Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

As markets resume trading in 2024 the biggest issue is foreign exchange. Are things going to get better or worse? Sometimes, we believe, and when all the evidence points to trouble, it pays to be optimistic.

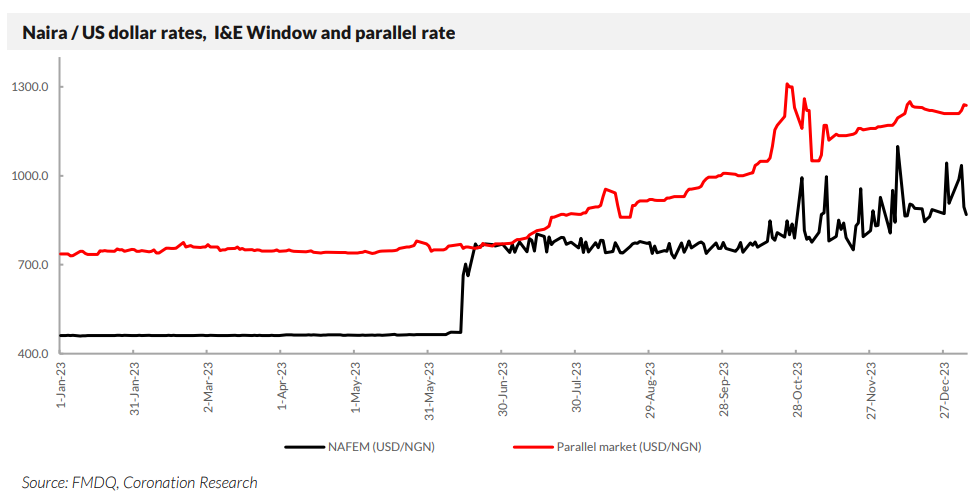

Recovering from the previous week’s loss, the exchange rate at the Nigeria Autonomous Foreign Exchange Market (NAFEM) gained 4.34% to close at ₦869.39/US$1 last week. Conversely, the parallel rate lost 2.18% to close at N1,237.00/US$1. The CBN’s published gross foreign exchange reserve rose by 0.39% to close at US$33.04bn.

Some of the backlog with airlines was cleared last week, according to the press. This emphasises the CBN’s commitment to addressing the challenges around FX supply. As we mentioned last week, we expect new policies to regulate the market. But the supply issues require a lot of work to put right. This may take months, in our view.

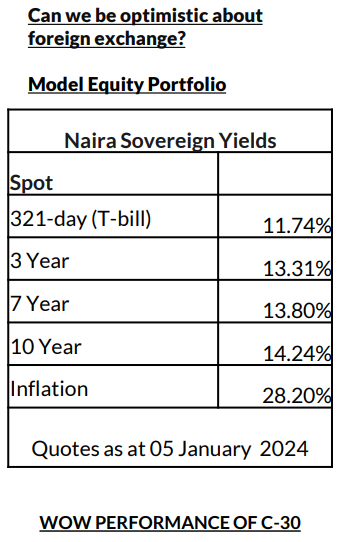

Average yields in the secondary market for treasury bills declined by 34 basis points to settle at 5.95% pa. The overall change in average yields was fueled particularly by buying interest at the long-end of the yield curve where average yields declined by 69 basis points to 8.39%; and marginally by an 8 basis points decline in average yields at the mid-point of the curve. There was little to no activity at the short-end of the curve as average yields remained unchanged at 2.67%.

In the secondary market for FGN bonds, average yields declined by 41 basis points to 13.73% pa. Across the yield curve, the average yields at the short end fell 19 basis points to 11.43%, the average yields at the mid-point lost 58 basis points to 13.96%, while the average yields at the long-end of the curve fell by 40 basis points to close at 15.22%.

We hope to infer the direction of rates from the treasury bill auction scheduled for January 11 (Thursday), and the Monetary Policy Council meeting which is expected to take place later in the month.

Last week, the Brent price settled higher, by 2.23%, to close at US$78.76/bbl. This brought the year-to-date change in the price of the commodity to an average of US$77.62/bbl which is 5.55% lower than the average of US$82.19/bbl in 2023.

The oil price is expected to stay erratic through this period of geopolitical unrest. OPEC+ (OPEC plus Russia) has stated its policy to cut output by six million barrels per day, or 6% of world supply, but there is no evidence of this yet.

We anticipate that prices this year will probably stay over the US$77.96/bbl assumption in Nigeria’s government budget.

ICYMI: First thoughts for 2024

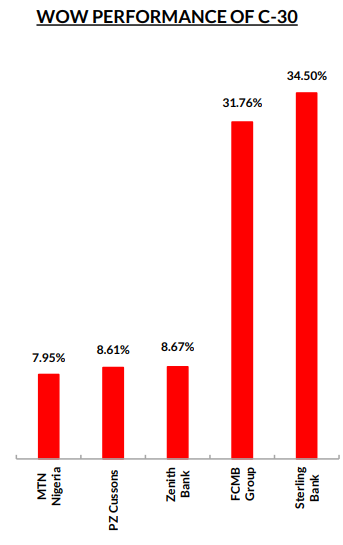

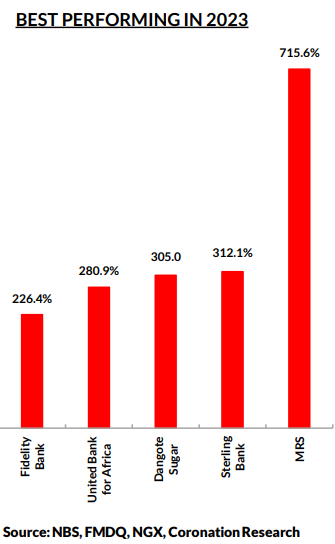

The NGX All-Share Index started the year positive reaching a record-high of 79,664.66 points with a 6.54% gain week-on-week. The performance was buoyed by gains in Sterling Bank (+34.50%), FCMB Group (+31.76%), and Zenith Bank (+8.67%) offsetting losses in Guinness Nigeria (-7.58%), Stanbic IBTC Holdings (-5.96%) and Honeywell Flour Mills (-3.92%).

We attribute the optimism in the market to the traditional January rally as well as investors taking position ahead of earnings release and dividend declarations for the just-concluded year. We expect this rally to continue this month though we may see some corrections further down the line.

The NGX Insurance index led all other sectoral indices on the gainer’s table with a 17.33% return for the week, followed by the NGX Banking index (+11.53%), the NGX Pension index (+10.68%), the NGX 30 index (+7.38%), the NGX Industrial index (+3.60%), the NGX Oil and Gas index (+3.11%) and the Consumer Goods index (+2.92).

As 2024 gets into gear the single largest issue for Nigeria is its currency. We know the problem is a backlog of US dollars which the foreign exchange markets expect (or would like) the CBN to supply. We know the authorities are working on forward sales of the nation’s oil and gas to obtain the necessary US dollars to the clear the backlog. So, the question is: “How

are they doing?”

Newspaper reports back in October stated that the Finance Ministry plans to borrow US$10.0bn with forward sales of oil and

gas from the government-owned NNPC Limited (US$3.0bn) and its partly-owned Nigeria LNG Limited (US$7.0bn). This

raises two questions. First, will US$10.0bn be enough? Second, can the authorities really raise US$10.0bn?

We have never seen an assessment of the foreign exchange backlog. Foreign airlines, shipping companies and portfolio

investors are sitting on large sums of Naira waiting to be converted into US dollars and sent home. Then there are the

matured foreign exchange obligations of the CBN to Nigerian banks which are widely reported as close to US$7.0bn.

Whether the total, once netted off, is actually US$10.0bn is a moot point.

Second, the authorities have indeed started raising the money with forward sales (and are beginning to settle their obligations with banks). Project Gazelle was reported in the press as designed to secure US$3.3bn from a consortium of international lenders over five years with an interest rate of 11.85% (we cannot independently verify these details).

This kind of deal gets the ball rolling though we note that the Project Gazelle appears to be one of a series of similar deals made on behalf of the NNPC over several years, starting in 2020, with perhaps US$3.3bn already raised. This raises the question over how much more capacity there is, in the terms of the NNPC’s future oil production and royalties, to borrow against. The NNPC cannot mortgage all its production for obvious reasons: it needs to remit regular payments to the Federal Government (for its budget) and, as one would expect from standard lending practice, pledges more future production than necessary for the purposes of loan security.

This leaves the larger sum to be raised from the government’s stake in Nigeria LNG Limited. Details are not available at this time. Does this sound pessimistic? We think not. Banks do not publicise their loan agreements (not until they are completed) so it is quite likely that more is happening than meets the eye. And note that when these details are announced (see the dip in the parallel market rate back in early November) the parallel market reacts positively. It is just that the market is dealing with a lot of unknowns at the moment. Consequently, it is taking a dim view of things.

Readers might think that, under these circumstances, we cannot make forecasts. But we can make some. To begin with, the

chart on this page shows the NAFEM rate and the parallel rate diverging in 2023: we do not think they will hold their current

positions during 2024. Active financial markets almost never trade like that. They will either converge (because the Nigerian

authorities find enough money to settle the backlog of foreign exchange demand, and confidence picks up); or they will diverge again. A third possibility is that the authorities capitulate and leave the NAFEM rate to merge with the parallel rate,

although this would go against the CBN’s signals that it wishes to exercise control over the FX market. If we have a bias as a

research department, it is towards optimism. We think that a meaningful part of the backlog will be settled and that

participants will appreciate that the parallel marketrate is extremely cheap. We shall see.

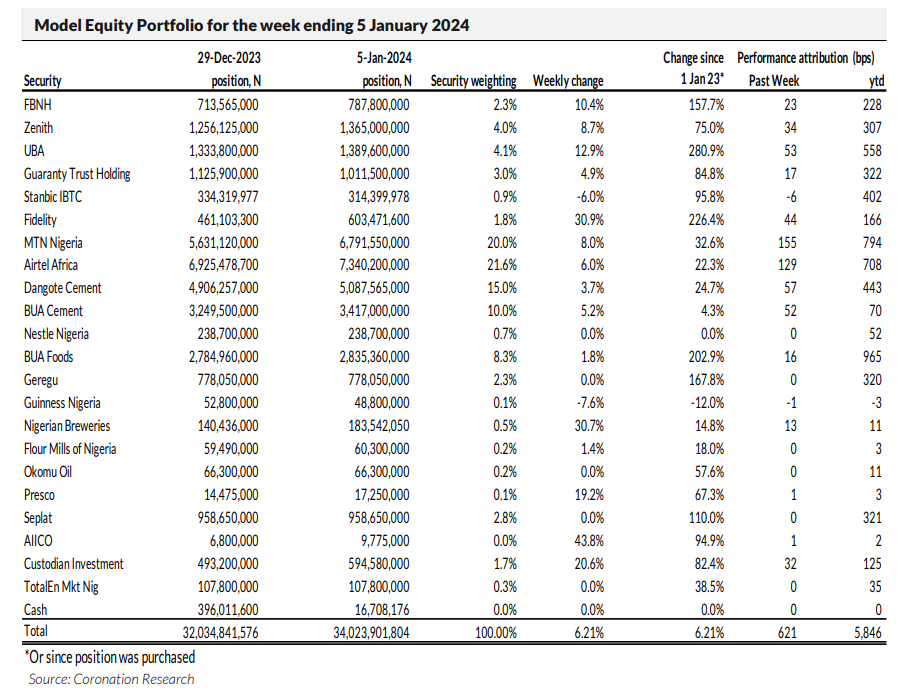

During the first week of 2024 (four trading days) the Model Equity Portfolio rose by 6.21% compared with a rise in the NGX

All-Share Index of 6.54%, underperforming it by 33bps.

This was another painful week, in terms of relative performance, for the Model Equity Portfolio, just as the last two weeks of

December were. In truth, very sharp bull markets in the NGX All-Share Index are difficult to deal with, as small stocks (we

cannot have notional positions in all of them) undergo rapid appreciation.

This week we will rebalance our major holdings in the largest index weights in order to realise some much-needed notional cash. We will redeploy this notional cash to create a tactical overweight in the banking sector of 200bps and we will build positions up to a neutral weight in each of Okomu Oil and Presco, two stocks in which we should have had larger notional positions in 2023.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.