Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

One for Two. This is the formula.

The Access Holdings Rights Issue offers a profitable investment opportunity.

As a shareholder of Access Holdings PLC, (the holding company of Hydrogen Payment Services Company Ltd, Access Insurance Brokers Ltd, Access Pensions Ltd and Access Bank PLC), you can purchase additional shares and enjoy increased dividends.

What are your financial goals?

To start your dream business in the next 5 to 10 years? Or save for retirement? Participating in the rights issue can help you fund these dreams. With over 900,000 shareholders, the race is on to provide shareholders an opportunity to secure additional shares. Don’t be left behind.

The earnings from the rights issue will fortify the business against economic challenges and propel expansion for the bank and the other subsidiaries. This means better service and 100% useful products for customers.

Logically, happy customers will continue to patronize the business, this could mean more profits for the corporation and an increase in market valuation, leading to more dividends in your accounts.

One for Two, what does this mean?

Existing shareholders have the privilege to buy 1 new share for every two that they own.

To participate, the holder must have at least 2 shares as of 7th June 2024. The number of shares for uptake is 17,772,612,811 ordinary shares, priced at N19.75k each. The sale window opened on July 8th 2024 and closes on August 14th 2024.

The total amount to be raised is N351,545,225,622 (Three Hundred and Fifty-one Billion, Five Hundred and Forty-Five Million, Two Hundred and Twenty-Five Thousand, Six Hundred and Twenty-Two Naira), a part of a larger $1.5 billion capital raising as part of its recapitalization strategy.

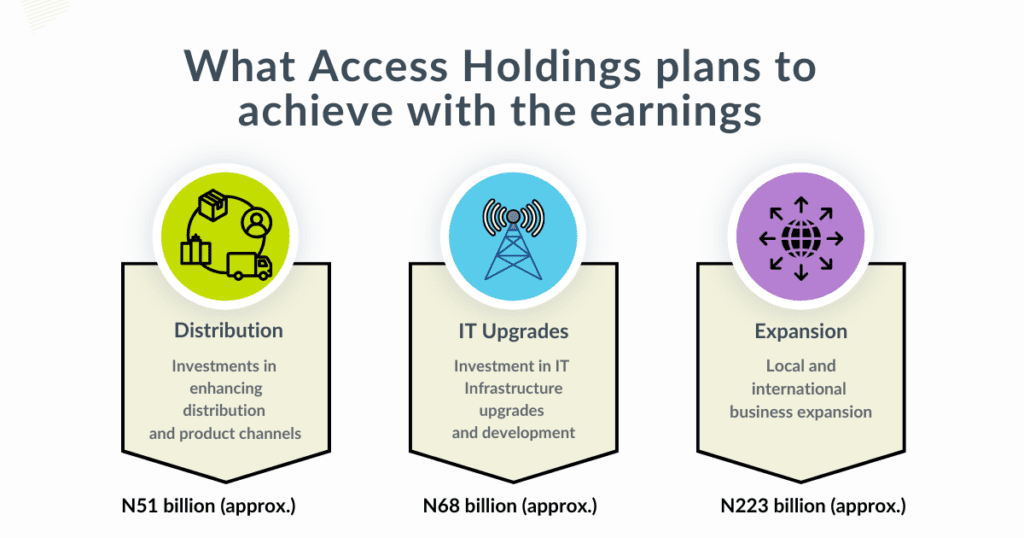

To remain accountable to shareholders, the corporation has listed how the proceeds will be reinvested into the business. When sales go as planned the proceeds will be utilized to support growth needs for Access Bank PLC and the other subsidiaries.

Infographic: Use of Access Holdings Rights proceeds explained (culled from Access-Holdings-Rights-Circular)

You’re a smart investor, increase your shareholding or sell them for a profit

The shares issued will also be tradable by shareholders on the floor of the Nigerian Exchange during the offer period. If you decide to trade your rights, our stockbrokers will guide you through the process.

Why is investing in Access Holdings Plc lucrative?

Access Bank PLC defied tough economic conditions in 2023 to achieve a remarkable 307% increase in profit. This strong performance, combined with an 87% growth in overall income, highlights the bank’s commitment to delivering value to shareholders.

Investing in Access Holding’s rights issue puts you in a prime position to benefit from its continued success.

This is a golden opportunity to grow your investment in Access Holdings Plc, a leading and stable financial institution, with a vision to become a top-5 African banking group by 2027.

Don’t miss out—act now

Invest in Access Holdings and be part of its continued success.

Ready to invest?

Click here to get started.

Need help?

kindly call the following contact persons or send an email to sales@coronationsl.com.

Alternatively, you can visit our office at 10, Amodu Ojikutu Street off Bishop Oluwole, Victoria Island. Lagos

Abiodun

08144646501

Susan

08185174109

Taiwo

08055444668

Kaliba

08033119651

Earnest

08186934710

Bashir

09076608122

Esther

08100103051

Adelekan

09074083213

Chineme

09091075502