Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

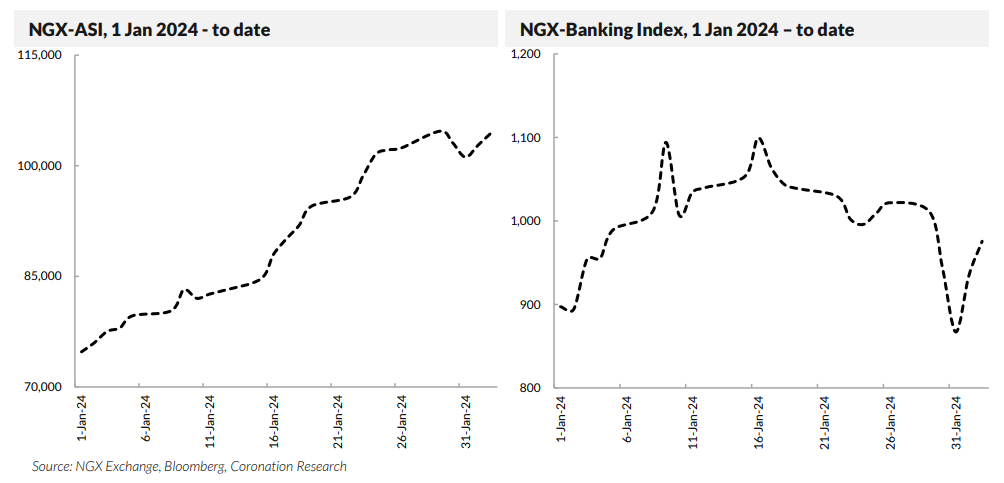

How big was the rally in the NGX All-Share Index in January? The correct answer is 35.8%, but there is another way of looking at the equity rally. Consider the huge rallies in Dangote Cement (+138.5%), BUA Cement (+90.7%), and BUA Foods (+40.5%), all of the index heavyweights. If we strip out the effect of these three behemoths, the underlying rally was 15.4%, more modest and more in line with past January rallies. This helps us assess the market’s future this year.

Last week, the exchange rate at the NAFEM window fell 38.87% to ₦1,435.53/US$1. The parallel exchange rate lost 1.05% to close at ₦1,453.00/US$1. The huge depreciation in the official market closed the existing gap with the street market rate. The CBN’s gross external reserves (last update on Tuesday), closed the week 0.05% lower at US$33.35bn.

Rates improved in the parallel market after touching the ₦1,500.00/US$1 mark last week. The market began to price in the possibility of FX supply into the market following the CBN’s directive to banks to sell down part of their net long positions of foreign currency. For details of this and of the CBN Governor’s televised interview this morning see: Coronation Economic Flashnote – CBN Governor Cardoso – Macro Insight, FX, Inflation, MPC.

The CBN offered ₦300.00bn (US$208.98m) in OMO bills last week. Total subscription reached ₦668.80bn, however ₦350.00bn worth of bills were sold. Stop rates for the 92-day and 176-day bills remained unchanged at 10.00% and 13.50%, respectively, while the stop rate on the 365-day bill declined by 50 basis points to 17.00%.

The Debt Management Office also re-opened issues of the Mar-27, Apr-29, Jun-33, and Jun-38 FGN bonds. The total offer amount was ₦360.00bn (US$250.78m), oversubscribed by ₦244.57bn: however, sales were finalised at ₦418.21bn. The bid-to-cover ratio declined to 1.4x (vs 3.2x at the previous auction), while rates remained unchanged across the tenors, at 15.00%, 15.50%, 16.00%, and 16.50% respectively.

Bearish sentiment continued to drive yields upward in the secondary market last week. Average yields on treasury bills rose 292bps to 9.66% pa, driven majorly by sell-offs around the mid-point (average yields: +577bps to 8.51%), and the short-end (+369bps to 5.46%) of the yield curve. Similarly, for FGN bonds, average yields added 97bps to 14.77% pa, with selloffs majorly at the short-end (average yields: +155bps to 13.52%), and the long-end (+88bps to 16.14%).

Last week, the Brent crude price dropped by 7.44%, the biggest drop since October 6, 2023, to close at US$77.33/bbl. This brought the year-to-date average price US$79.06/bbl which is 3.81% lower than the average of US$82.19/bbl in 2023.

Prices appeared to be negatively affected by China’s weakening growth and the likelihood of a peaceful resolution of the Middle East conflict. We expect that the average price this year will exceed the US$77.96/bbl assumption in Nigeria’s 2024 budget.

The market continued its bull run last week as the NGX Exchange All-Share Index gained 1.97% to close at 104,421.23 points, bringing the year-to-date return to 39.65%. Continued gains in Tripple Gee and Company (+42.05%) alongside Meyer (+20.79%), and Cornerstone (+20.25%) outweighed losses in Daar Communications (-22.22%), Eterna Nigeria (-19.49%)

and Sunu Assurance (-19.11%).

As was the case a week previously, the current enthusiasm for stocks is concentrated in a small number of the largest stocks by index weight, notably Dangote Cement, BUA Cement and BUA Foods, as well as Geregu. In addition, some small stocks are being marked up sharply. This has taken the traditional New Year rally to unprecedented levels, as we explained in last week’s Nigeria Weekly Update: but the rally at this stage is not as broadly-based as it was three weeks ago.

The NGX Banking index (-4.52%) led the laggards, followed by the NGX Insurance index (-4.07%), the NGX Oil and Gas index (-2.47%) and the NGX Pension index (-1.85%). On the flip side, the NGX Industrial Goods index (+6.36%), the NGX 30 index (+2.05%) and NGX Consumer Goods index (+1.30%) closed positive.

In our recent publication, Nigeria Weekly Update, Should you sell the January rally? on January 23, we analysed market trends over the past fifteen years and observed that January typically experiences a rally in the NGX All-Share Index 60% of the time. More notably, these January rallies often serve as reliable predictors for the market’s performance throughout the entire year, even if they tend to correct and offer opportunities to buy the market more cheaply a few months later.

January 2024 has presented us with an extraordinary scenario. We saw the index surge by 35.8% over the month. Compare this with the total return of 45.9% for the entire year of 2023. And compare January’s 35.8% return (39.6% up until the end of last week) with the average return of a January rally (nine of them over the past 15 years) of 8.1%. Was January 2024’s 35.8% return truly representative of the market? Was it a good guide to most of the stocks in the market?

We think not. Significant gains in just three stocks—Dangote Cement, BUA Cement, and BUA Foods—have predominantly driven the rally in January 2024. To understand the impact of these stocks on the overall market performance, we have constructed a synthetic index that excludes these three outperformers. This approach allows us evaluate whether the market would have aligned with the typical returns seen in past January rallies, had these three stocks not performed exceptionally well. Our findings from this adjusted index provide a clearer perspective on the true market dynamics during

this unusual January rally.

Taking out the effects of these three big outperformer stocks on the index, our study shows the rest of the market would have delivered a 15.4% return in January. This, in our view, reflects the underlying performance of the market, reflecting the broad-based demand for a large number of different stocks. It is also a more compatible return with the average January rally of 8.1% than the headline figure of 35.8%.

Our analysis suggests that investors were enthusiastic about the market in January, though not as enthusiastic as the headline performance suggests. Recent corrections (over the past two weeks) in the sub-index of banks suggest that at least some investors are taking profits. This January rally might prove to be similar to past ones. It may indicate a positive return for the full year, but it may also precede a period of profit-taking and present opportunities for later buying.

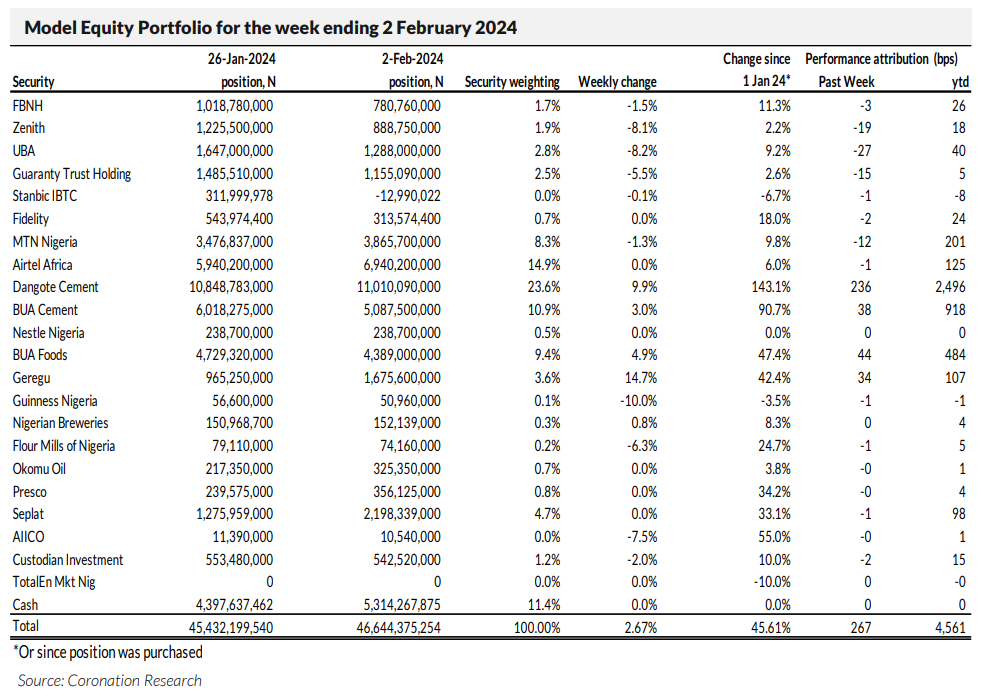

Last week, the Model Equity Portfolio rose by 2.67% compared with a rise of 1.97% in the NGX All-Share Index, outperforming it by 70 basis points (bps). Year-to-date it has returned 45.61% compared with a return for the NGX All-Share Index of 39.65%, outperforming it by 596bps.

Last week, and as advised on these pages earlier, we did four things. We made notional sales in our index-neutral position in the banks, bringing their aggregate notional position to two percentage points below their neutral index weight. We made notional purchases in Seplat Energy and built a notional position equivalent to one-and-a-half times its index weight. We made adjustments in our notional holdings of the five largest stocks by index weight (Dangote Cement, MTN Nigeria, Airtel Africa, BUA Cement, and BUA Foods, which together make up almost 70.0% of the NGX All-Share Index) in order to bring them into line with their neutral positions. We made notional purchases in Okomu Oil and Presco, with a view to building positions equivalent to double their index weights. Only the last task remains unfinished as we head into this week, and we will continue with it.

As we wrote last week, it is time to reckon with this market. It keeps on going up, but this is largely due to the effect of a few large stocks (e.g. Dangote Cement, BUA Cement, and BUA Foods, not to mention Geregu) going up a lot. Elsewhere the market is not so buoyant. The sub-index of banks fell 4.52% last week, and it fell 1.62% the week before that. As we wrote two weeks ago, rallies in January have a habit of correcting with the result that it is sometimes possible to buy the market more cheaply later in the year. Although we do not like making binary choices as to the direction of the market (we prefer to buy stocks when they look cheap and hold onto them) this market does appear to be over-bought.

This week, and as mentioned above, we will make notional purchases with a view to making double over-weights in Okomu Oil and Presco. We will make further notional sales across our bank holdings in order to bring them down to four percentage points beneath their aggregate neutral weight. We plan no further changes this week.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.