Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Monday, September 25, 2023

The yields of US Government bonds have been rising this year, with the yields of the 2-year and 10-year bonds reaching year-highs during the past week. What are the implications for Federal Government of Nigeria (FGN) Eurobonds? In our view the news is good, not so much for the issuer but for the savers.

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) gained 1.22% to close at ₦747.76/US$1. In the parallel (or street) market, the Naira slipped by 4.02% to close at ₦995.00/US$1. Currently, the gap between the I&E Window and the parallel market stands at 33.06%. The gross foreign exchange (FX) reserves of the Central Bank of Nigeria (CBN) slipped by 0.05% to US$33.28bn.

Notwithstanding the current pressure on the Naira, we maintain that the reforms in the foreign currency market will lead to improvements in FX liquidity in the medium term.

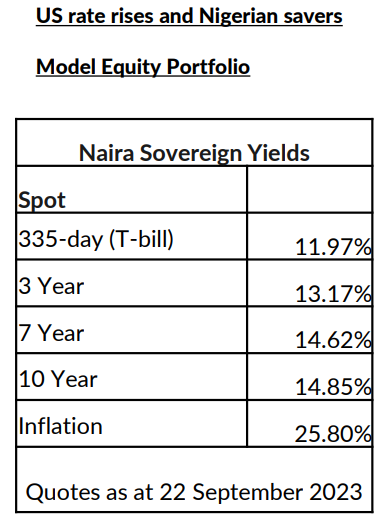

In the secondary market for T-bills, performance was very slightly bearish as average yields slipped by 1bp to 7.97% pa. Average yields at the short of the yield curve rose to 4.25% (+2bps), while the long end tightened by 19bps to 9.70%.

At the secondary market for FGN bonds, average yields increased by 8bps to 14.47%. Similar to the secondary market for T-bills, average yields along the FGN bond yield curve rose at the short end (26bps to 12.67%) and mid-end (3bps to 14.68%) while the long end dipped marginally (1bp to 15.61%).

We are waiting for the FGN bond issuance calendar for Q4 which will give us insights into the directions of rates for the rest of the year. The calendar may be quite light going forward, in which case rates may well stabilise from here onwards. Given very significant changes in fiscal (e.g., fuel subsidy removal) and monetary (exchange rate liberalisation) polices, it is noticeable that T-bill and FGN bond rates have only just begun to move upwards in recent weeks. This is the background as the newly appointed Governor of the CBN, Dr Yemi Cardoso, takes office. And, as we wrote last week, much depends on how he intends to set interest rate policy going forward.

Last week, oil prices slipped as Brent Crude closed down by 0.70% to settle at US$93.27/bbl. Year-to-date, it is up by 8.57% and it is trading at an average of US$81.63/bbl year-to-date which is 17.62% lower than the average of US$99.09/bbl in 2022.

Last week, the NGX All-Share Index closed lower, decreasing by 0.11% to settle at 67,324.59 points. Its year-to-date return fell to 31.36%. Dangote Cement (-8.49%), FBN Holdings (-5.06%), and Unilever Nigeria (-4.48%) closed negative while Stanbic IBTC (+13.21%), Oando (+7.73%), and BUA Foods (+6.32%) closed positive. Performances across the NGX sub-indices were mostly positive as the NGX Insurance (+3.34%) topped the list, followed by NGX Consumer Goods (+2.98%), NGX Banking (+0.61%), NGX Pension (+0.56%), and NGX Oil/Gas (+0.56%) indices closing green. On the other hand, the NGX Industrial Goods (-4.80%) and NGX 30 (-0.13%) indices closed in the red.

In case you missed it: The amazing strength of the equity market

What is the connection between rising US market interest rates and the investment outlook for Nigerian savers? The

obvious answer lies in the Eurobond market where the yields of Nigeran government bonds remain far higher than the

yields they were issued at.

Take the sample of six Federal Government of Nigeria (FGN) Eurobonds featured on this page, and simply compare their current yields with the coupons given with their names. Current yields are much higher than coupons (the coupons represent the yields available at par value when they were issued). On average current yields are 3.42 percentage points (342bps) higher than the coupons.

The fact that yields have risen over time suggests that investors view these bonds as riskier than when they were issued. Yet risk is not the whole story: far from it. The benchmarks for all US dollar-denominated bonds are the US Government’s own bond yields, and these have been rising, too. The yield on the US Government’s 2-year bond has risen by 0.67 percentage points (67bps) from 4.43% to 5.10% so far this year, while the yield on its 10-year bond has risen by 55bps from 3.87% to 4.42%. These rises set the hurdle a little higher for FGN Eurobond yields.

Yet the yields of our sample of six FGN Eurobonds have all fallen this year, on average by 78bps. Clearly, investors’

opinions of Nigerian risk have improved since the beginning of the year, despite the ballooning of Nigerian public sector debt. The realization of Nigeria’s ballooning public sector debt was largely a function of adding the Central Bank of Nigeria’s so-called ‘Ways and Means’ loans (which are in Naira) to the FGN’s total debt. Our colleagues in Coronation

Merchant Bank Economic Research discuss it in their publication Significant Rise in Public Debt Stock, 22 September. The rise was not a surprise and Nigeria’s debt/GDP ratio is still much better than many comparable nations.

All the same, it is noticeable that FGN Eurobond yields have tracked up somewhat since mid-August, by some 0.44 percentage points (44bps) across our sample.

It seems that FGN Eurobond yields are unlikely to trade down to their issue levels (i.e., their coupons) in the immediate

future. US rates are too high for this to happen soon. And US rates keep on rising because the Federal Reserve is signalling that its own rates (the upper band of the Federal Funds target rate is 5.50%) may remain elevated for a long time during 2024.

This irony is that this would prevent the FGN issuing more Eurobonds (the coupons would be too high) going forward, so the stock of FGN Eurobond debt would then remain constant. That itself is a positive factor in the investment case for FGN Eurobonds.

Last week, the Model Equity Portfolio rose by 0.45% compared with a fall in the NGX All-Share Index of 0.11%,

outperforming it by 56bps. Year-to-date it has risen by 34.94% compared with a rise of 31.36% in the NGX All-Share

Index, outperforming it by 358bps.

Last week was a significant one for the market with the NGX All-Share Index reaching a year-high of 68,359.22 points on Tuesday, up 33.38% on the year. While the broad market was down overall by the end of the week (largely a function of Dangote Cement losing 8.5% and BUA Foods gaining 6.3%), the banking index closed the week up 0.62%.

We were, as promised last week, notional sellers of bank stocks but the ones we held did well and our aggregate position in banks contributed 91bps in performance. We are now neutral in our overall bank exposure but will make further adjustments this week to bring our weights in line with the sub-index of banks, as much as possible, and bring our overall position to a small underweight.

Last week were made notional purchases of Seplat Energy as part of our effort to create a double overweight in the

stock, prompted to do this by recent gains in oil prices. Liquidity was insufficient to get the job done (we respect actual

market liquidity even though this is a notional portfolio) and so we will continue to make such notional purchases this

week. We plan no other changes this week.