Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

We’ll begin with a simple analogy to explain what mutual funds are. Let’s say you’re making a pot of jollof rice. If you just use rice and the regular ingredients, it might cook, but it won’t be that tasty. But then add tomatoes, peppers, spices (ginger, garlic, etc.), and other ingredients, and suddenly, you’ve got a delicious dish! Similarly, mutual funds mix different investments to create a balanced “dish” for your money. Instead of putting all your funds into one stock or bond, a mutual fund combines several. This mix helps reduce the risk of losing everything, even if one part of the “recipe” doesn’t turn out perfectly.

In this blog, we’ll cover all you need to know about mutual funds. From the types of funds to how they work in Nigeria, you’ll learn what it takes to make your money grow steadily and safely.

So, what is a mutual fund? It’s a pool of money collected from different investors. Professional managers then use it to buy stocks, bonds, or other assets. Each investor gets a small share of the whole pot. This makes it easy for anyone to invest in large markets without needing huge amounts of cash.

For many Nigerians, mutual funds are becoming a go-to choice. They provide a simple, low-cost way to invest while minimising risk. You don’t have to monitor the market daily or worry about complex financial terms. Instead, you can put your money to work with less stress.

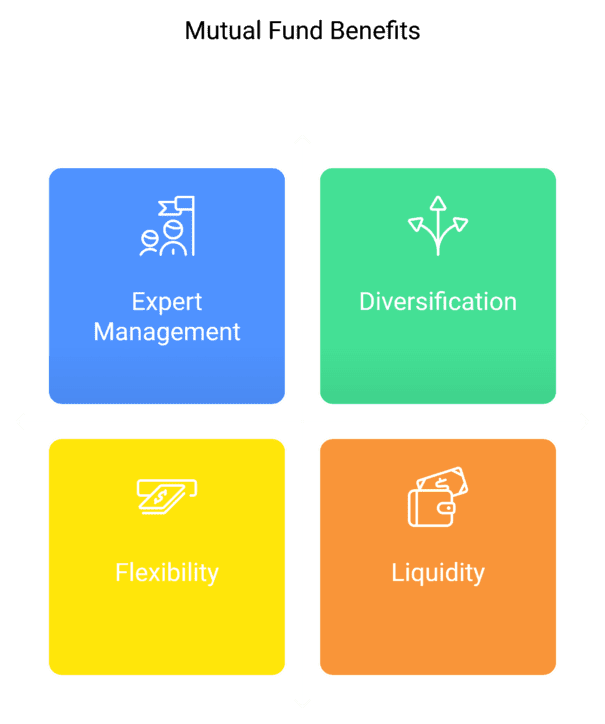

Mutual funds come with a lot of perks that make them a popular choice for building wealth. First up, they’re managed by experts. These professionals know the ins and outs of the market. They watch for the best opportunities, so you don’t have to spend hours researching every little detail. Instead, you can relax knowing your money’s in good hands.

Another big reason people choose mutual funds is for diversification. Let’s say you put all your money in one stock, and then it takes a nosedive. That’s tough. But with a mutual fund, your money spreads across many investments, like a mix of stocks, bonds, and more. This variety helps reduce risk. If one part of the fund struggles, others can help balance things out, so you don’t feel the full impact.

Mutual funds are also really flexible. You can start small, adding just a bit of money at a time. Many funds let you add more when you’re ready or even take some out if you need it. This flexibility makes it easy to fit mutual funds into your financial plans.

Then there’s liquidity, which just means you can turn your investments into cash pretty quickly. With some other investments, you might have to wait months or even years to access your money. But mutual funds make it easy to cash out when you need funds on short notice.

So, can you lose money with mutual funds? The short answer is yes, because every investment has risks. However, the way mutual funds are set up helps lower those risks. Because of diversification, one bad day for a stock doesn’t have to mean a bad day for your whole fund. This mix makes mutual funds a safer and steadier choice.

Mutual funds may seem complex, but they work in a simple way. First, a mutual fund collects money from many investors. The fund manager then uses this money to buy a mix of investments, like stocks, bonds, or other assets. Each investor owns a small share of the entire fund.

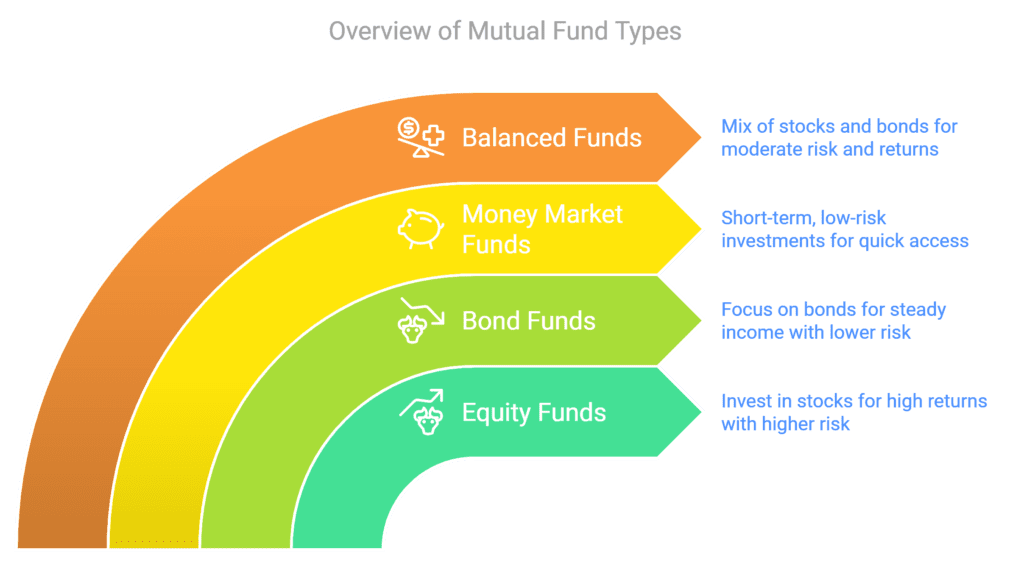

There are several types of mutual funds. Here’s a breakdown of some of the different types of mutual funds, each with a simple explanation:

So, how do mutual funds make money? They earn returns in a few ways. If the stocks or bonds in the fund increase in value, so does your share. Mutual funds also make money from dividends and interest on bonds. This income is shared with all investors in the fund. When the fund performs well, investors see their investment grow.

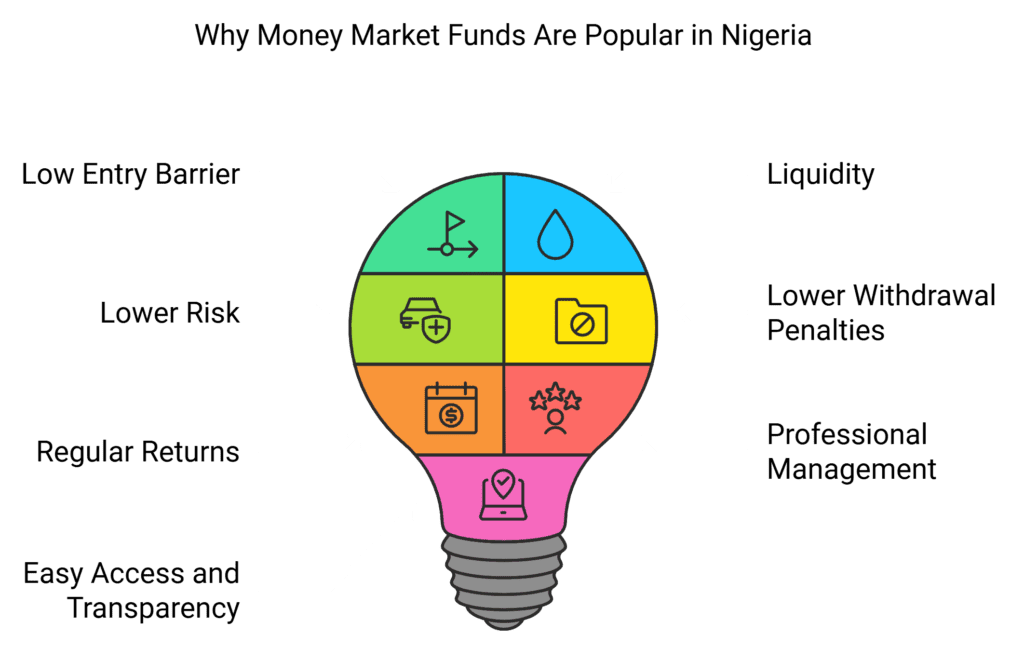

In the previous section, we covered different types of mutual funds and their unique benefits. However, money market mutual funds stand out as the most popular choice in Nigeria. Their popularity comes from several appealing features—like low entry barriers, easy access to funds, and reduced risks. Let’s take a closer look at what makes money market mutual funds a preferred option for many investors.

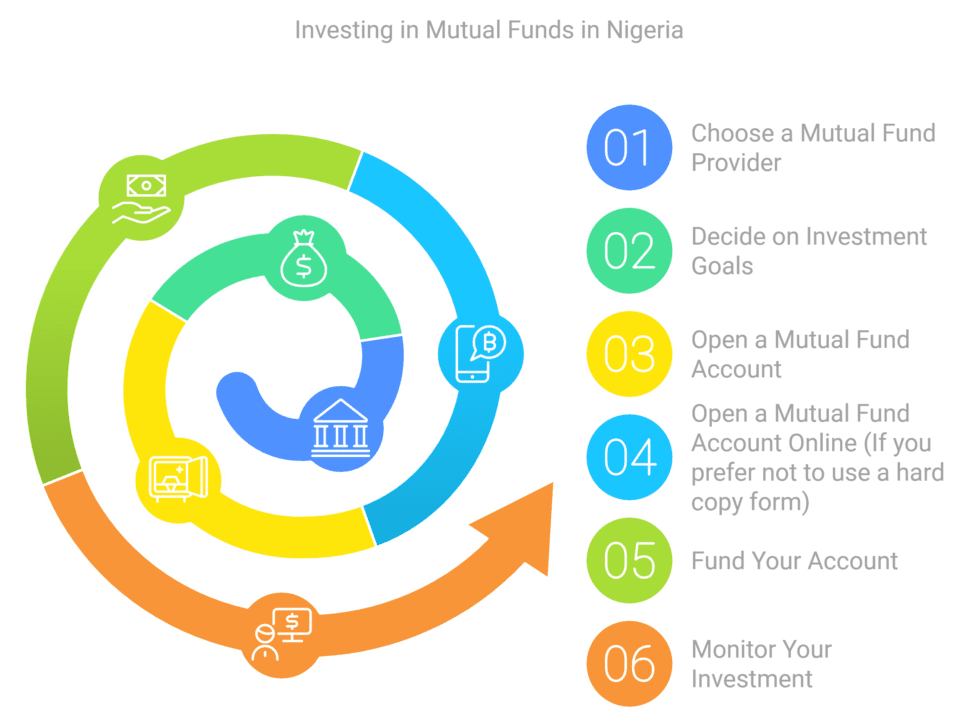

Investing in mutual funds in Nigeria is simple, even if you’re new to investing. Here’s a step-by-step guide to help you get started.

Investing in mutual funds in Nigeria is straightforward. Just follow these steps, and soon you’ll be on your way to building wealth in a way that suits your goals.

Money market mutual funds are known for their stability and low risk, but understanding their performance can help you see how your money grows. Here’s a look at how they work and how to calculate returns.

Money market mutual funds invest in low-risk, short-term assets like treasury bills, certificates of deposit, and government securities. These assets provide steady income, mostly through interest payments, which are the main source of returns in a money market fund. Since these investments are low-risk, the returns are modest compared to higher-risk funds, but they’re also more reliable.

Calculating Money Market Mutual Fund Returns

Money market fund performance is usually measured through its yield—the income generated based on the fund’s net asset value (NAV).

In funds that earn daily returns, the daily yield is calculated each day based on the fund’s portfolio value and current rates. The interest rate fluctuates with the market, so returns vary depending on short-term rates for instruments like treasury bills, commercial papers, and certificates of deposit, which make up the fund. Here’s a step-by-step way to calculate your earnings:

Daily yield = annual interest rate / 365

For instance, if the annual rate that day is 10%, the daily rate would be:

Daily yield = 0.1 / 365 = 0.000274 = 0.0274%

The daily yield is applied to the investor’s balance to determine how much they earn each day.

Daily Earnings = investment balance * daily yield

So, if you have ₦100,000 invested, and the daily yield is 0.0274%, your daily earnings for that day would be:

Daily Earnings = ₦ 100,000 * 0.000274 = ₦ 27.40

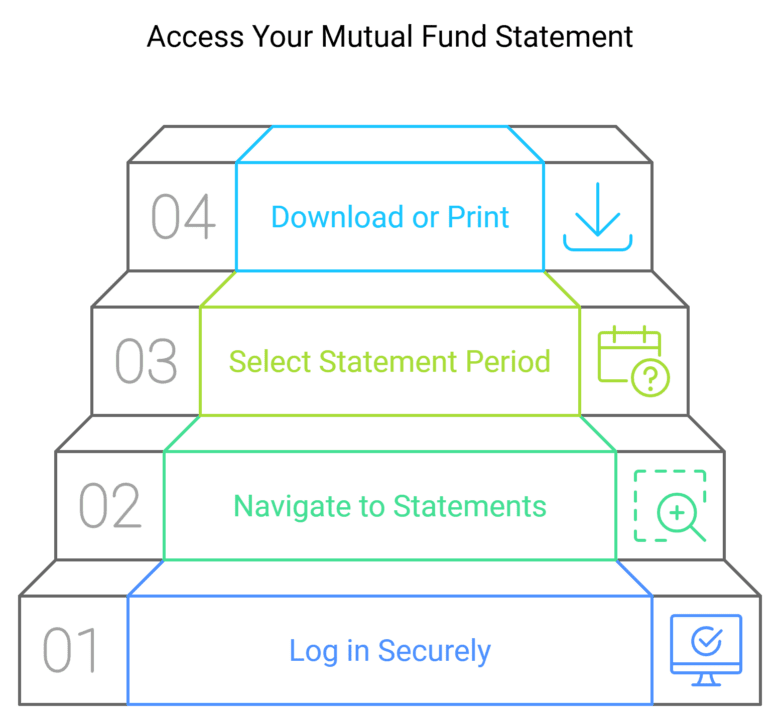

It’s important to track your mutual fund investments. Knowing your fund’s progress helps you plan better and stay informed. Luckily, you can easily check your mutual fund statement online. Here’s how:

For many Nigerian investors, money market mutual funds are the most popular choice. These funds are known for their focus on stable, short-term investments, like treasury bills and commercial papers. Because of this, they’re considered lower-risk compared to other types of mutual funds.

But you might wonder, “Can I lose money in money market mutual funds?” Generally, these funds are designed to protect your principal, so the risk of losing your original investment is very low. Even if interest rates drop, the principal usually remains intact because of the fund’s low-risk, short-term assets. That said, these funds are not legally insured or guaranteed, so there’s always a slight chance of loss, although it’s rare.

To manage the small risks that do exist, keep a balanced approach. Money market funds can offer stability, but it’s still wise to diversify your investments. This way, if one area performs poorly, other assets in your portfolio can help maintain your overall growth.

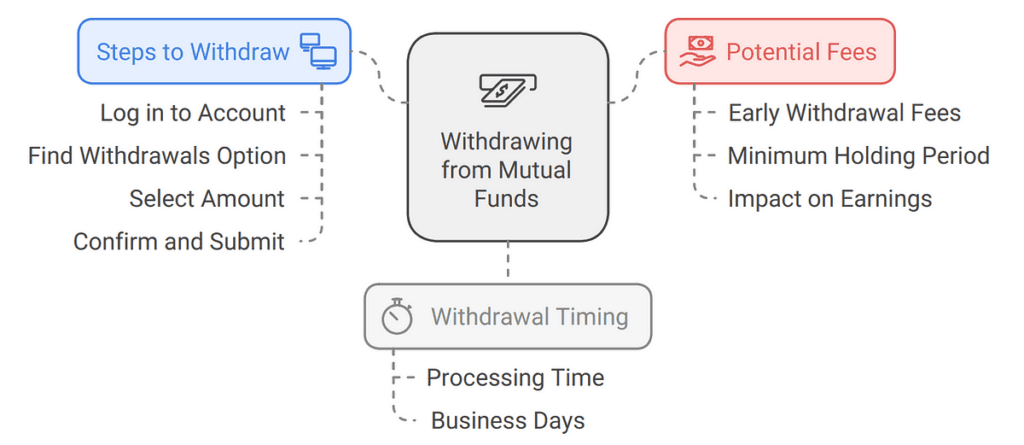

To start, first, log in to your account on the fund provider’s platform. Find the option for “withdrawals” or “redeem,” often listed under “Account” or “Transactions.” Select the amount you want to withdraw, confirm, and submit your request.

Keep in mind, though, that withdrawing isn’t always instant. Most funds process withdrawals within a few business days, so it’s best to plan if you need the funds soon.

What about fees? Some funds charge fees or penalties for early withdrawals, especially if you haven’t held the investment for a minimum period. For example, withdrawing too soon might reduce your earnings due to early-exit fees.

So, while taking out your funds is straightforward, make sure you’re aware of any fees or waiting periods. This way, you can get your money without any surprises along the road.

When is the best time to start investing in mutual funds? Truthfully, there is no “perfect” time, but there are good strategies to follow.

First, look at your financial goals. Think about what you want to achieve, like saving for a home, education, or retirement. Next, consider your risk comfort level. Some mutual funds, like equity funds, can be risky but offer high returns over time. Money market mutual funds are lower-risk, so they’re a good option for conservative investors.

You might wonder about timing the market. Should you wait for a market dip? Experts often recommend regular investments instead of waiting. This approach is called dollar-cost averaging. It means investing a set amount regularly, which helps balance market ups and downs.

Starting small can be smart, too. Even a little each month can grow over time. Remember, the best time to start investing is when you’re ready and have some funds to commit. Don’t let the idea of timing hold you back.

Mutual funds offer a smart way for Nigerians to grow their wealth. With professional management and diversification, you can find a fund that suits your financial goals; it doesn’t matter if you prefer the stability of money market funds or the growth potential of equity funds.

This guide covered the essentials of mutual funds, including types, investment strategies, fees, and withdrawal processes. Understanding these elements allows you to make informed choices as you invest.

Starting early can significantly impact your finances. Investing in mutual funds allows you to benefit from compounding returns over time. So, take the first step today.