Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Welcome to the New Year. 2023 was an extraordinary year, with general elections bringing an inflection point to markets thanks to a reforming presidential administration. The Naira fell against the US dollar, NGX Exchange-listed equities rallied 45.90%, T-bills and Naira-denominated FGN bonds delivered mediocre returns while FGN Eurobonds rallied.

The exchange rate at the NAFEM window closed the last week of the year with a negative 2.43% movement to close at N907.11/US$1, this brought the year-on-year fall to 49.12%. Conversely, the parallel market rate gained 0.83% to settle at ₦1,210.00/US$1 for the year. At the close of the year, the gap between the official and street market was 33.39%. Additionally, the CBN’s published gross foreign exchange reserve decline 0.34% to close at US$32.89, bringing the year-on-year change to -11.30%.

The decline of Naira/US dollar reflects the supply gap which was created as a result of the adoption of the willing-buyer, willing-seller policy in the market. While some of the US dollar backlogs with banks are being cleared, and there are to be new policies to regulate the market, we expect supply issues to linger into Q1 2024.

The CBN rolled out another OMO auction on December 20, with a total offer amount of N100bn (US$110.24m) across the 91, 181, and 356-day tenors. Total subscription reached ₦422.80bn (bid-to-offer 4.23x), however only a ₦100bn worth of bills was allotted with no sale of the 91-day bill. Stop rates on the 181 and 356-day maturities declined to 12.00% (-248bps) and 15.00% (-298bps) respectively as demand outweighed supply. Another OMO auction was announced by the CBN for December 22, however, there were no sales.

At the last T-bill auction of the year, the CBN offered bills worth ₦67.02bn (US$73.88m). The bid-to-offer ratio settled at 15.48x as subscription reached ₦1.04tn. Total sales were ₦317.02bn with a net issuance of ₦250.00bn. The stop rate at the 91-day bill added 75bps to 7.00%, while stop rates on the 182-day and 364-day declined by 100 and 126bps to 10.00% and 12.24%, respectively.

In case you missed it: Pension funds and equities

In the secondary market for FGN bonds, average yields declined by 23bps to 14.13% pa across the yield spectrum. The yield at the short-end fell 52bps to 11.62%, the mid-point declined by 12bps to 14.54%, while the long-end lost 11bps to close at 15.62%. Similarly, in the secondary market for T-bills, average yields declined by 183bps to close the year at

6.29% pa. Yields on the short-end (-167bps to 2.67%), mid-point (-176bps to 5.25%), and the long-end (-135bps to 9.08%) of the yield curve all declined.

We await the T-bill auction on January 11 for a signal of the CBN’s intentions for market rates this year, especially with regards to recent comments prioritising price stability.

Brent price lost 2.60% to close at US$71.65/bbl last week. This brought the year-to-date change in the price of the commodity to -16.60%, trading at an average of US$81.96/bbl which is 17.29% lower than the average of US$99.09/bbl in 2022. The volatile trading year was characterised by political instability and concerns about the global primary producers’ oil output levels. We maintain our view that, this year, prices are likely to remain above the US$77.96/bbl mark set in Nigeria’s government budget.

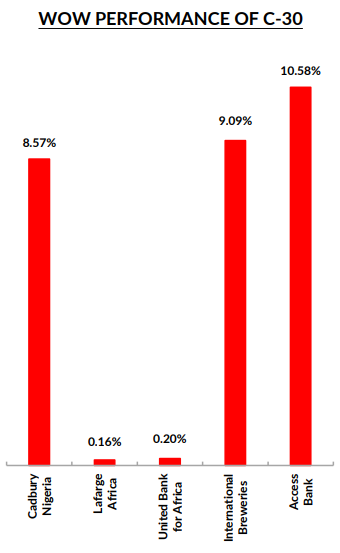

The NGX All-Share Index closed the year at 74,773.77 points with a 1.01% gain week-on-week; year-to-date the index has returned 45.90%. The week’s performance was buoyed by gains in Access Holdings (+10.58%), International Breweries (+9.09%), and United Bank for Africa (+0.20%) offsetting losses in Sterling Bank (-4.67%) and Oando (-2.78%).

The NGX Insurance index led all other sectoral indices on the gainer’s table with a 5.19% return for the week, followed by the NGX Pension index (+0.77%), the NGX 30 index (+0.54%) and the NGX Oil and Gas index (+0.26%); while the NGX Banking index (-0.04%), the NGX Consumer Goods (-0.04%) index and NGX Industrial Goods index (-0.01%)

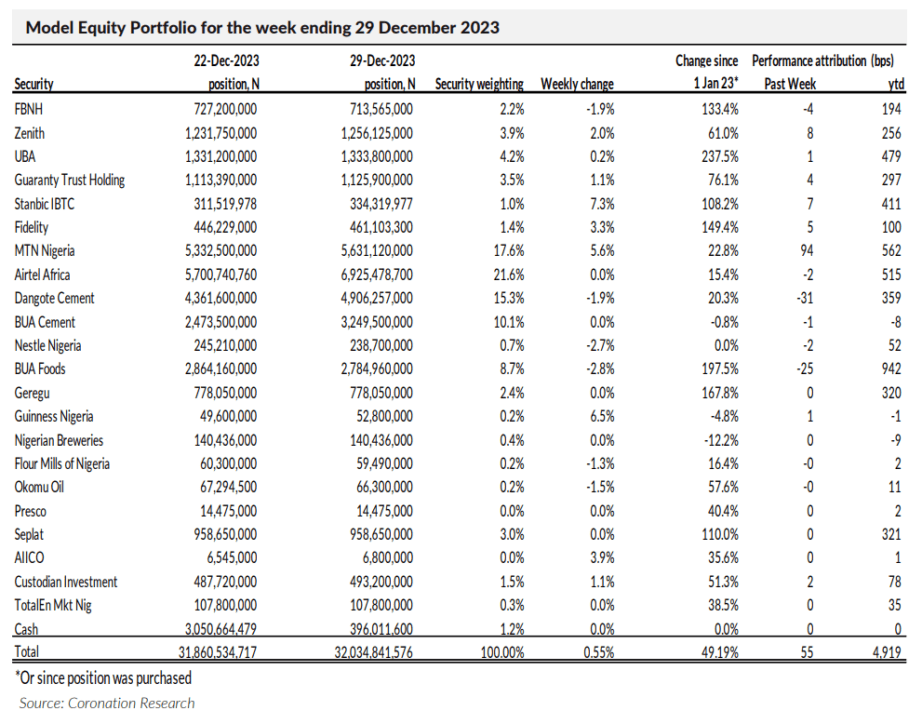

closed in the red. See the Model Equity Portfolio below.

Any account of Nigerian investments must begin with the exchange rate, the issue closest to Nigerian savers’ hearts.

2023 unleashed forces on the Naira/US dollar rate which saw the official rate fall 49.12% from ₦461.50/US$ to

₦907.11/US$1 and the parallel rate fall 37.17% from ₦736.00/US$1.00 to ₦1,200.00/US$1. The exchange rate was partially liberalised in June, and for a few weeks the official and parallel rates were close to each other, but unsatisfied demand for US dollars combined with a lack of US dollar inflows took the parallel rate away again.

Going into 2024, what are the prospects? There is not a lot to be gained by saying that the Naira is cheap in the official

market and very cheap in the parallel market: this is not about fair value but supply and demand, at least for the time being. In October measures were announced to sell forward government-controlled oil and gas production in order to

raise money to satisfy the backlog of demand for US dollars. This appears to be happening, but it is taking time. We

expect it will take a few months for the parallel rate to be brought into line with the official rate again.

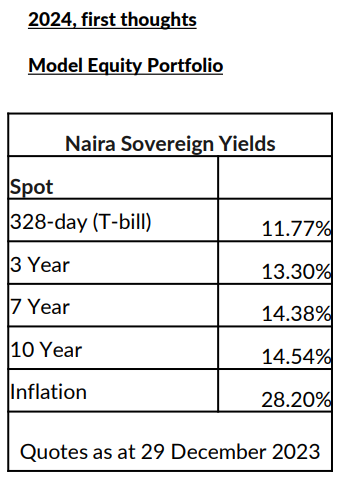

T-bill rates had been low for four years (the crash happened in November 2019) when in November 2023 they began to rise again. 1-year T-bill rates rose to as high as 20.00% at the Central Bank of Nigeria auction, reflecting the desire of the Governor of the CBN to take bold steps to control money supply and beat inflation, and following its core mission to create price stability. However, by the end of December 1-year T-bill rates had moderated to 11.77%, well short of the inflation rate (for November) of 28.20% (a rate that was 21.82% back in January 2023).

What is in store for 2024? The market is waiting for a clear signal from the CBN about rates and we look forward the T-bill auction due on Thursday 11 January in this regard. High rates – say, 20.00% per annum or above – might contribute to a fall in inflation, prompt investors to hold T-bills and FGN bonds, and persuade the market that fixed income returns will begin to deliver value again (once inflation comes down). Low rates would have investors looking for risk-related returns, such as NGX Exchange-listed equities, alternative investments, and US dollars.

The government of President Bola Tinubu began its term, in May 2023, by largely removing the fuel subsidy and

attempting to liberalise the Naira/US dollar exchange rate. The market saw this as improving future US dollar revenues for the Nigerian state and therefore bought FGN US dollar-denominated Eurobonds. Although publication of CBN accounts later in the year posed questions as to the CBN’s net US dollar position, overall sentiment towards FGN Eurobonds was positive, for example the yield of the November 2027 maturity falling from 11.78% to 9.21% over the year.

Going into 2024, we see reasons for investors to favour FGN Eurobonds again, following upgrades to Nigeria’s outlook by two ratings agencies. Our reasons? The first is that the FGN continues to look for way to maximise its US dollar earnings where possible. The second is that the trajectory of US Government bond rates appears to be downward, with the result that the value proposition of FGN Eurobonds is set to improve.

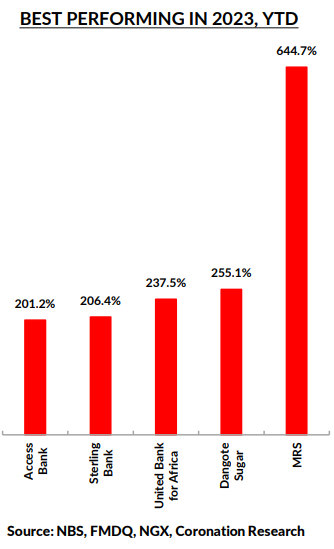

The NGX Exchange All-Share Index delivered a return of 45.90% in 2023, the total return (with gross dividends

reinvested) coming to 53.00%. The NGX-ASI has now delivered its fourth consecutive year of positive gains (2020:

50.07%; 2021: 6.07%; 2022: 19.98%) with a four-year compound annual growth rate of 29.19%, easily exceeding returns on T-bills and FGN bonds, and compensating for the effects of inflation over this period.

How do things look going into 2024? To begin with, the month of January has a tendency to deliver a rally (nine of the

last 15 have), though in the majority of cases it was possible to buy the market more cheaply later in the year. For the full year it is clear that valuations are not as compelling as one year ago, and if bank stocks look cheap on a price-to-earnings basis that is partly because of the US dollar revaluation gains they are set to report for 2023. On balance, the market is not as cheap as it was, but if interest rates stay low there is still potential for moderate positive performance this year, in our view.

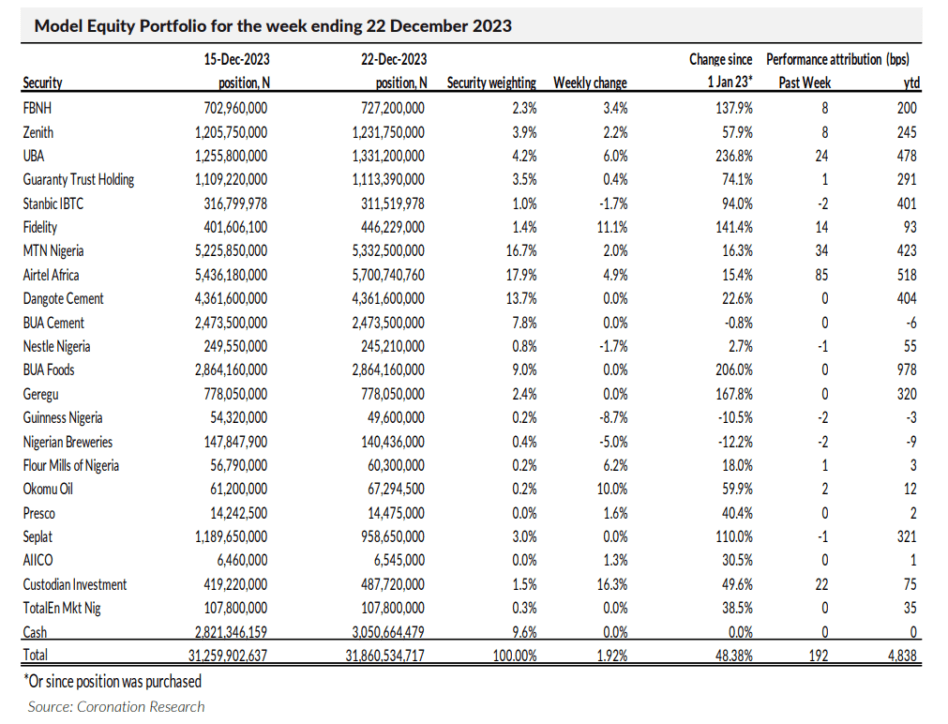

During the week ending December 22, 2023, the Model Equity Portfolio rose by 1.92% compared with a rise in the NGX All-Share Index of 2.26%, underperforming it by 34bps. Between the beginning of the year and 22 December it rose by

48.38% compared with a rise of 44.43% in the NGX All-Share Index, outperforming it by 395bps.

The cause of our underperformance during this week, was not our selection of banks stocks (this had been the problem during the preceding two weeks) as our selection of banks stocks delivered a gain of 3.4%, in line with the sub-index of banks. Rather it was a case of the market being driven by a number of small stocks that made exceptional gains, and we do not have notional positions in them. Examples are Transcorp which rallied by 26.4%, Transcorp Hotels which rallied by 36.03% and Okomu Oil which gained 9.96%. The market was in an exuberant mood and buying a selection of mid-cap stocks merrily.

We completed making notional sales in Seplat Energy during this week, as earlier advised, bringing it down to a neutral

weight.

During the last week of 2023 (which consisted of just three trading days) the Model Equity Portfolio rose by 0.55%

compared with a rise in the NGX All-Share Index of 1.01%, underperforming it by 46bps. During the year it rose by

49.19% compared with a rise of 45.90% in the NGX All-Share Index, outperforming it by 330bps.

In terms of relative performance, last week was truly painful for the Model Equity Portfolio; short trading weeks are something we have learned to view with trepidation over the years, and last week proved no exception. The market was interested in bidding up some mid-cap stocks, and these do not feature in our model portfolio. For example, Transcorp Hotels rose 10.0% last week, Guinness Nigeria by 6.45% and Nascon by 4.57%.

Going into 2024 we will continue to rebalance our principal holdings in order to be broadly in line with market. This will

give us a measure of protection but only a measure: if mid-cap stocks rally again, we run the risk of underperforming.

And over the coming weeks we will begin to put together our strategy for beating the market again.

The analysts and Head of Research have prepared the report independently, using publicly available information. We believe the information is accurate but have not independently verified it. We intend the report for client use. It should not be considered as soliciting to buy or sell securities.

No liability is accepted for errors or omissions. And readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.