Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

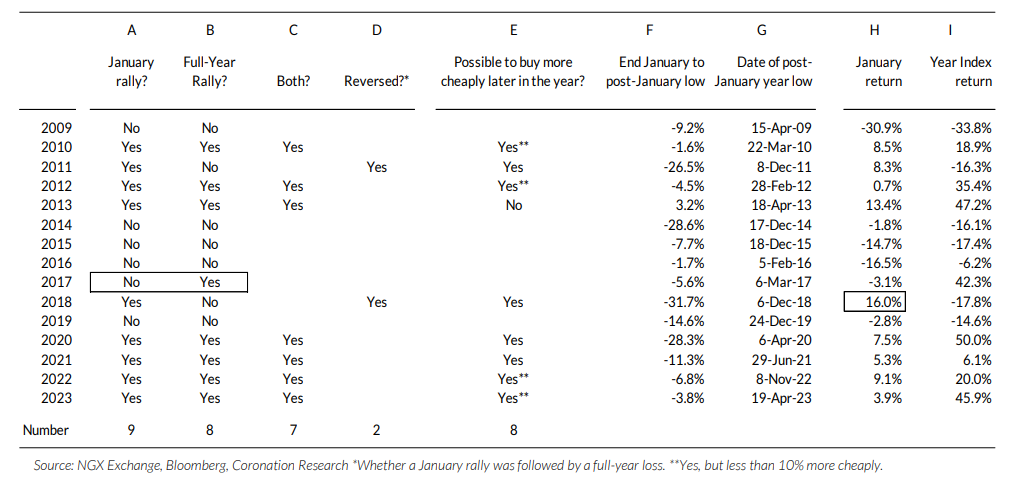

As of last Friday, the NGX All-Share Index was up 26.4% year-to-date, and is within 6% of hitting 100,000 points. Do January rallies mean full-year rallies? And, if you make money out of a January rally, should you hang on for the full year, or should you take profits and reinvest later?

For the second week in a row, the exchange rate at the NAFEM window closed in the red, falling 1.32% to ₦902.45.US$1. In the parallel market, the depreciation was even larger as the Naira fell 6.99% to close at ₦1,360.00/US$1. This brought the gap between the official and street market to 50.70%. The CBN’s gross external reserves, however, rose by 0.41% to end the week at US$33.25bn.

While the CBN is slowly clearing backlog demand for US dollars, there continues to be short supply of FX in the market. We maintain that the situation may reverse. However, it is likely to take several months, and the two distinct exchange rates will most likely remain during this period.

The CBN offered ₦300.00bn (US$332.43mn) in an OMO auction last week across the 92,183, and 365-day tenors. The offer met increased demand as total subscription reached ₦519.90bn (bid-to-offer of 1.73x vs 1.19x in the previous auction). Consequently, stop rates across the trio of maturities declined to 10.00%, 13.50%, and 17.50%, respectively. Total sales equaled the amount offered.

In the secondary market, average yields of Treasury bills added 11 basis points to 3.39% pa last week. The movement in yields was driven majorly by activities at the short end of the yield curve where average yields gained 17 basis points to 1.74%. Average yields at the mid and long-end of the curve remained unchanged at 2.74% and 4.55%, respectively, as there were little to no activity in these instruments.

In the FGN bond market, average yields rose to 13.56% pa, adding 27 basis points. Bond prices declined across the yield spectrum as the average yields on the short-end of the curve added 35 basis points to 11.87%, the mid-point added 42 basis points to 14.07%, and the long-end gained 4 basis points to 14.97%.

ICYMI: Where savings rates are going in 2024?

The first Monetary Policy Council meeting of the CBN this year is scheduled to hold next month. The CBN has continued to express its strategy to manage system liquidity through the issuance of OMO bills in its fight against inflation.

Last week, Brent crude gained 0.34%, to close at US$78.56/bbl. This brought the year-to-date change in the price of the commodity to an average of US$77.76/bbl which is 5.38% lower than the average of US$82.19/bbl in 2023.

In China, slower-than-expected growth in GDP raised doubts about projections that its economy will propel global demand growth in 2024. This concern contrasted with worries over the conflict in the Middle East and disruptions to oil supplies. We anticipate that the price will likely average more than the US$77.96/bbl assumption in Nigeria’s 2024 budget.

As the bull run intensified last week, the NGX All-Share Index achieved the feat of being the world’s best year-to-date (+26.43%). It rose by 13.84% and crossed the 90,000 mark, to close at 94,538.12 points. Gains in Dangote Cement (+53.94%), Honeywell Flour Mills (+50.77%), and May & Baker (+50.46%) outweighed losses in Royal Exchange Assurance Nigeria (-22.45%), Ikeja Hotel (-10.57%) and Linkage Assurance (-8.16%).

We maintain that positive sentiment can be linked to the traditional January surge as well as investors positioning themselves ahead of results and dividends for 2023. Though there may be a correction later on in the year (as in previous years, after January rallies), we expect the surge to continue this month.

The NGX Industrial Goods index led other sectoral indices on the gainers’ table with a 46.88% return for the week, followed by the NGX Insurance index (+14.94%), the NGX 30 index (+14.23%), the NGX Oil and Gas index (+8.82%), the NGX Consumer Goods index (+8.18%) and the NGX Pension index (+5.98%) while the NGX Banking index (-0.12%) closed negative.

Over the past fifteen years (2009-2023, inclusive) there have been nine January rallies (60% of the time). Of these nine January rallies seven of them (78%) went on to develop into full-year rallies. The January rally falsely indicated the market’s direction for the full year on only two occasions: 2011 and 2018.

And on only one occasion, 2017, was there a bear market in January which turned into a bull-run for the full year (see the box within the table, columns A and B). On all the other occasions when there was a bear market in January there was bear market over the full year (five out of six occasions, or 83%).

The direction of the market in January over the past 15 years has been a pretty good indicator (80% of the time) as to its direction for the full year. The two years, 2011 and 2018, when the market rallied in January but gave a negative return for the full year, were exceptions.

In 2011, the market was depressed by news of a single non-performing loan owed by a fuel marketing company to several banks (these were the days before large telecom listings and banks accounted for a large part of the index). In 2018, the January rally followed a spectacular rally in 2017 (+42.3%): the market thought that the trend would continue, but it came back down to earth.