Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

In July, we examined the extent to which Nigerian pension funds hold NGX Exchange-listed equities and concluded that they were warming again to stocks. Our examination of recent data suggests otherwise; they appear as cold as ever towards equities, having made only small net purchases this year despite several years of high investment returns. Part of the problem is the way they account for bonds, in our view.

Recovering from the weeks of losses, the exchange rate at the Nigerian Autonomous Foreign Exchange Market (NAFEM) gained 23.51% last week to close at ₦889.86/US$1. Conversely, at the parallel market, the Naira lost 3.00% to close at ₦1,232.00/US$1 bringing the gap between the official and black-market to 38.45% (8.73% the previous

week). The CBN’s published gross foreign exchange reserve declined by 0.10% to close at US$32.84bn.

At the Treasury bills auction, the Central Bank of Nigeria (CBN) rolled over bills worth ₦13.58bn (US$12.09m) across the 91-day, 182-day, and 364-day maturities. The demand increased, leading to a bid-to-offer ratio of 115.72x, driven by robust system liquidity (₦419.10bn on the auction day). Consequently, the stop rates for the 91-day, 182-day,

and 364-day maturities declined to 6.25%, 11.00%, and 15.60%, respectively.

A total of ₦263.58bn worth of bills were allotted, with a net issuance of ₦250.00bn. In addition, the Debt Management Office (DMO) offered ₦360.00bn (US$15.27bn) across the Apr-29, Jun-33, Jun-38, and Jun-53 instruments. The total subscription reached ₦886.41bn, with a bid-to-offer ratio of 2.46x. Yields on the bonds declined across all maturities, with the Apr-29 declining by 50bps to 15.50%, the Jun-33 and Jun-38 both falling by 100bps to 16.00% and 16.50%, respectively, while the Jun-53 yield declined by 85bps to 17.15%. The bid-to-cover ratio settled at 3.2x.

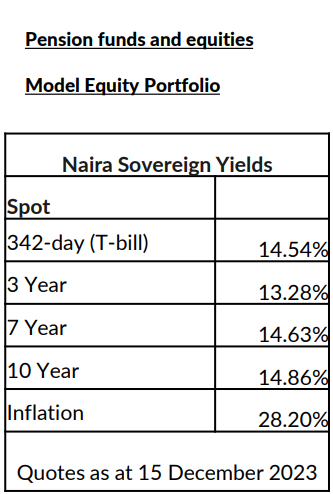

In the secondary market for Treasury bills, average yields declined by 272bps to 8.29% pa. Across the maturity spectrum, the short-end declined by 171bps to 4.54%, the mid-point fell 237bps to 7.02%. Similarly, in the secondary market for FGN bonds, average yields declined by 48bps to 14.38% pa. with renewed interest in bonds whose yields have risen in recent weeks. At the short-end of the yield curve, average yields declined by 45bps to 12.18%; the mid-point fell by just 3bps to 14.73%; while the long-end declined by 94bps to 15.69%.

ICYMI: How to beat the equity market

We think that the monetary authorities will continue to support Naira fixed income yields in the high teens per annum, in order to address money supply issues and address inflation, which increased from 27.33% y/y for October to 28.20% y/y for November.

Breaking its losing streak, Brent price was up 0.94% to close at US$76.56/bbl last week. This brought the year-to-date change in the price of the commodity to -10.89%, trading at an average of US$82.30/bbl which is 16.94% lower than the average of US$99.09/bbl in 2022.

Recent attacks on vessels navigating through the Red Sea and the Suez Canal, which are major shipping arteries, have exerted upward pressure on oil prices in recent trading sessions. We maintain our view that, this year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

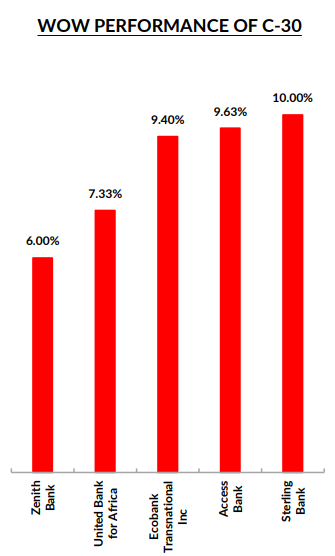

The NGX All-Share Index hinged up higher with a 1.18% gain to settle at 72,389.23 points; year-to-date the index has returned 41.24%. The week’s performance was buoyed by gains in MTN Nigeria (+2.68%), BUA Cement (+0.52%), and Zenith Bank (+6.00%) offsetting losses in FBN Holdings (-2.73%), International Breweries (-2.22%), and Unilever

Nigeria (-0.34%).

The NGX Banking index led all other sectoral indices on the gainer’s table with a 7.00% return for the week, followed by the NGX 30 index (+1.32%), the NGX Pension index (+1.31%), the NGX Consumer Goods (+0.24%) index, and the NGX Industrial Goods index (+0.24%); while the NGX Insurance index and the NGX Oil and Gas index both closed in

the red by 0.96% and 0.27%, respectively.

In July we examined the low allocation of Nigerian pension funds to equities. We predicted that they would increase their equity allocation, given the high returns of equities over the past few years and the drivers that would propel equities still higher this year (for example, see Coronation Research, Investment Opportunities from FX Liberalisation, July 10)

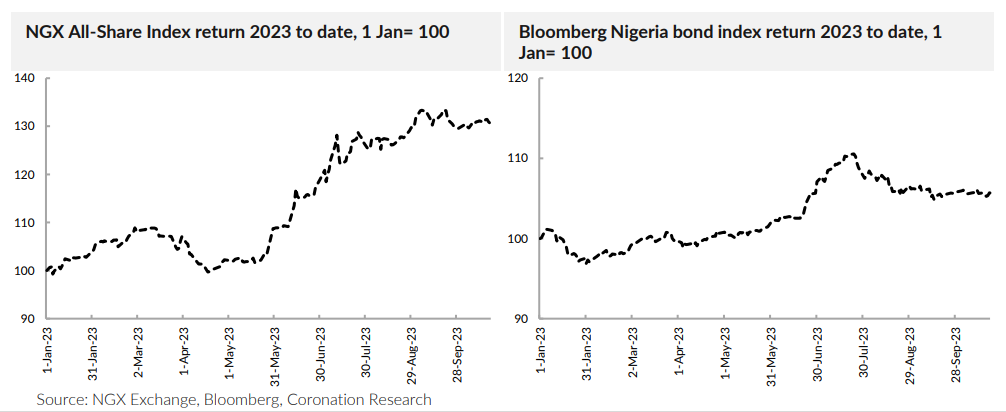

What has happened this year surprises us. The most recent data indicates that pension funds have increased their overall allocation to equities to 8.1% of their total funds, but the stock market’s rise accounts for almost all of this increase, rather than actual purchases.

At the end of Q1 2023 Nigerian pension funds had a total ₦1.04trillion in equities, 6.07% of their total assets. The latest data from the end of October shows them with a total ₦1.43tn in equities (8.1% of total assets). We mainly assume these to be equities listed on the NGX Exchange.

So, if the pension funds had neither bought nor sold equities during the intervening seven months, we would expect this total to have increased to ₦1.33tn by the end of October. They held only ₦98.5bn more than this, some ₦1.43tn in total.

And, of that incremental ₦98.5bn, over half could have come from the effects of receiving dividends and reinvesting them. Perhaps as little as ₦50.0bn in additional equity purchases were made. This would have had some effect on driving the market higher but, in the context of a market trading some ₦7.0bn per day, not much.

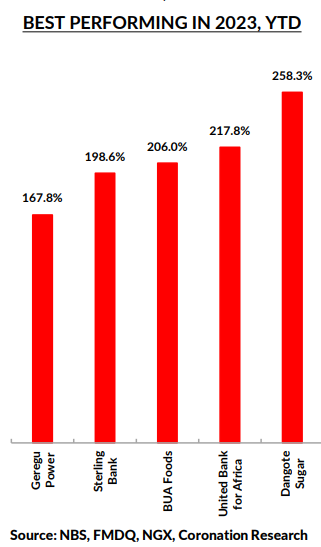

So, why don’t pension funds invest more in equities, given the enormous returns of the NGX All-Share Index over the past four years (2020: 50%, 2021: 6%, 2022: 20%, 2023: 41% year-to-date)? One answer suggests that funds for people nearing retirement tie up a large sum of money, and one must allocate these to low-risk fixed income funds rather than equities. But the biggest single source of new subscriptions, by number, to Nigerian pension funds are from people under 30 years of age, and their funds can be exposed to equities.

There is an understandable tendency to hold bonds to maturity, but this can lead to not valuing them according to the mark-to-market method. In a year like 2023, when market interest rates rise and the mark-to-market value of bonds falls, this is important. Knowing the market value of a bonds helps compare its value with that of equities. Not thinking along market-to-market lines avoids making the comparison and contributes, in our view, to the conservatism of Nigerian pension funds. We now revise our opinion, expressed last July, that Nigerian pension funds are ‘warming to equities’ and instead believe that they are as cold towards equities as they ever have been. For some categories of Nigerian pension fund holder, this is a pity.

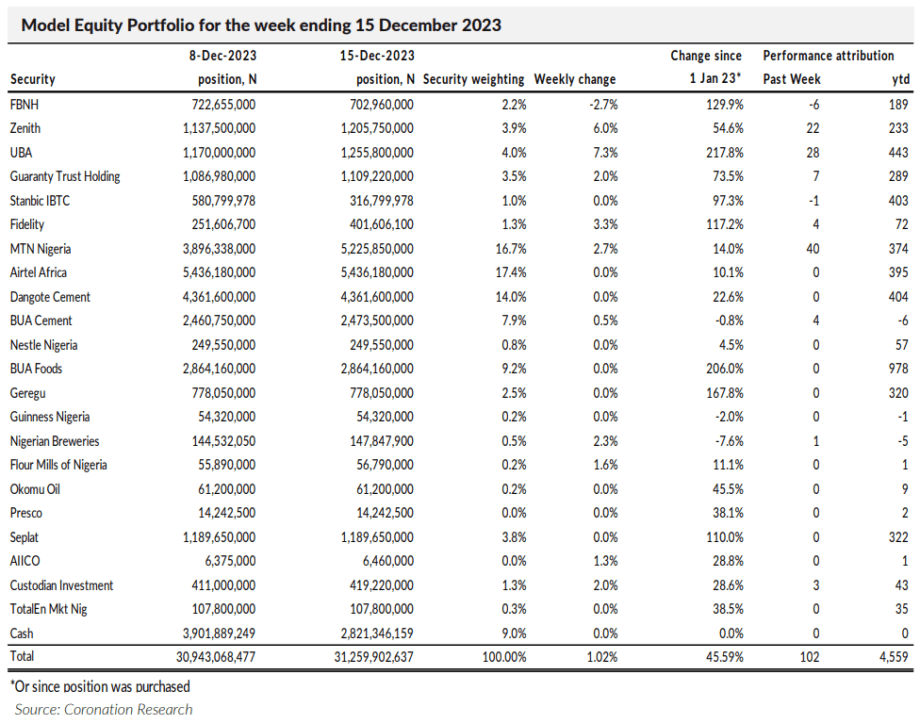

Last week, the Model Equity Portfolio rose by 1.02% compared with a rise in the NGX All-Share Index of 1.18%,

underperforming it by 16bps. Year-to-date it has risen by 46.59% compared with a rise of 41.34% in the NGX All-Share

Index, outperforming it by 434bps.

The cause of our underperformance last week, as was the case a week previously, was our selection of bank stocks which unperformed the sub-index of banks. We do not have a notional holding in Access Holdings and when it rallies, we lose out, simple as that. Most of our notional positions in banks correlate with Access Holdings most of the time, just not the past two weeks.

We will continue to make notional sales in Seplat Energy this week in order to bring it down to a neutral notional position relative to the index – this operation is almost complete. We plan no further changes this week.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.