A Thoughtful Gift That Speaks Louder Than Words

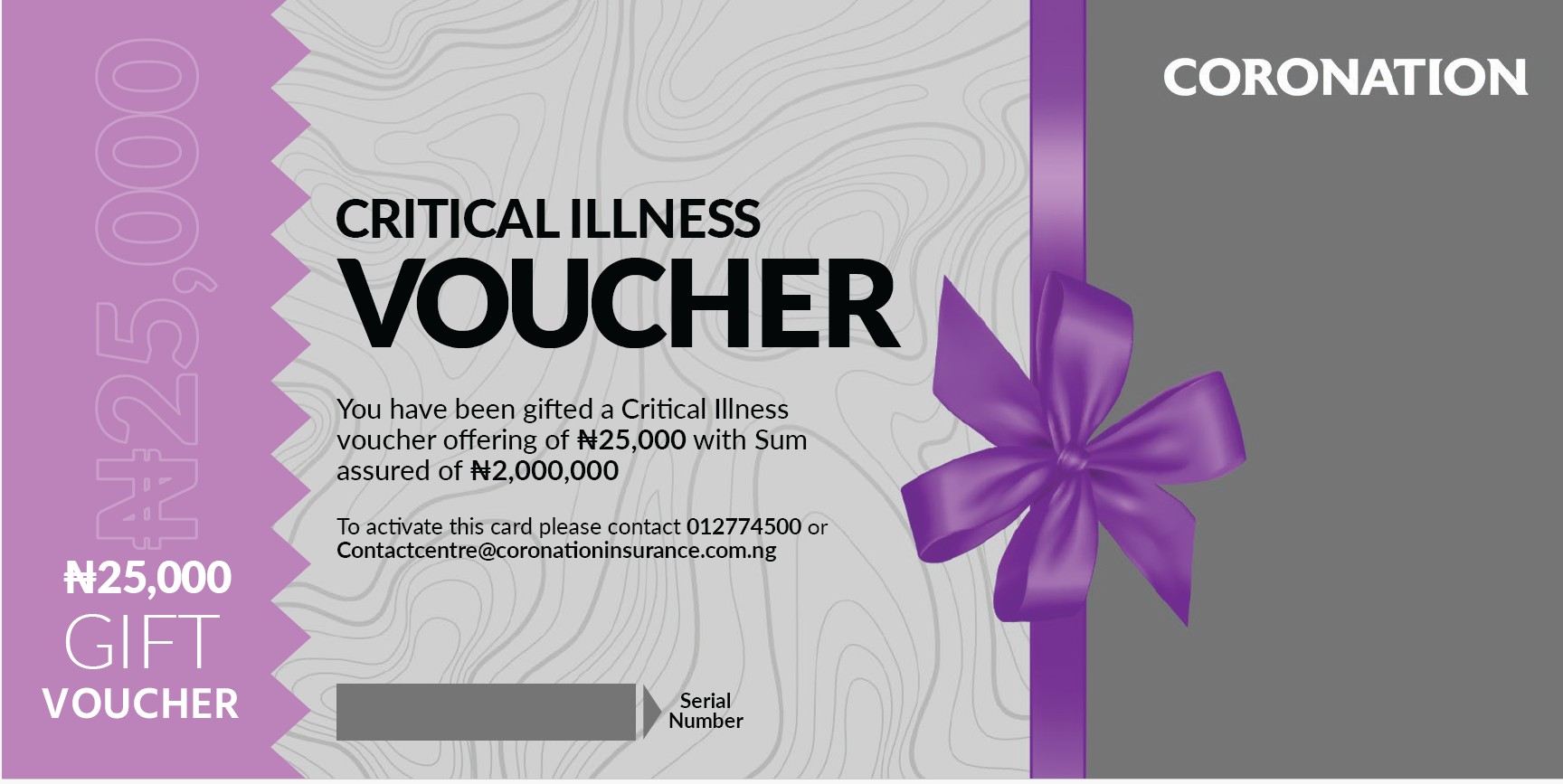

With Coronation’s Critical Illness Plan, you can give yourself—or someone you care about—the financial support to fight serious illness without the added stress of cost.

Imagine being able to stand strong in a health crisis—or help a loved one do the same. That’s what this cover offers.

Whether for yourself, a parent, your spouse, or even your staff, our Critical Illness Plan is more than a policy—it’s a gift of readiness, care, and compassion.

What is the Critical Illness Policy?

Our Critical Illness Policy is a comprehensive life insurance product designed to provide a lump-sum payout if the insured person is diagnosed with a life-threatening condition covered under the policy. This payout can significantly alleviate the financial strain associated with critical illnesses, offering support to both the insured and their families.

Benefits

• It provides for higher cover for critical illness beyond the threshold of normal HMO

• Helps to prevent out-of-pocket medical expenditure for critical illness

• Covers for accidental, total and permanent disability and death.

• Qualifies for Tax relief.

Why Choose Our Critical Illness Policy?

• Comprehensive Coverage: Our policy covers a wide range of critical illnesses, offering robust protection over 10 major illnesses, including cancer, stroke & heart disease

• Peace of Mind: Secure your loved ones’ future with financial support when it matters most.

• No Medical Jargon: Just simple, clear coverage

• Easy Payment Structure: Make a one-time payment or easy installments

• Fit For All Purposes: Ideal for birthdays, anniversaries, employee wellness, or “just because”

Conditions Covered

We cover a wide range of serious conditions, with a lump sum payout that helps cover:

• Choose Your Coverage: Select a benefit amount that best suits your needs.

• Sign Up: Apply for the Critical Illness Policy online or through our representatives.

• Enjoy Peace of Mind: Rest easy knowing you’ve provided a safety net for your loved ones.

• Treatment costs

• Recovery support

• Living expenses during downtime

• Unexpected medical needs

Choose our Critical Illness Policy to protect yourself and your loved ones against life’s uncertainties.

Fill the Form Below To Sign Up