Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Tuesday, October 3, 2023

2023 has seen significant rallies in US and European equity markets: the last two months have seen those markets change direction. What are the reasons for this and what are the implications for the Nigerian equity market? At the same time, and given the specific drivers of the Nigerian equity market, what are the prospects for it now that we are at the start of the fourth quarter?

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) lost 0.99% to close at ₦755.27/US$1. In the parallel market, the Naira slipped by 1.29% to close at ₦1,008.00/US$1. Currently, the gap between the I&E Window and the parallel market stands at 33.46%. The gross foreign exchange (FX) reserves of the Central Bank of Nigeria (CBN) slipped by 0.10% to US$33.24bn.

Notwithstanding the current pressure on the Naira, we maintain that the reforms in the foreign currency market will lead to improvements in FX liquidity in the medium term.

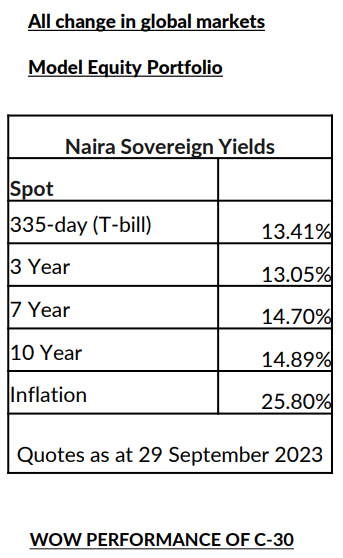

In the secondary market for T-bills, performance was mixed as average yields slipped by 3bps to 7.94% pa. Average yields at the short and medium end of the yield curve declined by 61bps to 3.65%, and by 58bps to 6.55%, respectively, while average yield at the long end rose by 79bps to 10.49%.

At the secondary market for FGN bonds, average yield also dipped by 3bps to 14.44%; with average yield across the short and long-end of the curve declining by 15 and 3 basis points to 12.52% and 15.59%, respectively. However, at the mid-end of the curve, average yield rose by 6 basis points to 14.74%.

At the Primary Market Auction for Treasury Bills which was held last week, the CBN offered ₦177.12bn across the 91, 184, and 364-day maturities. The auction met high demand across the trio of instruments with total subscription reaching ₦786.79bn implying a bid to offer of 4.44x (versus 4.23x at the previous auction). High system liquidity which was further boosted by FAAC disbursement and bond coupon payments spurred the demand level. Total allotment of ₦177.12bn was made, while rates across the 91-day, 184-day and 364-day maturities declined to 4.99%, 6.55% and 11.37% respectively (versus 6.50%, 7.00% and 12.98% at the previous auction).

In case you missed it: US Rate Rises And Nigerian Savers

As we mentioned last week, the bond issuance calendar for Q4 will guide our insight into the direction of rates for the rest of the year. In the short term we anticipate a potential stabilisation of interest rates hinged on our assumption that the borrowing calendar will be light. Like the rest of the market, we expect the newly appointed Governor of the CBN to express his own preferences for interest rate development, though his tenure has only begun, and it may take a while for these to become clear.

Last week, oil prices gained 2.19% to settle at US$95.31/bbl. Year-to-date, the price of Brent crude is up by 10.94% and it is trading at an average of US$81.97/bbl year-to-date which is 17.28% lower than the average of US$99.09/bbl in 2022.

Saudi and Russian production reductions are expected to continue supporting higher prices, but we think that gains towards the $100/bbl mark could prove transient as long as global economic worries persist.

We maintain our view that, for most of the year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

Last week, the NGX All-Share Index further declined by 1.40% to settle at 66,382.14 points. Its year-to-date return fell to 29.52%. Oando (-33.76%), BUA Cement (-11.08%), and Access Holdings (-8.70%) closed negative while Lafarge Africa (+4.72%), Nigerian Breweries (+3.42%), and Flour Mills of Nigeria (+3.16%) closed positive. Performances

across the NGX sub-indices were mostly negative as the NGX Banking (-4.17%) topped the list, followed by, NGX Industrial Goods (-3.04%), NGX-30 (-1.47%) and NGX Oil/Gas (-1.24%) indices closing red. On the other hand, the NGX Insurance (+2.77%) and NGX Consumer Goods (+1.59%) indices closed in the green.

Major international stock markets have changed direction decisively over the past two months, with the US S&P 500 Index and the Nasdaq Composite Index both trending down. Whereas the S&P 500 Index rose by 19.5% in the seven months to the end of July, it has lost 6.6% since. And while the Nasdaq Composite Index rose by 37.1% in the seven months to the end of July, it has lost 7.9% since. In the Eurozone, the Euro Stoxx 50 Index has followed a similar pattern. Meanwhile the price of Brent crude, the price of which barely changed between 1 January and 31 July, has gained 11.40% over the past two months.

What is going on? For almost exactly one year (i.e., since the beginning-to-middle of October 2022) US markets have

been responding positively to the prospect of monetary authorities in the US getting on top of its inflation problem. The markets’ confidence may seem strange, since both inflation and the Federal Reserve’s intervention rate continued to rise after October 2022. But efficient equity markets typically look ahead – nine months to one year ahead – when it comes to anticipating economic conditions. And company results, particularly in the tech sector (think of Meta, for example), were extremely good in early 2023.

This accounts for the rally. The correction reflects a concern that, having come close to taming inflation, the US Federal Reserve will now play safe with its intervention rate rather than cut it. The Federal Reserve is thought likely to raise its target funds rate, with an upper band of 5.50% per annum, one more time this year, with a possible 25 basis points hike. The fear is that it will hold rates high for a long time during 2024 in order to quash inflation. This is the so-called higher for longer scenario.

This is the reason why US government bond yields continue to rise, with the 2-year yield up from 4.88% to 5.04% and

the 10-year yield up from 3.96% to 4.55% over the past two months. As we explained on these pages last week, this has profoundly positive implications for US dollar savers as US government yields are the basis for pricing all international US dollar bonds, including Federal Government of Nigeria Eurobonds, whose yields we consider attractive.

What is the implication for the Nigerian equity market? As we often point out, there is close to zero correlation between international markets and the NGX Exchange All-Share Index, which is not surprising given the paucity of international investment capital flows in and out of Nigeria. (The periods of close correlation are ones of truly international catastrophe, such as the onset of the Covid-19 pandemic in 2020.) The NGX All-Share Index continued to gain ground after July this year, making a further 3.2% gain during August and September.

But it is clear that momentum in the Nigerian equity market is not what it was. As we have been arguing on these pages for several weeks (in fact, since 21 August) much of heavy lifting in the NGX Exchange All-Share Index for 2023 appears to have been completed for now, particularly in the bank sector where the banking sub-index has gained -almost as much year-to-date as it did during the whole of 2017 (the last time when Naira/US dollar issues were resolved). This is not to say that we rule out a further rally in Q4 2023: after all, the last three years all featured rallies in Q4. It is just that the rally appears to have run it course for now.

Besides, we do not set ourselves the task of making successive binary choices (e.g., whether the market will go up or down) because it difficult and to commit to it is foolish. The better way to manage risk is to take a market-neutral stance until a decisive catalyst, such as fuel subsidy removal or foreign exchange liberalisation, appears, and then to buy risk accordingly. See Coronation Research, Investment Opportunities from FX Liberalisation, 10 July, for example.

Last week, the Model Equity Portfolio fell 1.03% compared with a fall in the NGX All-Share Index of 1.40%, outperforming it by 37bps. Year-to-date it has risen by 33.56% compared with a rise of 29.52% in the NGX All-Share

Index, outperforming it by 404bps.

Last week the market was weak, with the NGX All-Share Index down by 1.40% and the sub-index of banks, the NGX Banking 10, down by 4.17% (it had been up by 0.62% the previous week). As advised last week (Monday 25 September),

we made notional sales of our bank positions during the week, which had the effect of taking our notional cash position up from 10.7% to 12.2% of the portfolio. Also as advised last week, we made notional purchases in Seplat Energy (oil prices are trending up) with the aim of building a double overweight position in it relative to the index. We were held back by insufficient liquidity in the stock (we respect actual market liquidity even though this is a notional portfolio) so we could only increase the position a little.

This week we will continue with last week’s tasks, namely continuing to make notional sales in our bank positions with the aim of making the overall position into an underweight and continuing to make notional purchases of Seplat Energy. We plan no further changes this week.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. The information is believed to be accurate but not independently verified. The report is intended for the use of clients and should not be considered as a solicitation to buy or sell securities.

No liability is accepted for errors or omissions, and readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.