Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

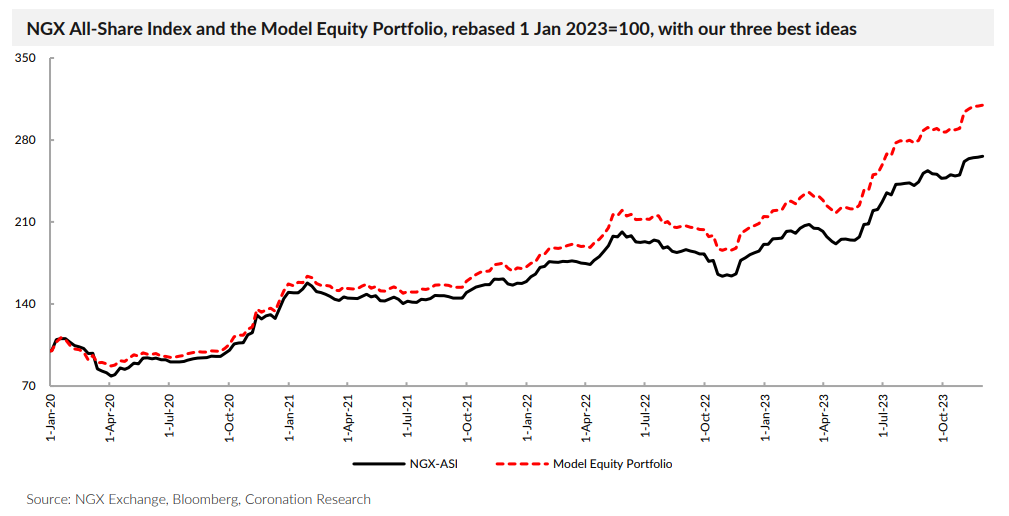

This month, we approach the fourth anniversary of the launch of our Model Equity Portfolio, which is generally published on page 3 of the Nigeria Weekly Update. It comes with a forewarning of changes we intend to make. The lesson we have learnt this year? To follow the ideas generated by our research, but – we wish we had grasped this earlier – to implement those ideas with real conviction.

The exchange rate at the NAFEM window continued its losing streak last week, falling by a significant 14.27% to close at ₦927.19/US$1 bringing the year-to-date decline of the Naira against the US dollar to 50.23%. The exchange rate at the parallel market closed in the negative as well, losing 0.86% to close at ₦1,165.00/US$1.

Due to the significant depreciation at the NAFEM window, the gap between the NAFEM and parallel market narrowed to 25.65% (45.30% a week previously). The published gross foreign exchange reserve of the CBN declined by 0.51% to close at US$33.00bn.

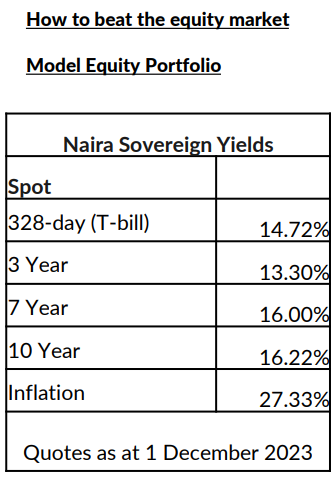

In the secondary market for Treasury Bills last week, average yields closed at 10.50% pa. Sentiment in the market remained bullish as average yields fell both at the short-end (-65bps to 6.21%) and the mid-end (-25bps to 8.86%) of the curve: however, average yields at the long-end of the curve remained unchanged at 12.93%.

In the secondary market for FGN bonds, average yields fell by 22bps to close at 15.96%. Significant buying activity at the short end of the spectrum drove the decline in yields by 81 basis points to 13.40%. Average yields at the mid-point and long end of the curve closed flat at 16.10% and 17.01%, respectively, as there was little activity in the bonds.

Based on recent auctions, we believe the CBN is likely to keep rates elevated in the coming auctions as it continues efforts to rein in inflation through interest rates.

In case you missed it: Nigeria Weekly Update – Action on Rates

Brent prices slipped again for the sixth consecutive week, by 2.11% to close at US$78.88 per barrel. Year-to-date, the price of the commodity is down by 8.18% and it has been trading at an average of US$82.58 per barrel year-to-date which is 16.66% lower than the average of US$99.09/bbl in 2022.

At the OPEC+ meeting, which was held on Thursday, the organisation declared voluntary production cuts of around 900,000 barrels per day starting in January 2024, while Saudi Arabia also declared its intention to prolong its voluntary production cut of 1million barrels per day into 2024. However, uncertainty around the magnitude of production cuts for some member countries, such as Angola which rejected the quota saying it would produce more, coupled with concerns over other member countries’ compliance, led to a drop in prices.

We maintain our view that, this year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

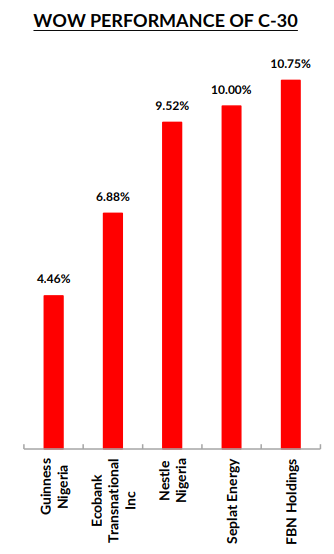

Continuing its bullish run for the sixth week in a row; the NGX All-Share Index closed in the green as it gained 0.27% to settle at 71,419.87 points, bringing the year-to-date return to 39.35%.

The market’s performance was buoyed by movements in Airtel Africa (+0.56%), Seplat Energy (+10.00%), and Zenith Bank (+0.86%); off-setting losses in Dangote Cement (-2.44%), BUA Foods (-1.92%), and Stanbic IBTC (-4.54%).

On sectoral performance, the NGX Oil and Gas index led the gainers’ table with a return of 5.97%, followed by the NGX Banking index (+1.92%), the NGX Pension index (+0.95%), and the NGX30 index (+0.44%), while the NGX Insurance index (-2.03%), the NGX Industrial Goods index (-1.23%) and the NGX Consumer Goods index (-0.47%) closed in the negative.

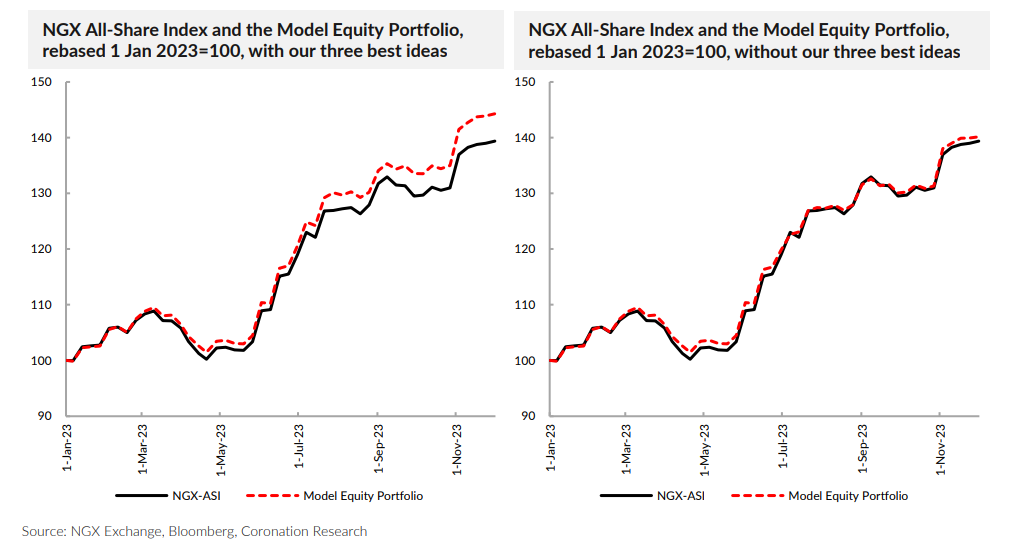

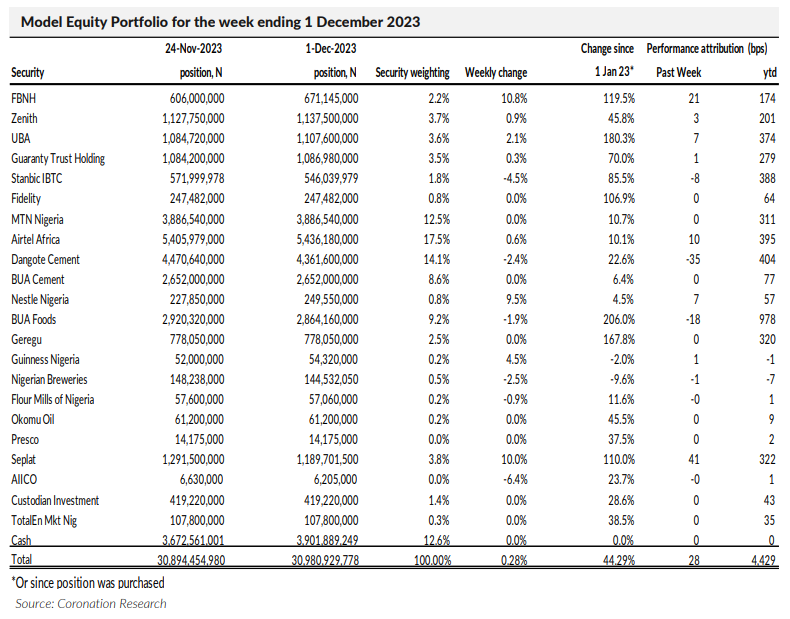

Every week, we publish our Model Equity Portfolio (MEP). This is a notional (it does not exist in real money) portfolio of equities. We use it to express our preferences for NGX Exchange-listed companies and we aim to beat the NGX All-Share Index each year. We state our preferences at the beginning of each week and adjust our positions accordingly. This year the Model Equity Portfolio is up 44.29% compared with the NGX All-Share’s 39.35% gain, an outperformance of 4.93 percentage points.

In many ways the MEP is an easy portfolio to manage (even if we do pay notional commissions and respect actual market liquidity when making notional trades). At ₦30.9bn (it was ₦10.0bn at inception, four years ago) it is smaller than and easier to adjust than some institutional portfolios. It operates without constraints from benchmarks or limits, allowing us, for example, to hold a large proportion in notional cash if we wish.

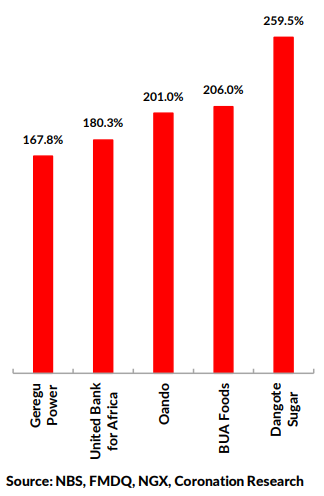

At the beginning of 2023, we did not take overweight positions in any of the leading stock performers of the year: Dangote Sugar, BUA Foods, Oando, United Bank for Africa, and Geregu Power).

We took three key investment decisions, based on events and changes in government policy, and these worked out well.

First, and in reaction to the announcement liberalising fuel prices at the end of May, we took an overweight position in fuel marketer TotalEnergies (the stock prices of other downstream fuel marketers had rallied too quickly for us to catch them). This earned us 35bps. We explained our ideas in Coronation Research, Investment Opportunities from Fuel Subsidy Removal, June 9, 2023.

Second, and in reaction to the announcement of the liberalisation of the foreign exchange market in June, we published our intention (in mid-June) to raise our notional exposure to the bank sector. We explained our ideas in full in Coronation Research, Investment Opportunities from Currency Liberalisation, July 10, 2023. We took our exposure up from 16.0% at the beginning of June to 33% by late July. Re-running our numbers through our performance attribution model, we calculate that this decision has earned us an incremental 317bps.

Third, in mid-September, and in response to rising oil prices, we wrote that we would increase our notional position in

upstream oil producer Seplat Energy, and we took our notional position up to a double-overweight relative to its weight in the index. This generated an additional 82bps in performance.

So, of our 493bps outperformance year-to-date, 35bps come from a decision to overweight an oil marketing company,

317bps come from a decision to overweight banks, and 82bps comes from an overweight in an upstream oil company.

Remove these (our three best ideas) and our outperformance would have been much lower, by 0.59 percentage points.

It would have been nice, too, to have held a notional position in a stock like Dangote Sugar, or an overweight (rather than a neutral position) in Geregu, but it was not to be. We had to make the best of the decisions we took.

And here is a lesson, namely that when you have a good idea you need to act swiftly and decisively. We did take an

overweight position in banks, but we could have taken the overweight to three times a neutral position rather than merely twice the neutral index weight. That would have shown more conviction and resulted in greater outperformance.

Since we launched the Model Equity Portfolio at the beginning of 2020 it has risen from a notional ₦10.0bn to a notional ₦30.9bn, a return of 210% (a CAGR of 33%) compared with a return in the NGX All-Share Index of 166% (a CAGR of 28%). This is the index-related return and does not include the effect of reinvesting dividends (the total return) which would be higher. That is a topic for a separate publication.

Quite simply because listed companies have, for the most part, continued to increase their earnings while Naira interest rates have been extremely low (well below the rate of inflation). Lacking adequate returns from fixed income investments, Nigerian investors have turned to risky assets, and in large measure this means equities.

Given that Naira interest rates are now going up, which implies that investors may move back into fixed income investments, this era of past performance may not be a good guide to the future – much depends on where rates go from here. All the same, we will continue with the Model Equity Portfolio. If nothing else, it gives us empathy with Nigerian equity market investors and gives us a reason to focus on the market.

Last week, the Model Equity Portfolio rose by 0.28% compared with a rise in the NGX All-Share Index of 0.27%,

outperforming it by 1bp. Year-to-date it has risen by 44.29% compared with a rise of 39.35% in the NGX All-Share

Index, outperforming it by 494bps.

We managed a small (very small) outperformance last week even though our selection of bank stocks delivered 158bps whereas its benchmark sub-index of banks rose by 192bps. Our notional holdings in the main NGX Exchange-listed stocks by weight (namely, Airtel Africa, Dangote Cement, MTN Nigeria, BUA Foods and BUA Cement, which together make up over 60.0% of the NGX All-Share Index) are at roughly index-neutral levels.

As earlier advised, we continued to make notional sales of Seplat Energy last week with the intention of bringing the notional position down to an index-neutral weight. We will continue with this task this week and likewise continue to make notional sales in TotalEnergies in order to take profits on this position. We plan no further changes this week.

Click here to download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.