtel Africa shares in Lagos and selling them in London is one way of realising foreign exchange. It is straightforward. An investor buys Airtel Africa shares in Lagos for Naira, has them cancelled and reissued in London where they are sold for Pounds Sterling.

The result can be pressure on the parallel exchange rate (as was the case last year). But not all companies tolerate using the swap structure of the parallel market: some prefer to use the dual-listing route because this gives them a counterparty in the form of a UK-regulated stockbroker.

One would think that the supply of Airtel Africa shares listed in Nigeria would simply run out this way. However, when the Naira/US dollar exchange rate is much lower than that implied by the Airtel Africa foreign exchange transaction, shares flow into Nigeria. For example, exactly a year ago, it was possible to buy Airtel Africa shares in London for GBP1.17/share, cancel them and reissue them in Nigeria, sell them for N1,660/share, and swap them back into US dollars at the parallel exchange rate of N752/US$1 and realise a 47% return in Pounds Sterling, allowing 10% for costs. That caused the shares to flow back into Nigeria for a while.

For the past few months, such transactions (either from London to Nigeria, or from Nigeria to London) have not yielded such arbitrage opportunities, because the implied exchange rate has been close to the parallel market rate. Assuming this continues to be the case, then movements in the price of Nigerian Airtel Africa shares may be strongly influenced by the parallel exchange rate. That, at least, would explain the continued appreciation of Airtel Africa shares which are up 6.0% this year.

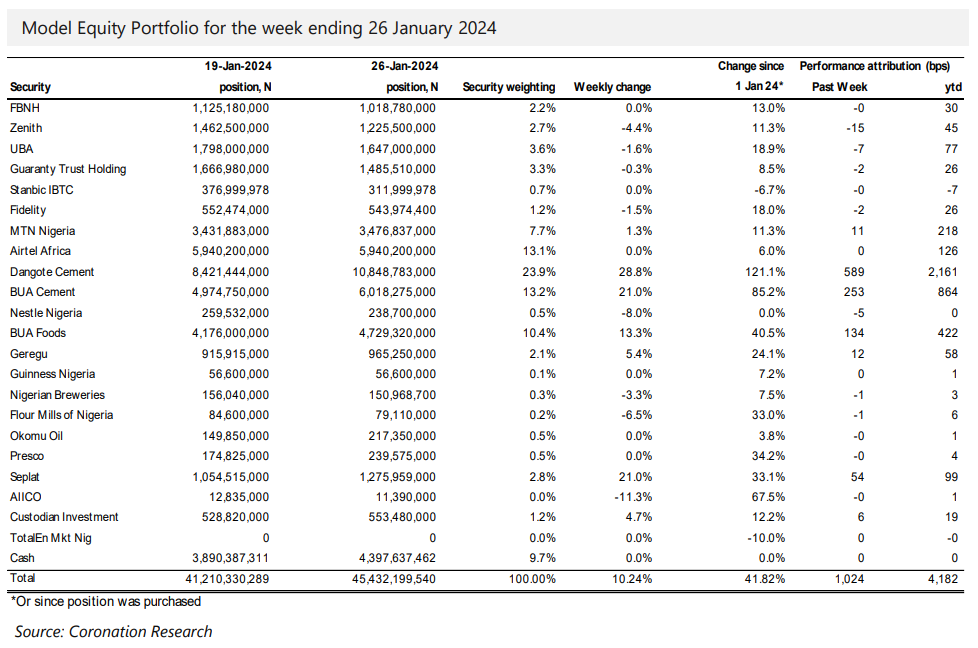

Last week, the Model Equity Portfolio rose by 10.24% compared with a rise of 8.32% in the NGX All-Share Index, outperforming it by 192 basis points (bps). Year-to-date it has returned 41.82% compared with a return for the NGX All-Share Index of 35.95%, outperforming it by 487bps.

It is time to reckon with this market. Without the enormous rises in Dangote Cement (up 28.8% in a week), BUA Cement (up 21.0% in a week) and BUA Foods (up 13.3% in a week), our Model Equity Portfolio would have returned 0.48% not 10.25%. That 0.48% gain, in our view, is a more reliable pointer to the underlying strength of the market than the headline index returns last week. And we note that the banking index fell by 1.63% last week. As we argued in Nigeria Weekly Update’s last edition, January rallies have a habit of correcting and delivering opportunities to buy more cheaply later in the year.

As we wrote last week, is rather humbling to think that the kind of outperformance we strive for over a year can arrive in a week or two, and largely by chance (we remained very slightly overweight the two major cement stocks). Last week, we reversed our tactical overweight in the banks, bringing our exposure down to a neutral weight with notional sales, and increased our weights in Okomu Oil and Presco. We will continue to build our notional weights in Okomu Oil and Presco this week, with a view to making them double overweight.

In addition, this week, we will make small notional adjustments to the largest stocks by index weight in order to keep them at index-neutral levels (it is not as easy as it sounds). Recognising that oil prices are moving up again we will start to build a notional 50% overweight in Seplat Energy. We will make a small – two percentage point – underweight in our total aggregate position in the banks by making notional sales across the board.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.