Your Roadmap to Financial Security

Start your wealth journey with us today

Partner with Coronation’s team of financial experts to make smart choices to preserve and grow your wealth.

Are you looking to make your ₦5 million work harder for you?

If you have this amount ready to invest in a reliable asset, this blog highlights an opportunity you might miss. Click here, and we’ll contact you with more details.

Investors looking for safe, short-term options for their ₦5 million (or more capital) are usually only familiar with traditional investment opportunities and haven’t considered commercial paper a viable alternative.

“In this guide, you’ll be introduced to commercial paper—what it is, how to subscribe, its unique benefits, potential risks to be aware of, and how Coronation Securities ensures security throughout your investment journey.

As an investor looking to maximize returns while managing risk, you’ve likely explored various options for your portfolio. But there’s one powerful instrument you may have overlooked: Commercial Paper.

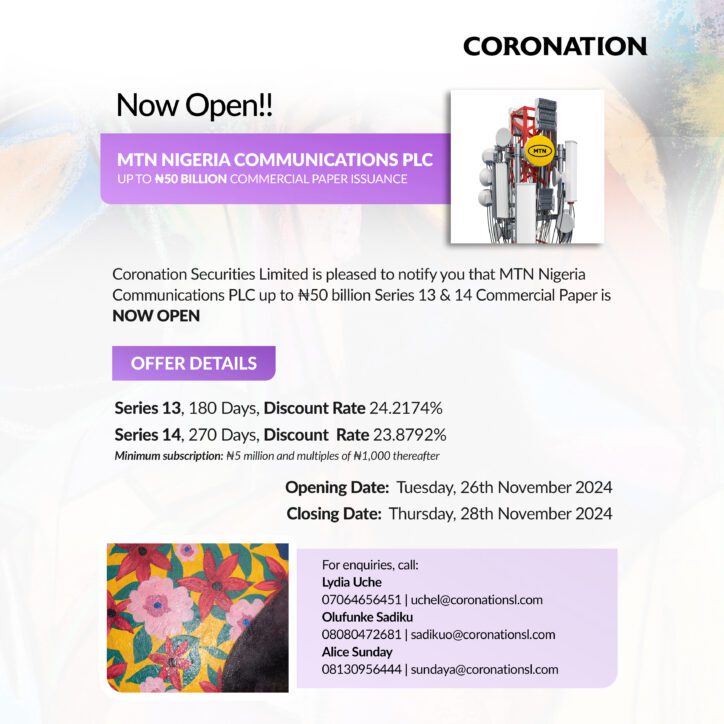

Commercial Paper (CP) is a short-term debt instrument issued by large corporations and financial institutions to cover immediate operational needs. When you invest in CP, you’re essentially lending money directly to these established companies for a short duration—typically between 179 and 270 days, or even less, in exchange for interest rates that often exceed those of traditional bank deposits. Find examples of CP issued by companies through Coronation Securities below.

CP provides competitive yields and liquidity unlike long-term investments that lock up your capital for years. By subscribing to a CP, you’re becoming a short-term lender to corporations with strong credit ratings, and in return, you receive your principal plus interest upon maturity.

What makes CP intriguing is its sweet spot in the risk-reward spectrum. While bank deposits offer security but minimal returns, and stocks provide higher potential returns with volatility that you may be unable to handle, Commercial Paper occupies that valuable middle ground, offering yields higher than treasury bills with marginally increased risk.

For investors with capital (₦5 million and above), CPs represent an opportunity to put idle funds to work without the commitment of long-term investments or the volatility of equity markets.

Perhaps most compelling is the customization available. Companies issue CP with various maturity dates, allowing you to align your investments with your cash flow needs—whether that’s 90 days or 270 days from now.

Moreover, investing in CP provides several strategic options:

Despite these advantages, many investors hesitate to venture into Commercial Paper due to several barriers:

2. Market Access Challenges: Coronation Securities will grant you access to the market. Even though the CP market primarily caters to institutional investors, making it difficult for individuals to identify and access attractive offerings.

3. Due Diligence Requirements: We will adequately evaluate issuer creditworthiness, which requires sophisticated financial analysis and access to information not readily available to individual investors. Coronation Securities is here to support you and help you subscribe to genuine CPs.

4. Administrative Complexity: Again, we will handle all administrative complexities. The subscription process involves paperwork, compliance requirements, and settlement procedures that can be daunting without professional guidance.

5. Liquidity Concerns: Click here if you have liquidity concerns. While CPs have defined maturity dates, selling them before maturity can be challenging without established secondary market connections.

This is where Coronation transforms your CP investment experience:

2. Market Intelligence: Our dedicated research team continuously analyzes the CP market, identifying the most attractive opportunities based on yield, issuer quality, and maturity.

3. Rigorous Due Diligence: We conduct comprehensive credit analysis of all issuers, ensuring your investments are directed only to companies with strong fundamentals and repayment capacity.

6. Streamlined Process: Our digital platform simplifies the entire subscription process—from initial investment to maturity—eliminating paperwork and administrative hassles.

7. Liquidity Solutions: Should you need funds before your CP matures, our extensive market connections can help facilitate early liquidation options.

8. Portfolio Advisory: Our experts provide personalized guidance on how CP can complement your existing investments, optimizing your overall portfolio performance.

By incorporating Commercial Paper into your investment strategy through Coronation, you can expect:

Enhanced Yields: Typically 2-4% higher returns compared to traditional bank deposits of similar tenure.

Capital Preservation: Investment in highly-rated issuers minimizes principal risk.

Liquidity Management: Better alignment of investment maturities with your cash flow needs

Portfolio Efficiency: Improved overall returns without significantly increasing risk profile

Financial Flexibility: Access to funds at predetermined dates without depending on market conditions

With your ₦5 million, you can invest in Commercial Paper, enjoy short-term profits, and elevate your portfolio performance while maintaining the security and liquidity you require.

Contact our investment advisors today to begin your journey into this sophisticated yet accessible market.

Access more lucrative investments HERE

🆔Olufunke Sadiku

📧SadikuO@coronationsl.com

📞08080472681

🆔Alice Sunday

📧SadikuO@coronationsl.com

📞08130956444