Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

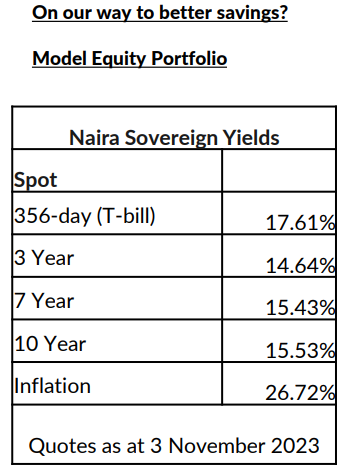

For exactly four years, Nigerian savers have been denied an interest rate for their Treasury bills above the rate of inflation. In fact, T-bill rates languished while inflation rose. Last week, the Central Bank of Nigeria (CBN) used market intervention to create higher rates. And a 1-year T-bill reached a yield of 17.61% in the secondary market. This does not beat inflation, of course, but it is much better than any rate achieved so far this year. And there may be more to come.

Last week, the exchange rate at the Nigerian Autonomous Foreign Exchange Market (NAFEM) gained 1.78% to close at ₦776.14/US$1. In the parallel (street) market, the Naira gained by 17.14% to close at ₦1,050.00/US$1. Consequently, the gap between the NAFEM window and the parallel market narrowed to 35.29%. The gross foreign exchange (FX) reserves of the Central Bank of Nigeria (CBN) rose by 0.18% to US$33.39bn.

The week ended on a positive note for the Naira with significant gains against the US dollar following reports of inflows into the market and of the CBN clearing of FX forwards with banks. Whether the large inflows of US dollar funds, as described by the finance minister two weeks ago, have arrived yet, is not clear. But it is clear that the securitisation of future cash flows from NLNG and the NNPC is planning inflows. We expect the trend in the currency markets to continue as the CBN continues to intervene.

Bearish sentiments dominated activity in the secondary market for FGN bonds and Treasury bills last week. Sell-offs in the markets drove yields up.

In the secondary market for FGN bonds, average yields rose by 74 basis points to 15.61% pa. At the short-end of the yield curve, there was significant rally in yields as the March 2024 bond yield rose significantly by 695 basis points to 13.81% (vs 6.85% last week). Similarly, the Mar-2025 and Jan-2026 bonds rose by 205 basis points and 126 basis points to settle at 14.40% and 14.64%, respectively. At the mid- and long-end of the yield curve, average yields rose by 15 and 36 basis points to settle at 15.48% and 16.41%, respectively.

Yields in the secondary market for treasury bills also rose significantly last week. Average yields rose by 699 basis points to 14.13% pa. Across the yield curve, the short end added +566bps to 9.71%. At the mid-end yields rose +804bps to 13.95%, while the long end of the curve rose +661bps to 15.63%.

The CBN rolled out two OMO auctions last week (Monday and Wednesday). The two auctions featured a total ₦650.00bn (US$837.48mn) worth of bills. Total allotment was ₦477.20bn (US$614.84mn). At the second auction, subscription was weak as the bid-to-offer ratio came in low at 0.51x (₦127.95bn versus ₦250.00bn). Stop rates declined marginally by 1bps at the 97-day ,181-day, and 265-day bills to 13.48%, 14.48%, and 14.99%. While the rate on the 342-day bill rose by 48bps to 17.98%.

In our opinion, the move to roll out multiple auctions in a week was a move by the CBN to mop up excess liquidity (₦963.79bn as of last Monday) from the system to support the Naira’s value, push up rates and tackle inflation.

Last week, the price of Brent crude lost 6.81% to settle at US$84.89/bbl. Year-to-date, the price of Brent crude is down by 1.19%. And it has been trading at an average of US$82.69/bbl year-to-date which is 16.55% lower than the average of US$99.09/bbl in 2022.

Oil prices dropped last week as worries about the Gaza conflict spreading into a larger regional issue subsided. As a result, we removed the risk premium that had been driving prices higher in recent weeks. At the same time, concerns about demand reemerged as a key element affecting prices. We maintain our view that, for most of the year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

ICYMI: Can a US$ injection boost Nigerian markets?

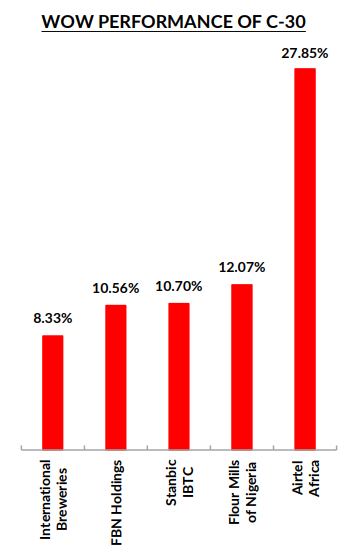

Last week, the NGX All-Share Index gained 4.56% to settle at 70,196.77 points. Its year-to-date return rose to 36.97%. Dangote Cement (+5.77%), Airtel Africa (+27.85%) and Zenith Bank (+2.10%) closed positive. While MTN Nigeria (-5.07%), BUA Cement (-5.01%), and Guaranty Trust Holdco (-0.57%) closed negative. The NGX sub-indices delivered mostly positive performances, with the NGX Insurance (+7.96%) leading the gainers, followed by the NGX30 (+4.52%), NGX Pension (+4.30%), NGX Banking (+2.67%), and NGX Industrial Goods (+0.73%). Additionally, the NGX Consumer Goods (+0.47%) index also closed in the green, while the NGX Oil and Gas remained unchanged.

Reform is on the agenda again, and this time it affects Naira interest rates. As we detailed last week, Finance Minister Wale Edun announced (on October 23) the imminent arrival of US$10.0bn to shore up the nation’s foreign exchange reserves and its foreign exchange market. On the same day CBN Governor, Dr Yemi Cardoso, declared that the CBN would take its job of fighting inflation very seriously. What evidence do we have to support his assertion, so far?

The evidence originates from recent Open Market Operations (OMO) conducted by the CBN. The clearing rates (or stop rates) have been moving upwards, likewise the effective yields. OMO auctions are a way of influencing market interest rates by draining (and, sometimes, not draining) liquidity from the market. At its OMO auction in at the end of October, the CBN offered ₦400.0bn in OMO bills (against ₦150.0bn back in August) and allotted the amount offered, with the stop-rate for a 364-day bill settling at 17.50%, an effective yield of 21.21% pa. The next OMO auction, two days later, achieved a 21.62% yield for the same maturity.

Not surprisingly, Treasury bill rates have been affected. With money being drained out of the market, yields in the

secondary market for 1-year T-bills moved up to 17.61% at the end of last week. These are much better rates than savers have seen all year. What are the objectives? Clearly, one objective is to support the Naira in the foreign exchange market by improving Naira returns. Another, quite likely, is to address inflation which runs at 26.72%.

Does this mean a reversal in the CBN’s interest policy? It was four years ago to the month that the CBN crashed OMO rates (by disqualifying certain institutions from holding them) and thereby crashed T-bill rates. For four years T-bill rates have not even approached the rate of inflation, and inflation has moved up.

Raising rates is likely intended to address inflation, but it carries the risk of increasing borrowing costs, which is always a sensitive issue. We think that the CBN has a fine balancing act to play. As for pronouncements on interest rate policy, we will learn more from the Monetary Policy Council (MPC) meeting on November 21. For now, the news is good for savers.

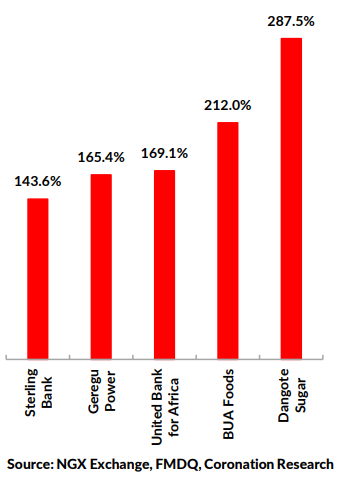

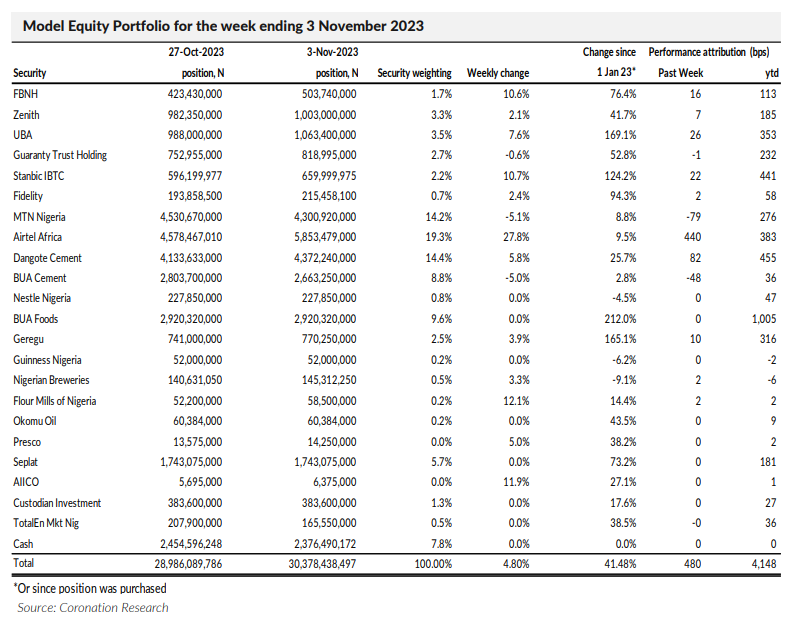

Last week, the Model Equity Portfolio rose by 4.80% compared with a rise in the NGX All-Share Index of 4.56%,

outperforming it by 24bps. Year-to-date it has risen by 41.48% compared with a rise of 36.97% in the NGX All-Share

Index, outperforming it by 451bps.

We attribute the market’s clear happiness with the progress made in addressing shortfalls in the foreign exchange market to renewed confidence among domestic investors.

“Last week, our small notional overweight position in MTN Nigeria, one of only two major stocks (the other one being BUA Cement) to fall, pleasantly surprised us with its outperformance.” (By ‘major stocks’ we mean the top-five stocks by index weight: Dangote Cement; Airtel Africa; MTN Nigeria; BUA Foods; and BUA Cement.) What helped us was our selection of banking stocks which together delivered a 5.2% return over the week while the sub-index of banks as a whole rose by just 2.7%. We do not expect that kind of outperformance on regular basis.

“We maintained index-neutral positions in the major stocks for the most part, with the exception of a small overweight in MTN Nigeria, ensuring that the sudden rise in Airtel Africa did not catch us out.”

Last week, and earlier advised, we took our notional total position in banks up by a meagre 0.4% of the Model Equity

Portfolio, leaving a little more work to be done this week to bring it up to an equivalent index-neutral position. Also, as

earlier advised, we reduced our notional position in TotalEnergies, which has contributed a useful 36bps this year, and we will continue this week. This week we will carefully re-balance our notional holdings in the major stocks to reflect their index weights but retain the small overweight in MTN Nigeria.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. The information is believed to be accurate but not independently verified. The report is intended for the use of clients. It should not be considered as a solicitation to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.