Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

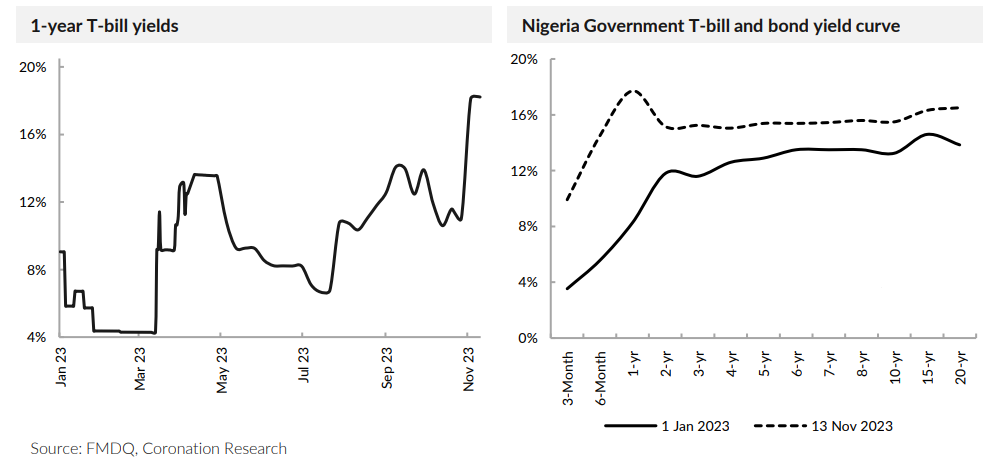

Over the past two years, savings rates in US dollars have risen to the point where US Government bonds now yield more than inflation. The same cannot be said for Nigerian Treasury Bills and bonds. Yet, recent action by the Central Bank of Nigeria (CBN) is having the effect of raising Naira market interest rates. While we may be nearing a peak in US

Government dollar bond rates, Naira T-bill and bond rates are heading upwards. We are at a crossroads. Whether you are a US dollar saver, or a borrower, a Naira saver, or a borrower, there are profound implications.

The exchange rate in the Nigerian Autonomous Foreign Exchange Market (NAFEM) fell by 0.51% to close at ₦780.14/US$1 last week. Losing almost half of the previous week’s gain, the Naira fell by 6.25% to close at ₦1,120.00/US$1 in the parallel market. Consequently, the gap between the NAFEM window and the parallel market widened to 43.56%. The gross foreign exchange (FX) reserves of the CBN fell by 0.13% to close at US$33.39bn, which we attribute to interventions seen in the FX market from the preceding week.

The positive sentiment seen in the FX market a few weeks ago appears to have been short-lived. We expect the CBN to continue to intervene in the market until some stabilisation is seen and, as we described recently, we expect the CBN to obtain significant firepower in terms of US dollars to address the FX market in due course.

The mood in the secondary market for FGN bonds was predominantly bearish last week as average yields rose 6 basis points to settle at 15.67% pa. However, there was significant buying interest at the short-end of the curve, particularly in the Mar-2024 bond which drove the yield on that bond down to 11.80% (versus 13.81% last week).

There was significant buying interest in the secondary market for treasury bills, following the rise in yields the previous week. Average yields declined by 93 basis points to 13.36% pa. Along the yield curve, the short-end dipped by -141bps to 8.30%, the mid-end also dipped by -137bps to 12.58%, while the long-end added +7bps to 15.70%.

At the primary market auction held last week, the CBN offered ₦310.12bn across the 91-day, 182-day and the 364-day maturities. Demand was strong as total subscriptions settled at ₦875.79bn, implying a bid-to-offer of 2.82x. Total sales amounted to ₦497.20bn with a net issuance of ₦187.08bn. Despite the demand level at the auction, stop rates rose at the 91-day (+100bps to 7.00%), 182-day (+200bps to 11.00%), and the 364-day (+375bps to 16.75%, implying an annualised yield of 20.11%), respectively. The primary market, anomalously, yields far more than the secondary market, something we expect to be ironed out soon.z

It is clear that the CBN is using T-bill primary auctions to realise higher rates than before, much as it earlier used OMO bill auctions to the same effect (see Nigeria Weekly Update, November 6). The upwards direction in short-term market interest rates is clear.

Last week the price of Brent crude lost 4.08% to close at US$81.43/bbl. Year-to-date, the price of Brent crude is down by 5.21%. And it has been trading at an average of US$82.67/bbl year-to-date which is 16.57% lower than the average of US$99.09/bbl in 2022.

Oil prices declined for the third consecutive week, reflecting growing concerns about the demand outlook, especially from China and the US. The war between Israel and Hamas does not appear to be having an impact on oil prices. This is despite the danger of the conflict spreading. We maintain our view that, for most of the year, prices are likely to

remain above the US$75.00/bbl mark set in Nigeria’s government budget.

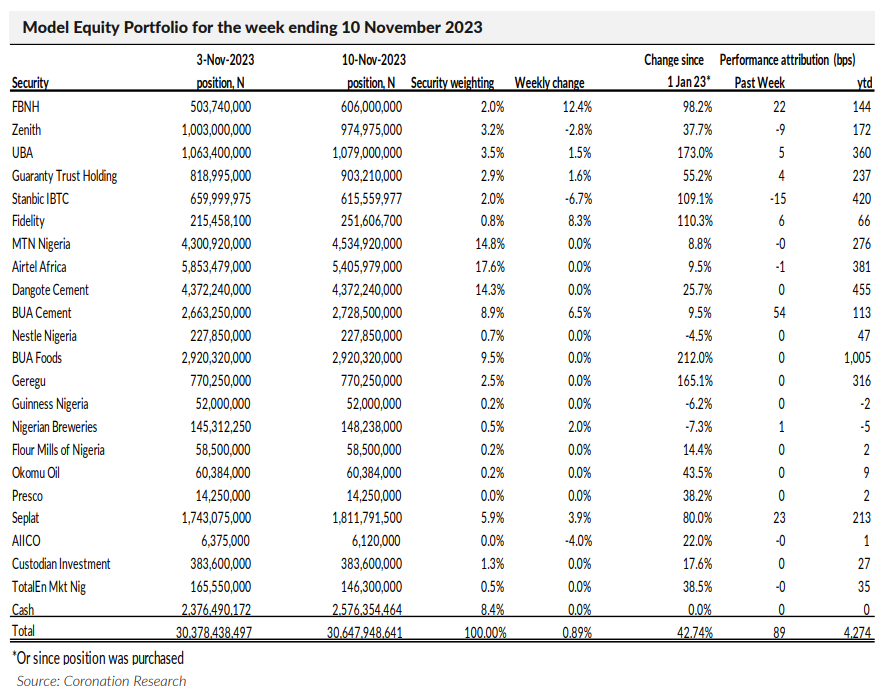

The NGX All-Share Index closed the week in the green as it gained 0.94% to settle at 70,854.18 points. Consequently, the year-to-date return rose to 38.25%. Gains in BUA Cement (+6.47%), Seplat Energy (+3.94%) and Guaranty Trust Holdco (+1.56%) drove the market, offsetting losses in Zenith Bank (-2.79%), Stanbic IBTC Holdings (-6.73%), and

Dangote Sugar (-0.96%). Across the sub-indices the NGX Oil/Gas (+2.91%) topped the list of gainers, followed by NGX Industrial Goods (+2.73%), NGX Banking (+1.71%), NGX30 (+0.90%), NGX Pension (+0.77%) and NGX Consumer Goods (+0.05%) indices, while the NGX Insurance index (-0.53%) closed negative. See the Model Equity Portfolio below.

As we approach the end of 2023, it is a good time to assess what savers can earn from interest rates. A good time, we

think, because US dollar interest rates appear to be nearing a peak while Naira interest rates are rising again. Depending on whether you hold US dollars or Naira, and whether you are a saver or a borrower, different measures can be taken.

First, consider US dollar market interest rates. Of course, these could move higher still, but look at where they stand today in comparison with where they were two years ago. 2-year US Government bond rates are 4.54 percentage points higher than they were two years ago. 10-year US Government bond rates are 3.06 percentage points higher than they were two years ago. And, at 5.06% per annum (pa) and 4.63% pa, respectively, they beat US dollar inflation at 3.70% y/y by a respectable margin.

Two years ago, there was not much to gain by saving money in US Government bonds. Now, US Government bonds are a much more remunerative than they were then, especially for low-risk investors such as those investing in US dollar annuities. For borrowers in US dollars, the opposite is true. Borrowing has become much more expensive. So, it makes sense to take short-term loans in the expectation that rates will come down.

Will US market rates come down? The good news on this front is that there are not many predictions of a rise in US policy rates (though this remains possible). And most commentary is about how long it will take for the Federal Reserve to start cutting rates in 2024. US investment banks’ predictions differ as to when trimming of US policy rates will start. The optimists predicting that it will start next June. The caveat here is that market rates may not necessarily follow policy rates. So, US Government bond yields could continue to climb, especially in the face of Chinese selling of US Government bond positions.

In contrast with the US, where both policy rates and Government bond rates are above the level of inflation, neither Nigeria’s policy rate (18.75% pa) nor its T-bill and FGN bond rates are above the level of inflation at 26.72% pa. Nigerian

market interest rates (T-bill rates, FGN bond rates) did not really follow the policy rate (the Monetary Policy Rate) when this started rising, beginning in May 2022 (when the MPR went from 11.5% to 13.0%). Since May 2022 the MPR has risen from 11.50% to 18.75%. But T-bill rates and FGN bond rates have not followed. Nigerian money markets – at least outside the regulated banking sector – have remained liquid and market interest rates have remained quite low.

This is changing. Recent open market operations (OMO), which are essentially auctions of bills by the CBN, have seen short-term market rates move up sharply. This is as we described in last week’s edition of Nigeria Weekly Update – On our way to better savings?

OMO rates influence T-bill rates, and so T-bill rates have been rising too as we saw at last week’s auction. These moves are consistent with a recent statement by CBN Governor Dr Yemi Cardoso on October 23, as reported by ThisDay newspaper. This is to the effect that the CBN would be taking price stability very seriously.

How high will Naira market interest rates go? Since the process has only just started, it is difficult to say. It is possible that the CBN will want market rates to settle a little below the rate of inflation. Then it will assess the effect on prices before adjusting again. If inflation falls as a result, we might, for the first time since October 2019, find 1-year T-bill rates in excess of inflation at some point in 2024. Time will tell.

Our point is that savings rates in Naira are in the process of becoming more attractive, which is the opposite of what we believe is happening with US savings rates. If we are right, then it makes sense for savers to lock in US rates. Savers in Naira, by contrast, might want to hold short-term money market instruments in order to keep their options open.

Last week, the Model Equity Portfolio rose by 0.89% compared with a rise in the NGX All-Share Index of 0.94%,

underperforming it by 5bps. Year-to-date it has risen by 42.74% compared with a rise of 38.25% in the NGX All-Share

Index, outperforming it by 451bps.

Last week, and as we advised, we made notional purchases of bank stocks. This is with the aim of having a market-neutral eight in them. There is a little bit more to be done on this front this week. Also as earlier advised, we made some notional sales in TotalEnergies to reduce our exposure. We will continue to do so this week.

We have a small overweight in MTN Nigeria (which we have had for several weeks) and a double overweight in Seplat

Energy, and we plan no changes in these positions this week. This week, we will continue to rebalance our positions in

the largest stocks by index weight (Dangote Cement, Airtel Africa, BUA Cement and BUA Foods). This in order to have neutral weights in them while maintaining our small overweight in MTN Nigeria. We plan no further changes this week.

NB: The Coronation Research Model Equity Portfolio is an expression of opinion about Nigerian equities and does not represent an actual portfolio of stocks (though market liquidity is respected, and notional commissions are paid). It does not constitute advice to buy or sell securities. Its contents are confidential to Coronation Research up until publication. This note should be read as an integral part of the disclaimer that appears at the end of this publication.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.