Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Every investor faces the same critical question: How can I pursue strong returns without taking excessive risk?

Mutual Funds offer a robust solution that blends diversification and professional management to help you strike that balance. Getting it right means more than steady growth. You will sleep soundly knowing your investments are working smarter, generating steady returns while keeping your capital protected.

But what exactly does that balance look like in practice and how can you achieve it without the guesswork?

Let’s dive into what this balance means and how Coronation Mutual Funds can help you achieve it easily and confidently.

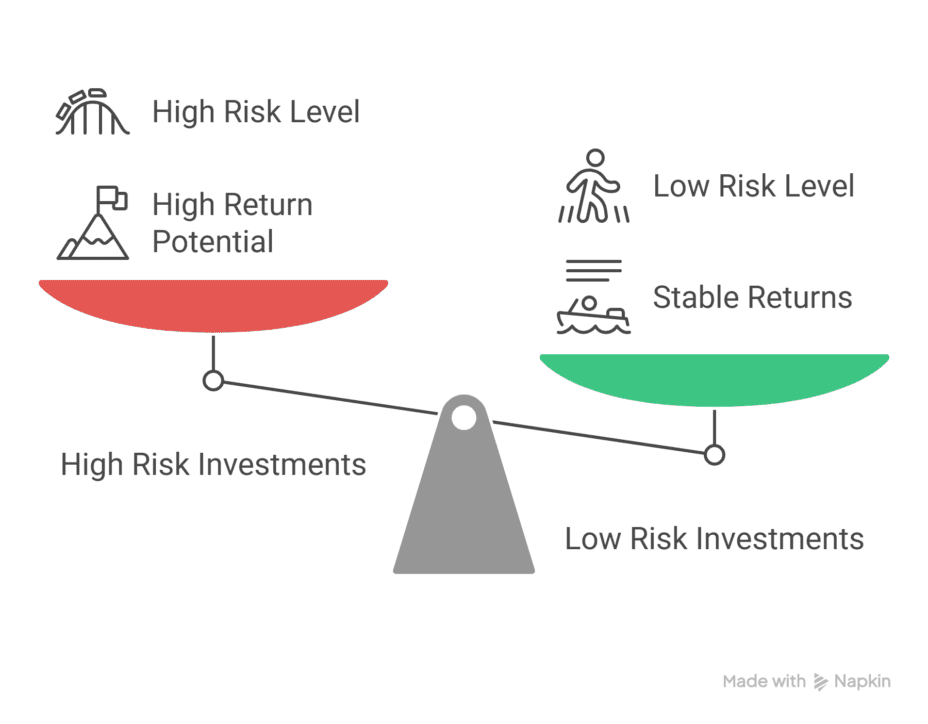

To begin, let’s explore these two foundational investment concepts:

High risk = potential for high return (and high loss)

Low risk = more stable returns, but lower potential gains

This trade-off is at the heart of all investment decisions. So, how do you decide what level of risk is right for you? That’s where strategic planning—and the right investment tools—come in.

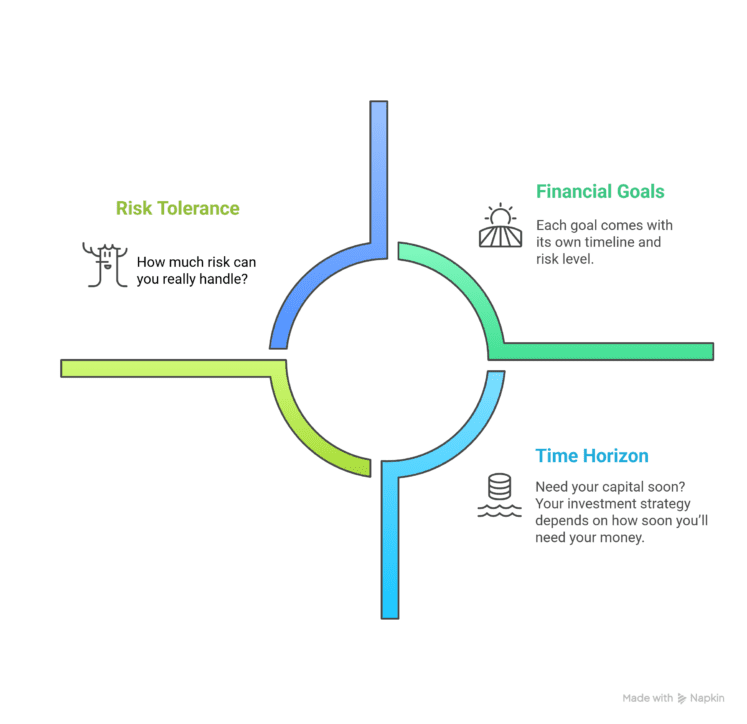

Balancing risk and return isn’t a one-size-fits-all process. It depends on:

Understanding how the market works or having a skilled fund manager by your side can help you make more informed decisions and avoid reacting out of panic. Want expert guidance? Click here to speak to a professional fund manager.

One key approach professionals often rely on is strategic asset allocation, which is the secret to achieving that much-needed balance.

One of the most effective ways to manage risk while pursuing attractive returns is through strategic asset allocation, which means distributing your investments across different asset classes (like equities, bonds, or money market instruments) to reduce risk and enhance return potential.

A properly allocated portfolio is like a “well-balanced diet”—it keeps your finances healthy throughout the year. This can be achieved by investing in Mutual Funds.

Achieving balance in your investments means finding the right mix of risk and return (ie investment options) that fits your goals. Coronation Mutual Funds are designed to make that easier for you.

With built-in diversification, professional fund management, and low entry barriers, these funds help you grow your money steadily while managing risk. For example, if you’re risk-averse or saving for short-term goals, our fund focuses on secure, short-term debt instruments. This gives you the peace of mind of stable returns with minimal exposure to market volatility—helping you stay on track without unnecessary stress.

This balanced approach isn’t just built into the fund’s structure—it’s also reflected in the experience we provide.

Our team of professional fund managers monitors market movements and actively adjusts investments to optimise returns and manage risk. With a low entry threshold, you don’t need millions to start investing. And because we’re transparent, you can always keep track of where your money is. This guarantees convenient access to monitor your investments easily and make adjustments when needed.

In uncertain times, chasing returns without understanding the risks can lead to setbacks. At the same time, playing it too safe may not protect you from inflation or help you achieve your long-term goals.

The smart move is to find your balance and stick to it. With Coronation Mutual Funds, you don’t have to guess or go it alone. We offer structured, well-managed solutions designed to help you grow wealth on your terms, with just the right level of risk.

Explore Coronation Mutual Funds today and take the first step toward smarter, more confident investing.

For further enquiries, please email Sales@coronationam.com or message us on WhatsApp.

You may also read All You Need To Know About Mutual Funds in Nigeria for a deep dive.