Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Monday, September 11, 2023

Does the price of Airtel Africa have any significance for the Naira/US dollar exchange rate? It may be a fanciful thought. But the sophisticated trades between Airtel Africa’s NGX Exchange listing and its London listing point to convergence. At least in the short term, between the arbitrage price and the parallel exchange rate.

Last week, the exchange rate at the Investors and Exporters Window (I&E Window) gained 0.51% to close at ₦736.62/US$1. In the parallel (or street) market, the Naira slipped by 1.40% to close at ₦930.00/US$1. Currently, the gap between the I&E Window and the parallel market stands at 26.25%. The gross foreign exchange (FX) reserves of the Central Bank of Nigeria (CBN) slipped by 0.54% to US$33.39bn.

Notwithstanding the current pressure on the Naira, we maintain that the reform of the foreign currency market will lead to improvements in FX liquidity in the medium term.

Last week, the secondary market for T-bills closed bearish with average yields increasing by 37bps to 7.93% pa. Average yields along the T-bill curve increased: at the short end (51bps to 4.24%); long-end (27bps to 9.84%) while the mid-end yield declined (86bps to 5.91%). In the primary T-bill auction, which took place mid-week, the CBN offered ₦214.74bn (US$165.69m) with a total subscription of ₦875.74bn. The bid to offer ratio was 4.08x compared with 5.09x for the auction held at the end of August. However, the average yield at auction fell by 104bps to 8.02% per annum.

The secondary market for FGN bonds moved in the same direction as the secondary market for T-bills. The average yield increased by 37bps to 7.93%. Average yields along the FGN bond yield curve rose: at the short end (51bps to 4.24%) and long end (27bps to 9.84%) while the mid-end declined (86bps to 5.91%).

We maintain our view that the market may be heading towards a new period of elevated rates in coming auctions. Persistently low system liquidity and elevated rates bidding by investors are the basis for our expectation. If another OMO auction takes place, as expected, it would further impact rates.

Last week, trading in oil was still going strong as Brent Crude closed 2.37% higher to settle at US$90.65/bbl. Year-to date, it is up by 5.52% and has been trading at an average of US$80.98/bbl year-to-date, 18.27% lower than the average of US$99.09/bbl in 2022.

Supply-side factors continue to dominate crude price movements. The Organisation of the Petroleum Exporting Countries (OPEC) and its ally Russia (hence OPEC+) will most likely maintain their production limits going into the fourth quarter.

We maintain our view that, for most of the year, prices are likely to remain above the US$75.00/bbl mark set in Nigeria’s government budget.

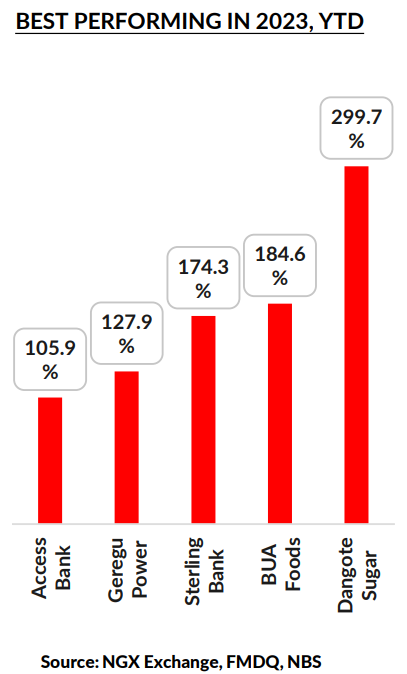

Last week, the NGX All-Share Index closed higher, increasing by 0.91% to settle at 68,143.34 points. Its year-to-date return rose to 32.96%. Oando (+38.74%), PZ Cussons (+14.29%), and FCMB Group (+13.33%) closed positive while Nigerian Breweries (-2.31%), Nestle Nigeria (-2.27%), and Dangote Cement (-1.30%) closed negative. Performances across the NGX sub-indices were mostly positive as the NGX Banking (+5.55%) topped the list, followed by NGX Consumer Goods (+2.24%), NGX Pension (+1.49%), and NGX 30 (+0.78%) indices closing green. On the other hand, the NGX Insurance (-2.94%), NGX Industrial Goods (-0.49%) and the NGX Oil/Gas (-0.12%) indices closed in the red.

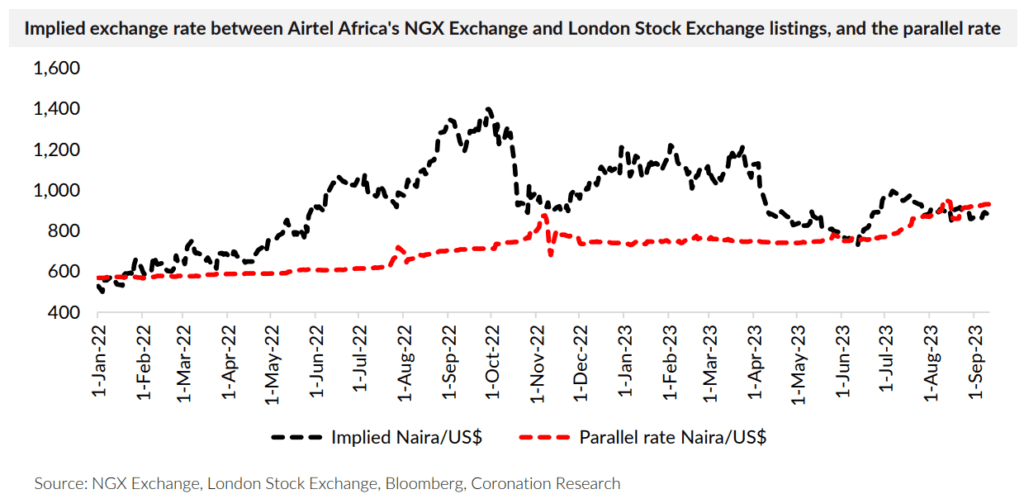

Nigeria is several months into its currency reform and the picture, so far, is frustrating. The I&E Window rate is ₦736.6/US$1 and the parallel exchange is close to ₦930.0/US$1. The gap having widened to 26.3% over the past few weeks. Yet one small part of the foreign exchange market appears to be reaching a consensus. At least in the short term, with the implied exchange rate between Airtel Africa’s shares traded in Nigeria and those traded in London reaching ₦876.8/US$1, very close to the parallel market rate.

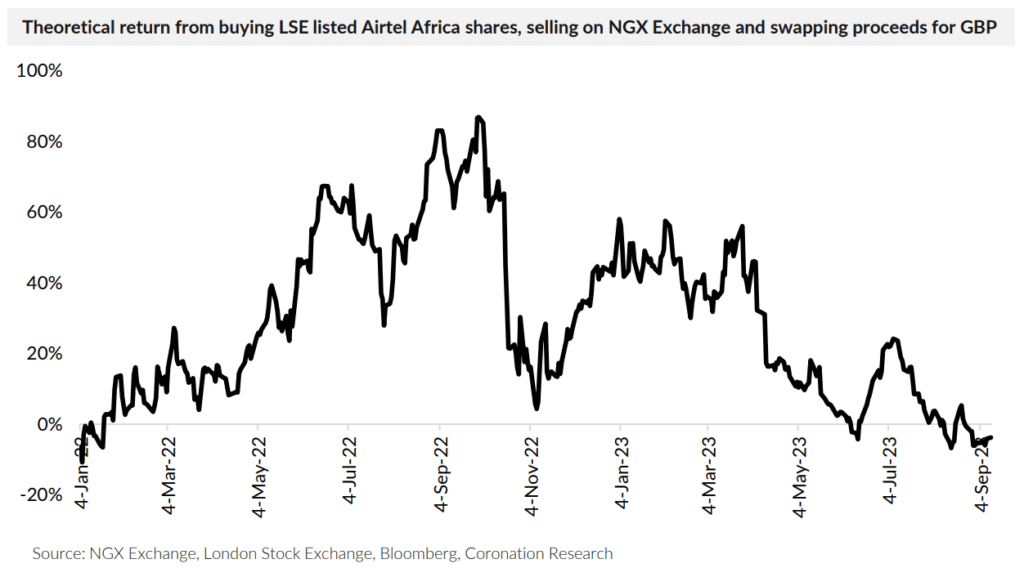

This was not always so. For much of 2022 and early 2023 the two exchange rates were out of kilter – by a wide margin. In late September 2022, the implied exchange rate was nearly ₦1,400/US$1, while as recently as last March it reached ₦1,210/US$1. This meant that some traders were prepared to buy Airtel Africa shares on the NGX Exchange at ₦1,548.7/s, have them cancelled and reissued in London, and sell them GBP1.05/s, paying ₦1,480.6 per Pound Sterling or ₦1,210.3 per US dollar. It was an expensive way of purchasing US dollars when the parallel exchange rate was ₦746.0/US$1. Though it had the advantage of delivering funds to the recipient via the London Stock Exchange.

Of course, with such a huge difference between the arbitrage rate (₦1,210/US$1) and parallel rate (₦746.0/US$1) it also made sense to do the trade in reverse. Arbitrageurs would buy London-listed shares, have them cancelled in London and reissued in Lagos, then sell the NGX Exchange listed shares for Naira and trade the proceeds via the parallel market for pounds or US dollars. With the share prices so far apart such trades could realise a return in excess of 40.0%.

Clearly, more participants are aware of this trade, and more participants have made themselves capable of doing it, than before. The arbitrage opportunity has all but disappeared. This implies that a large number of professional investors are involved, and it is interesting that the implied rate closely aligns with the parallel exchange rate. It is a feature of exchange rates settling down, in our view, that different arbitrage and parallel rates eventually converge.

This is not to say that either the parallel exchange or the exchange rate implied by Airtel Africa’s two listings have any bearing on where the Naira/US dollar rate will settle. Nor do they have any bearing on the Naira/US dollar rate in the I&E Window; nor do they have any bearing on the fair value of Naira/US dollar. But it may be a sign that the currency markets are becoming a little more efficient than they were.

Read also: Economic Implications Of Nigeria’s Relations With The UAE For Your Business

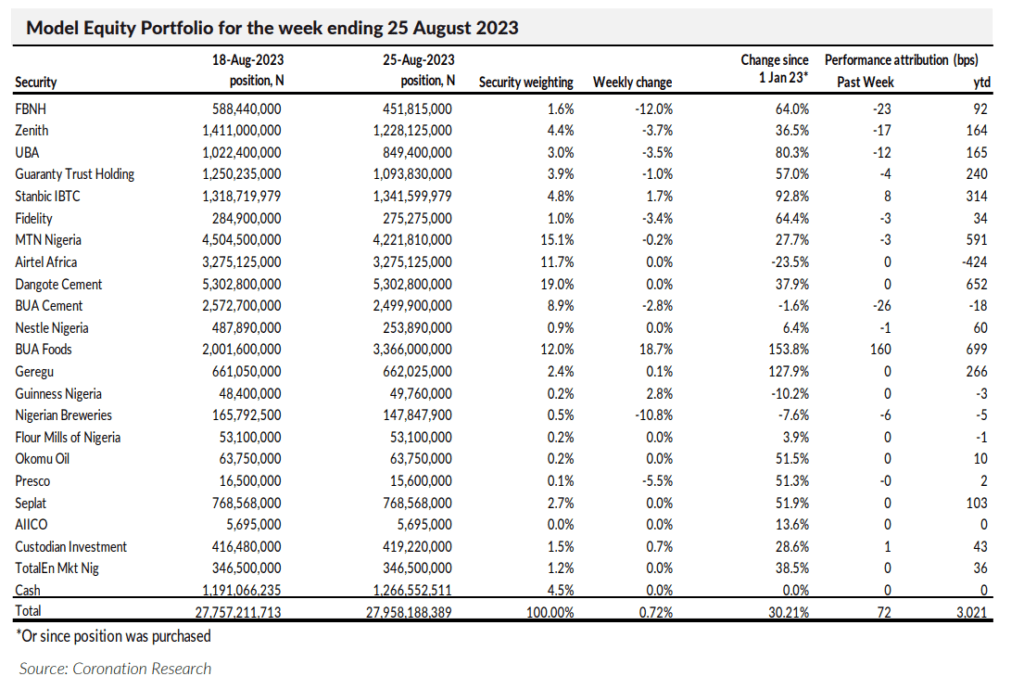

Last week the Model Equity Portfolio rose by 0.93% compared with a rise in the NGX All-Share Index of 0.91%, outperforming it by 2bps. Year-to-date it has risen by 35.34% compared with a rise of 32.96% in the NGX All-Share Index, outperforming it by 238bps.

Last week there were strong gains from our notional positions BUA Foods and the banks, where we remain overweight. Over the coming week we will continue to reduce our overweight positions in the banks, with a view to taking them to a neutral position in aggregate. We will also conduct a review of our positions in the major index weights and align our positions with them.

During this week the Model Equity Portfolio rose by 2.98% compared with a rise in the NGX All-Share Index of 3.00%,

underperforming it by 2bps. In the year to September 1, it rose by 34.09% compared with a rise of 31.76% in the NGX

All-Share Index, outperforming it by 233bps.

During the previous week, we missed out on the rally in Dangote Sugar as we had no notional position in it. The price of Dangote Sugar continued to rise following the announcement of the three-way merger between Dangote Sugar, Nascon, and the unlisted Dangote Salt. The good news, perhaps, was that the excitement in the market appeared to peak. Apart from this, we registered strong gains from notional positions in BUA Foods, and we also performed well in the bank stocks, where we still maintain a small overweight position (although not as overweight as a few weeks ago).

During this week, the Model Equity Portfolio rose by 0.72% compared with a rise in the NGX All-Share Index of 1.26%,

underperforming it by 52bps. In the year to August 25, it rose by 30.21% compared with a rise of 27.92% in the NGX

All-Share Index, outperforming it by 229bps.

Our severe underperformance during this week was due the announcement of the three-way merger between Dangote Sugar, Nascon and the unlisted Dangote Rice. One effect of this was for Dangote Sugar to rally by 49.3% during the week; and we had no notional position in Dangote Sugar. Although Dangote Sugar accounted for – to begin with – just 1.3% of the index, a rally of this magnitude left us with over 50bps of underperformance. There was nothing we could do – we do not have a crystal ball when it comes to mergers and acquisitions.

Follow this link download the full report.

The analysts and Head of Research have prepared the report independently, using publicly available information. The information is believed to be accurate but not independently verified. The report is intended for the use of clients and should not be considered as a solicitation to buy or sell securities.

No liability is accepted for errors or omissions, and readers should conduct their own evaluations and consult with financial advisers before making investment decisions.

This report is not intended for individual investors and should not be distributed where prohibited by law or regulations.