Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Investing in shares is an exciting way to grow your wealth. You can earn dividends from the profits of the companies you invest in or sell your shares when their value increases—it’s entirely up to you.

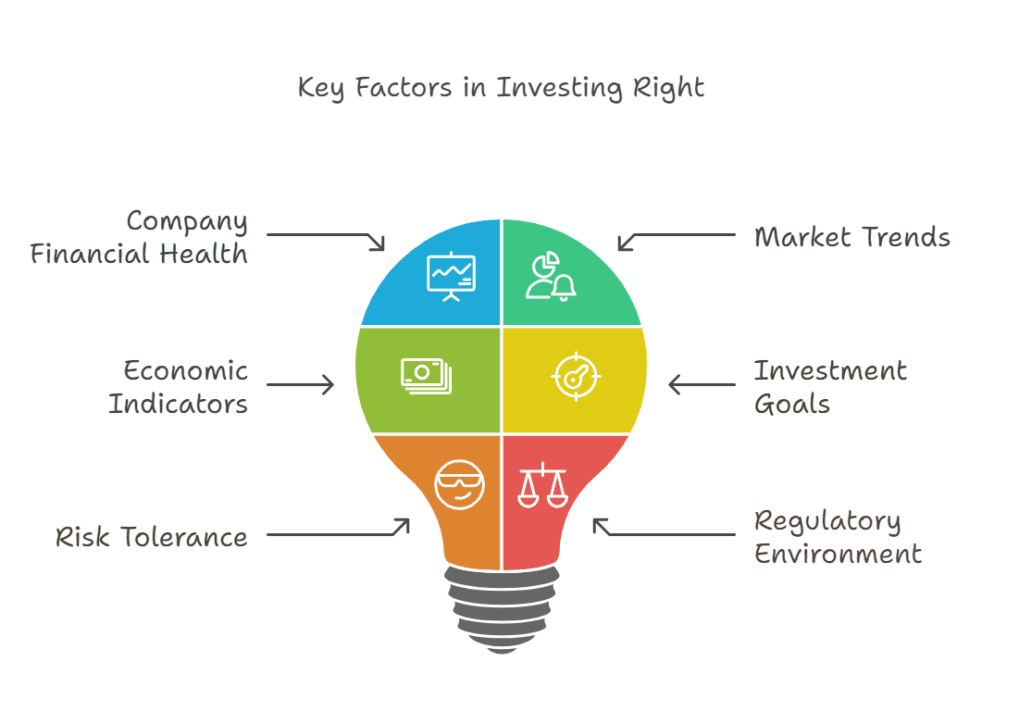

While buying or selling shares is a personal choice, making informed decisions is essential. To help you get the most out of your investment, here are six key factors to consider before taking action.

Before buying shares, take a close look at the company’s financial stability and performance. Review its financial statements to understand its profitability, debt levels, and overall financial condition.

A financially stable company is more likely to pay consistent dividends.

You can find a company’s financial statements in the following places:

Most publicly listed companies publish their financial statements in the Investor Relations section of their official website. Look for documents like annual reports, quarterly earnings reports, or audited financial statements.

Companies listed on stock exchanges are required to submit their financial statements regularly. Check the website of the stock exchange where the company is listed (e.g., Nigerian Exchange Group, New York Stock Exchange).

In Nigeria, for example, the Securities and Exchange Commission (SEC) and the Corporate Affairs Commission (CAC) provide access to company filings.

Stockbrokers or investment advisers often have access to detailed financial data and can provide insights tailored to your needs

The next action to consider before buying or selling your shares is to evaluate how the company fits within its industry. Does it have a strong market share or unique competitive advantages?

For example, if you’re considering buying shares of Dangote Cement, you’ll want to evaluate its performance within the cement industry. Start by checking whether Dangote Cement holds a significant portion of the market compared to competitors like Lafarge Africa or BUA Cement.

Check if the company has a history of paying dividends and assess its ability to continue doing so in the future. A consistent dividend-paying track record often signals stability and a commitment to rewarding you as a shareholder.

Learning technical analysis and valuation metrics of stocks will help you understand how stock prices change and what they might do in the future. If this seems complex, don’t worry—Coronation Securities is here to guide you every step of the way.

Set clear entry and exit points for buying and selling shares. While it’s impossible to time the market perfectly, strategies like limit orders and stop-loss orders can help manage risks and lock in profits.

Diversify your investments across different sectors and asset classes. Diversification reduces your reliance on any single asset, helping you manage risk more effectively.

Remember these six factors when you want to trade your shares. They’re your checklist for making smarter investment choices that can help grow your wealth.

Take advantage of current market opportunities:

If you enjoyed reading this, you should also read How to Choose the Right Brokerage Firm for Your Investment Goals.