Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

International trade often comes with challenges such as delayed payments and the risk of unfulfilled agreements. Letters of Credit offer a dependable solution. They act as a financial tool that bridges the gap between buyers and sellers across borders. These instruments simplify transactions while fostering trust in cross-border trading.

Letters of credit play an important role for businesses involved in importing or exporting. They facilitate smooth transactions and help address the risks associated with cross-border trade. Entrepreneurs can use this tool to expand their market reach while maintaining confidence in their business dealings.

This blog will explore the fundamentals of Letters of Credit, their types, and the step-by-step process involved. We will also discuss their benefits for businesses and highlight Coronation Merchant Bank’s trade finance solutions. This guide is designed to help you make informed decisions and grow your business through secure international transactions.

According to Article 1, UCP 600, a letter of credit is a commitment of the Issuing Bank (the bank serving the Buyer) to pay a certain amount of money within a certain period of time to the beneficiary (the seller), provided that the beneficiary presents a valid set of documents as specified in the Letter of Credit.

Put simply, it is a tool that makes buying and selling (imports and exports) across countries safer and easier. It is a promise from a bank to pay a seller on behalf of a buyer once certain conditions are met.

For example, if a business wants to buy goods from another country, the seller might worry about getting paid. The buyer’s bank can issue a Letter of Credit to reassure the seller. It guarantees payment once the seller proves they have shipped the goods.

This process protects both sides. The seller knows they will get their money after meeting the agreed terms, and the buyer knows they won’t pay until the goods are sent. Letters of Credit make trade smoother and help businesses build trust, even when they are far apart.

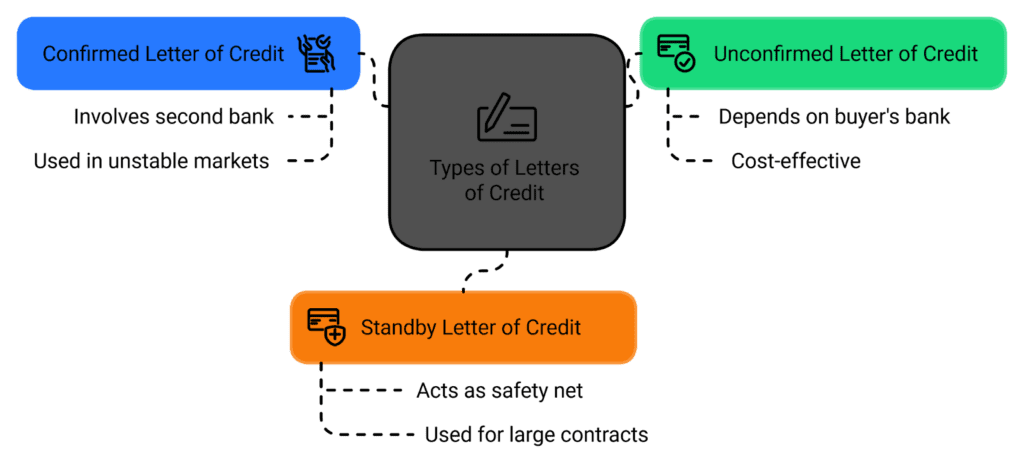

Letters of Credit come in several types, each designed to support specific trade needs. These types offer different levels of security and flexibility depending on the nature of the transaction and the trust between the buyer and seller. Let’s break them down:

These types of Letters of Credit help businesses handle different trade situations. The right choice depends on how much risk the buyer and seller are willing to take, the complexity of the transaction, and the level of trust between the parties involved.

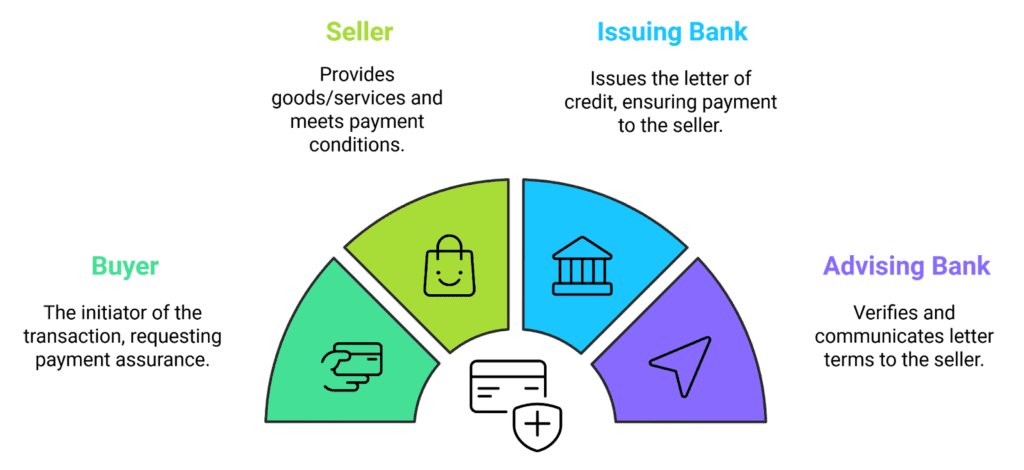

Key Parties Involved in Letters of Credit

Letters of credit involve several key players, each contributing to the smooth execution of trade transactions. Their combined roles help create a secure and structured process that reduces risks for all involved.

Each party plays an essential role in ensuring that letters of credit serve their purpose effectively. Through their collaboration, buyers and sellers can conduct transactions with greater confidence and reduced uncertainty.

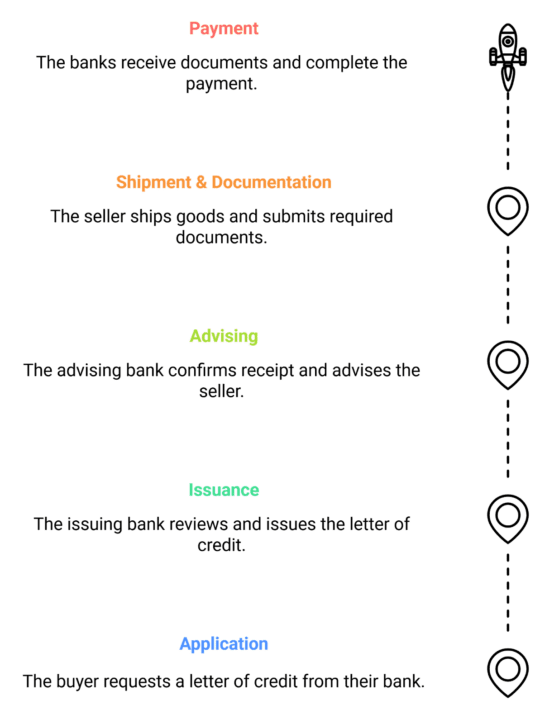

How Do Letters of Credit Work?

The process of using letters of credit involves several steps, each designed to protect both buyers and sellers during a transaction. This step-by-step explanation outlines how these financial instruments operate, especially in trade scenarios like importing or exporting goods.

This process creates a secure environment for trade, as letters of credit minimise risks for both buyers and sellers. They are especially beneficial in international transactions, providing assurance to all parties and fostering trust in cross-border trade.

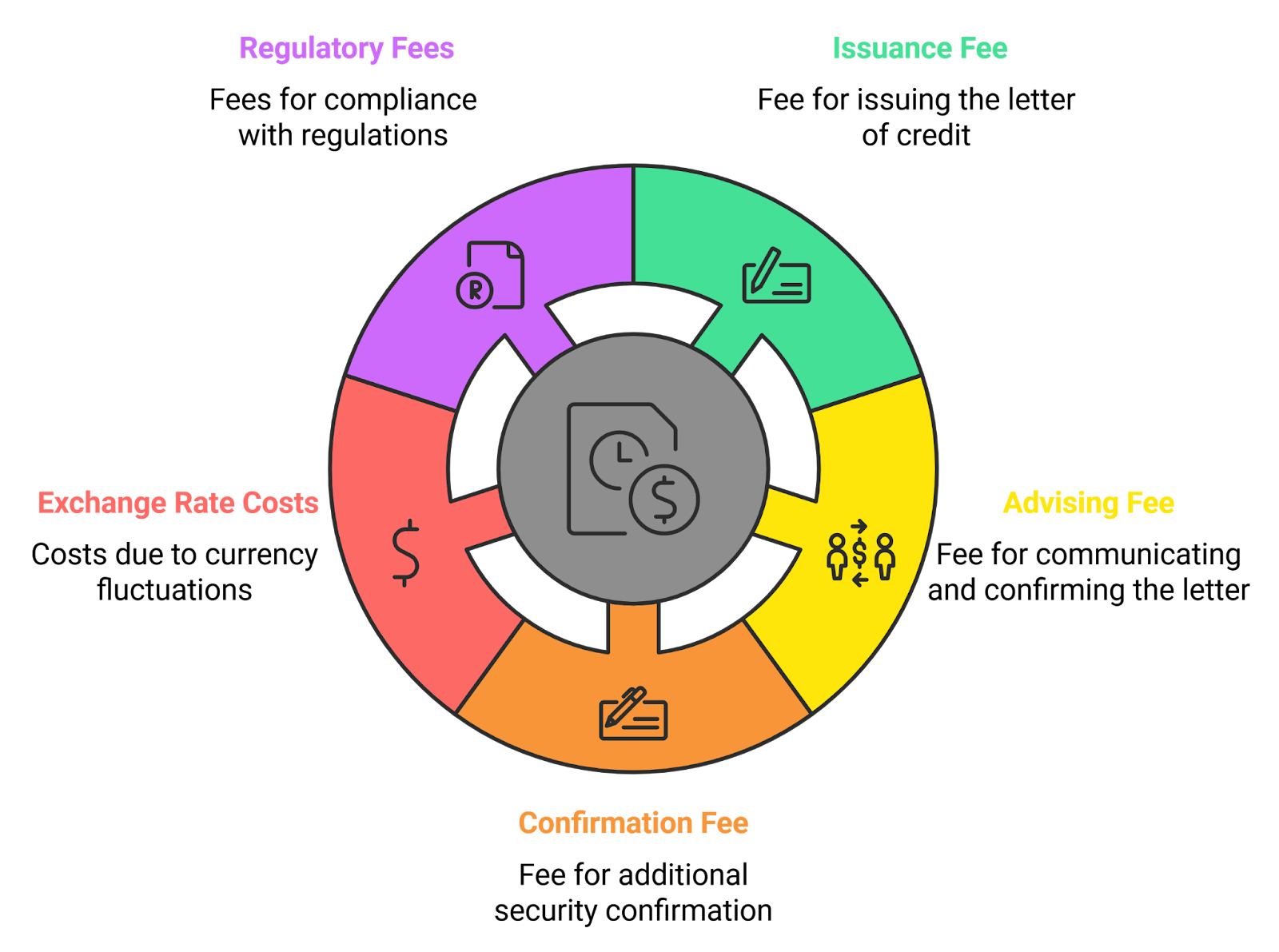

Letters of Credit Fees and Costs

When using letters of credit, businesses should be aware of the various fees and costs involved. These charges can vary depending on the banks, the nature of the transaction, and the specific requirements of the agreement. Here are a few of the most common costs.

The specific documents required for a letter of credit depend on the terms agreed upon by the buyer and seller. Commonly requested documents include:

The buyer, also known as the applicant, typically bears the cost of a letter of credit. This includes issuance fees, advising fees, confirmation fees (if applicable), and other bank charges. However, in some cases, the seller and buyer may agree to share these costs. The terms of cost-sharing are usually outlined in the trade agreement.

A letter of credit’s validity period depends on the terms negotiated between the buyer and seller. Typically, it is valid until the shipment and payment obligations are fulfilled. Standard durations are 60 to 90 days, but it can be longer for complex or high-value transactions. The expiration date is explicitly stated in the LC, and all required actions, such as shipment and document submission, must be completed before this date.

If a letter of credit is not paid, several scenarios may arise:

Not all letters of credit are transferable. Only a transferable LC, explicitly marked as such, allows the original beneficiary (seller) to transfer part or all of the credit to a second beneficiary. This feature is commonly used in transactions involving intermediaries or traders. Non-transferable LCs cannot be reassigned, and payment is made exclusively to the named beneficiary.

Conclusion

Letters of credit offer significant benefits to businesses involved in international trade. They provide security for both buyers and sellers, guarantee payments, and help build trust in cross-border transactions. Coronation Merchant Bank offers bespoke solutions that meet the unique needs of businesses. With expertise in trade finance and a deep understanding of the challenges in global markets, we ensure smooth, reliable transactions.

If you’re looking to expand your business through international trade, contact Coronation Merchant Bank today for a reliable and trusted partner in letters of credit and trade finance solutions.

Contact us:

Website: www.coronationmb.com

Email: crc@coronationmb.com

Phone: +234 (0)2-0188 87640