Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Monday, October 23, 2023

Have Nigerian pension funds had a change of heart? For many years, Nigerian pension fund eschewed equities. And they held only a small percentage of their total assets under management (AUM) in stocks. Now it seems they are buying equities and increasing equity holdings as a percentage of total assets. After a long gap, equities are back in fashion with institutional investors.

Last week, the exchange rate at the Nigerian Autonomous Foreign Exchange Market lost 5.37% to close at ₦808.27/US$1. Similarly, in the parallel market, the Naira fell by 10.34% to close at ₦1,170.00/US$1. Currently, the gap between the I&E Window and the parallel market stands at 44.75%. The gross foreign exchange (FX) reserves of the

Central Bank of Nigeria (CBN) rose marginally by 0.08% to US$33.25bn.

Following the lifting of the restrictions earlier placed on previously banned items, the demand for FX increased at the official window. This drove rates up to as high as ₦848.12/US$1 during the week. Similarly at the parallel market, FX illiquidity continues to drive rates. It is expected that the Federal Government will be able to provide some respite to this situation through inflows from international bodies. However, though details on these inflows have yet to be disclosed at the time of writing.

At the primary market auction for bonds last week, the Debt Management Office (DMO) allotted ₦374.76bn (including a non-competitive bid of ₦40bn) implying a bid-to-cover ratio of 1.02x (versus 0.92x at the last auction). Total subscription at the auction was ₦383.11bn, 31.7% higher than the previous auction with an oversubscription of

₦23.11bn. Nevertheless, rates across the April 2029 (+40bps to 14.90%), June 2033 (+30bps to 15.75%), June 2038 (+25bps to 15.80%), and June 2053 (+35bps to 16.60%) maturities increased.

In the secondary market for FGN bonds, average yield declined by 1 basis point last week to 14.45% pa. At the short and mid-end of the yield curve, rates declined by 11 basis points and 2 basis points to settle at 12.12% and 14.92% respectively. Conversely, at the long end of the yield curve, yields rose by 8 basis points to settle at 15.72%.

In the secondary market for Treasury bills, the average yield rose by 40 basis points last week to settle at 6.92% pa. At the short and long-end of the curve, yields rose by 38bps and 34 bps respectively. However, yield at the mid-end of the curve remained unchanged at 5.03%.

While stop rates have consistently risen over the last three bond auctions, this has not been the case at the auction for treasury bills. There has been a steepening of the yield curve. Looking forward, we await a steer on interest rate policy from the new management at the CBN.

Last week Brent oil prices lost 2.35% to settle at US$88.75/bbl. Year-to-date, the price of Brent crude is up by 3.31% and it has been trading at an average of US$82.39/bbl year-to-date which is 16.85% lower than the average of US$99.09/bbl in 2022.

With optimism that the Israeli-Palestinian conflict may defuse without engulfing the entire Middle East area and upsetting oil supplies, crude prices dropped on Friday following the release of two American hostages from Gaza.

We maintain our view that, for most of the year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

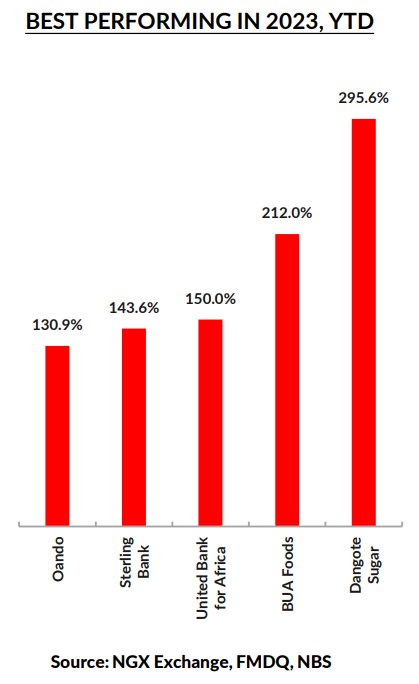

Last week, the NGX All-Share Index slipped by 0.42% to settle at 66,915.41 points. Its year-to-date return declined to 30.56%. Cadbury Nigeria (-16.00%), Stanbic IBTC (-13.06%), and Flour Mills of Nigeria (-11.88%) closed negative while United Bank of Nigeria (+8.26%), Dangote Sugar (+4.61%), and Access Holdings (+3.79%) closed positive. Performances across the NGX sub-indices were mostly negative as the NGX Pension (-1.16%) topped the list of losers, followed by NGX Insurance (-0.96%), NGX Consumer Goods (-0.46%), NGX-30 (-0.38%), NGX Industrial Goods (-0.07%) and NGX Oil and Gas (-0.02%) indices while the NGX Banking (+3.52%) index closed in the green.

From last week: Steady savings rates in 2023: Maintaining stability in uncertain times

It has taken a long time, and almost four successive years of positive equity returns from the NGX Exchange. But it appears that Nigeria’s enormous pension funds are warming to equities again. In contrast with industry data from 2022, the evidence this year suggests that pensions funds are enthusiastic buyers of equities.

From the beginning of 2023 to the end of July, the total AUM of Nigeria’s pension funds rose by 13.8% to ₦17.1 trillion (US$21.1bn at the NAFEM rate last Friday). The value of their equity holdings rose by 47.5% to ₦1.3 trillion over the

same period. The 25.5% rise in the NGX All-Share Index over that period does not account for that increase. So, either

Nigerian pension funds are very good stock pickers, or they were net purchasers of equities. The big rise in their equity

position was likely a combination of net purchases – up to ₦200.0bn, we think – and reasonable stock selection.

This took the percentage of equities in the assets under management of pension funds from 6.1% to 7.8%. If we look at the four months from the end of March to the end of July, the total equity holdings of pension funds rose from ₦1.04 trillion to ₦1.34 trillion. This is a rise of 28.4% compared with a rise in the total AUM of pension funds of 9.5%. The NGX All-Share Index only rose by 17.3% over the same period. So, again, pension funds were in all probability net buyers of equities.

Which equities have they been buying? It is difficult to pinpoint the answer with any accuracy. The National Pension

Commission (PENCOM) gives data on equity holdings but does not break down the data (which is hardly surprisingly given the complexity that would involve). We need to use some assumptions. Given the enormous aggregate size of pension funds, at ₦17.1 trillion, we imagine that pension funds are active in the most liquid stocks. And, for the most part, this means bank stocks.

Though not the largest stocks by index weight, banks are the most liquid, tending to have high free floats relative to their total equity. And banks tend to be generous dividend payers, something pension funds likely warm to.

Pension funds’ enthusiasm for equities in 2023 contrasts with their behaviour in 2022. In 2022, the total assets of pension funds rose by 11.7%. But their equity holdings actually fell by 0.8% over the year. Given that the NGX All-Share Index rose by 19.98% last year, this either means that pension funds were net sellers of equities or poor stock pickers (NB the sub-index of banks only rose by 2.81% last year), or a combination of the two.

At any rate, the data from PENCOM points to a change in attitude towards equities, in our view. Pension funds may well have observed that the return from the NGX All-Share Index was 50.03% in 2020, 6.07% in 2021 and 19.98% in 2022, cumulatively beating inflation by a decent margin and bond returns by a large margin. The comparison between bond and equity returns so far this year suggests that 2023 will be no different.

Last week, the Model Equity Portfolio fell by 0.39% compared with a fall in the NGX All-Share Index of 0.42%,

outperforming it by 3bps. Year-to-date it has risen by 34.40% compared with a rise of 30.56% in the NGX All-Share

Index, outperforming it by 384bps.

Once again, most of the action in the equity market took place among bank stocks last week, with comparatively little action among telecom and industrial stocks. For the second week running we saw no change in the prices of index

heavyweights Airtel Africa (14.4% of the NGX All-Share Index), and Dangote Cement (14.5%), though unlike the previous week we did a price change in MTN Nigeria (14.0% of the index) though this was marginal (a decline of 0.2%).

In addition, we saw no change in the prices of another two index heavyweights – BUA Foods (10.0% of the index) and BUA Cement (9.8%). In other words, we saw very little change in the prices of six companies representing 62.7% of the index.

Last week, and as advised a week ago, we re-balanced the positions in bank stocks to better reflect their near-neutral

weights relative to each other, while maintaining a small overall underweight position in them. We also made some small notional sales in Total Energies, as we advised we would last week. We currently express our opinions on stocks by holding a slightly overweight position in MTN Nigeria and a double overweight in Seplat Energy. This week we will continue to rebalance our notional bank holdings and revert to an overall neutral position – some 14.6% of the index – in them

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. The information is believed to be accurate but not independently verified. The report is intended for the use of clients. It should not be considered as a solicitation to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.