Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Naira savings rates, by which we mean T-bill and FGN bonds rates, have been below inflation for four years. There was some prospect of much higher rates in 2024 but we think these hopes have receded. Instead, look forward to moderate T-bill rates and expect savers to look for yield pick-up in specialised portfolios, infrastructure funds and the like.

Last week, the exchange rate at the NAFEM window lost 2.38% to close at ₦890.54/US$1 as supply challenges continue to impact the market. Similarly, at the parallel market, the Naira fell by 2.21% to close at ₦1,265.00/US$1 influenced by the supply inefficiencies in the official window. The Central Bank of Nigeria’s gross foreign exchange reserve rose 0.15% to close the week at US$33.09bn.

We expect that it will take several months for the authorities to fund the backlog in demand for US dollars and meanwhile the two distinct exchange rates will remain.

In the secondary market last week, the average yields of treasury bills declined to 3.28% pa (versus 5.95% the previous week). Across the yield spectrum, buying interest across the short, mid, and long-end of the curve drove average yields down to 1.58%, 2.74%, and 4.55% at the short, mid, and long-end of the yield curve, respectively.

Similarly, in the FGN bond market, average yields fell by 44 basis points to 13.28% pa. Average yields at the short end declined by 44 basis points to 11.52%, average yields at the mid-point lost 49 basis points to 13.65%, while yields at the long end of the curve fell by 40 basis points to 14.93%.

In the primary market, the CBN rolled over T-bills worth ₦56.56bn (US$63.51m). Demand at the auction increased (+9.9%) relative to the previous auction as total subscription reached ₦1.14tn (bid-to-offer 20.16x). As a result, stop rates declined to 2.44%, 4.22%, and 8.40% (vs 7.00%, 10.00% and 12.24%) for the 91-day, 182-day, and 364-day tenors, respectively. Total amount sold equalled the amount offered across the trio maturities.

The CBN also rolled out another OMO auction worth ₦300.00bn (US$336.87mn) across the 92, 183, and 365–day maturities. Total subscription reached ₦519.90bn implying a bid-to-offer ratio of 1.73x vs 1.19x at the previous auction. Total sales equaled the amount offered and despite the increased demand, stop rates across the trio maturities reached 10.50%, 14.00%, and 17.75%.

ICYMI: Can We Be Optimistic About Foreign Exchange?

Last week, the Brent price settled lower, by 0.60%, to close at US$78.29/bbl. This brought the year-to-date change in the price of the commodity to an average of US$77.41/bbl which is 1.62% lower than the average of US$82.19/bbl in 2023. Concerns about supply were heightened by Saudi Arabia’s substantial price drop and an unexpected increase in the country’s oil stocks.

We anticipate that prices this year will likely stay over the US$77.96/bbl assumption in Nigeria’s government budget.

The local bourse closed positive with a 4.24% gain to close at 83,042.96 points week-on-week. Gains in Guinea Insurance +65.52%), Royal Exchange (+55.56%), and Deap Capital Management and Trust (+51.72%) compensated for losses in Daar Communication (-30.23%), C and I Leasing (-26.43%) and Scoa Nigeria (-17.68%).

We maintain that the positive sentiment can be linked to the traditional January surge as well as investors positioning themselves ahead of results and dividends for 2023. Though there may be a correction later on in the year (as in previous years, after January rallies), we expect the surge to continue this month.

The NGX Consumer Goods index led other sectoral indices on the gainer’s table with a 9.60% return for the week, followed by the NGX Insurance index (+7.63%), the NGX Banking index (+5.10%), the NGX Industrial index (+4.80%), the NGX Pension index (+4.53%), the NGX 30 index (+4.28%) while the NGX Oil and Gas index (-1.61%) closed negative.

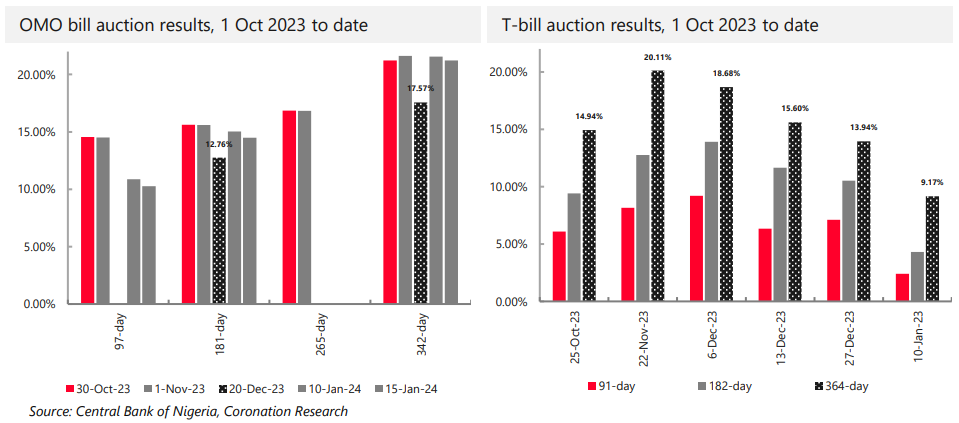

Last week, the CBN held two auctions that give us a good indication of where savings rates are headed in 2024, in our view. To get an indication so early in the year is unusual.

To begin with, we know that the Governor of the CBN, Dr. Yemi Cardoso, wishes to address price stability, i.e. inflation. One way of doing this is to raise Naira interest rates because raising rates puts a brake on borrowing and the supply of money to the economy. It is when money is supplied but not being used efficiently that inflation takes off.

In late October, the CBN signaled its intent with an open market operation, auctioning its OMO bills to banks at a tempting rate that was designed to suck money out of the banking system (the technical word is sterilisation). The 362-day OMO bill was sold at a yield of 16.92%. Then, in November, the CBN held an auction of T-bills that achieved a yield of 20.11% at the 1-year maturity.

While an OMO bill auction is designed to draw money out of the banking system, the effects of a successful T-bill auction are different. A T-bill auction funds government (in which case the money flows back into the economy) while encouraging savers to save money either with direct T-bill purchases or subscriptions to Money Market Mutual funds. But in either case, OMO or T-bill auction, money is being locked up in securities that might otherwise hit the street and influence prices.

In December, T-bill rates fell, with secondary market yields drifting down to 11.77%. With reported November inflation at 28.20% year-on-year, where was the assault on inflation?

The answer came last Wednesday. The CBN’s OMO auction achieved a 1-year yield rate of 21.56%, in line with its earlier auctions rates since late October; N350.0bn (US$393.3m) was removed from the banking system in a few hours. The CBN’s auction of T-bills that afternoon, by contrast, achieved a yield of 9.17% for 1-year paper. Quite a difference.

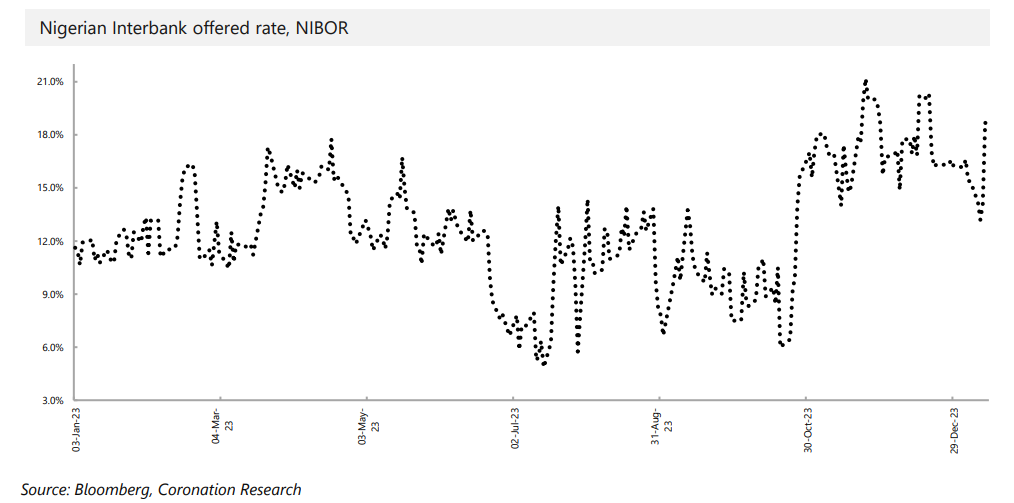

What does this mean for Nigerian savers? Ordinary Nigerian savers cannot buy OMO bills since the auctions are available to banks and to foreign portfolio investors. There can be indirect effects, whereby a high OMO rate influences banks’ own cost of funds, which can be seen in the Nigerian interbank rate. This has been high since last October. It can encourage banks to be generous when giving deposit rates to customers, particularly when professional asset management companies (as Financial Institutions) gather customers’ money to place deposits in large sums.

For the most part, ordinary Nigerian savers, as well as pension funds and mutual funds, purchase T-bills and Federal Government of Nigeria (FGN) bonds. The rates on these securities are well below the rate of inflation, so the government is getting a good deal by issuing them. One reason for the CBN to hold T-bill rates low is to manage – downwards – the cost of the government servicing its own debt.

So, we may be set for reasonably high OMO rates this year (albeit below the rate of inflation) but moderate T-bill rates (starting with an auction in January that settled at 17.75%). Since T-bill rates influence FGN bond rates, we may be set for moderate FGN bond rates this year, too.

In this environment we expect savers in Naira to go looking for extra yield. This can include specialist funds (like infrastructure funds), credit portfolios and equities, among other products. Most of these involve a degree of risk, so risk management is key. While we expect the authorities to make progress in the battle against inflation this year (with our year-end forecast at 23.5% year-on-year) we also expect savers to behave much as they have done over the past few years, looking for yield enhancement over Treasury Bills.

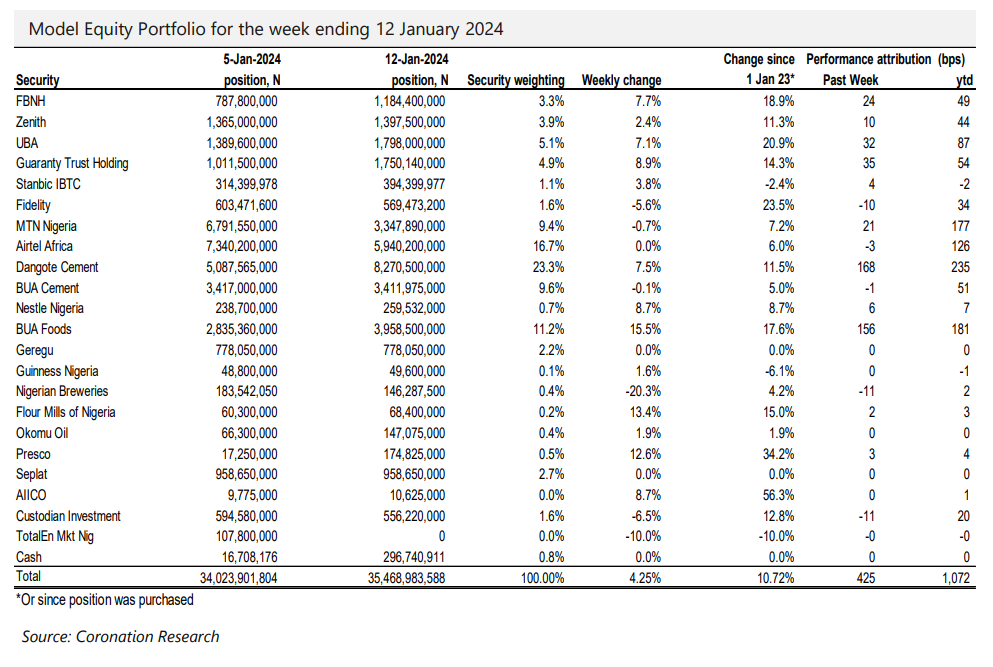

During the second trading week of January the Model Equity Portfolio rose by 4.25% compared with a rise in the NGX All-Share Index of 4.24%, outperforming it by one basis point (bp). Year-to-date it has returned 10.72% compared with a return for the NGX All-Share Index of 11.06%, underperforming it by 34bps.

As we explained last week, the construction of our Model Equity Portfolio is not well-attuned to very sharp rallies in the NGX All-Share Index, particularly when these involve significant appreciation of so-called mid-cap and small stocks which do not feature in our portfolio selection.

How do we deal with such rallies? It is not easy. The remedy we explained last week was to make a tactical increase in the allocation to banks, taking the overall notional exposure to 2.7 percentage points above their index-neutral weight. To do this we realised notional cash by rebalancing the notional holdings of the largest stocks by index weight. Being overweight the banks delivered the advantage we hoped for, the Banking 10 sub-index of banks rising by 5.1% over the week and our notional bank holdings delivering 95bps.

Also, and as advised last week, we made notional purchases of Okomu Oil and Presco to bring these up to neutral weights. We will continue to make notional purchases to bring these up to double their index-neutral weights over the coming weeks. We will continue to rebalance our major holdings in the largest index weights and realise some more notional cash.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.